Fed Notes

What was dovish?

The ‘neutral’ comment did a lot of the dovish/bullish lifting. Risk started to ramp at 2:32 EDT, pretty much the same time Powell said it.

So, I guess I'd start by saying we've been saying we would move expeditiously to get to the range of neutral. And I think we've done that now. We're at 2.25 to 2.5 and that's right in the range of what we think is neutral.

The reaction confused me somewhat because Powell had said at the June 15th press conference: “the longer-run neutral rate…we think that’s in the mid-2s.”

This also contributed:

…these rate hikes have been large and they've come quickly. And it's likely that their full effect has not been felt by the economy. So, there's probably some additional tightening, significant additional tightening in the pipeline.

Lastly, contrast Powell’s descriptions of the Fed’s threshold for pivoting:

We'd be asking ourselves are we confident that inflation is on a path down to 2 percent? That's really the question. And we'll be making-- our policy stance will be set at a level, ultimately, at which we are confident that inflation is going to be moving down to 2 percent. (7/27/2022)

We’re not going to declare victory until we see a series of these, really see convincing evidence, compelling evidence, that inflation is coming down. (6/15/22)

Previously the Fed needed convincing and compelling evidence of disinflation. Now they need only need confidence that inflation is on a path to 2 percent. So they’ve lowered the burden of proof for disinflation and they’ve changed the rules of evidence to allow their judgement to modulate the actual numbers.

Ennui

Powell sounded like he is tired of doing this and his low energy added to the dovish impression.

Addressing the Fed’s approach to inflation he was very passive.

We need to be confident that inflation is going to get back down to mandate consistent levels. That's not something we can avoid doing. That really needs to happen.

Later, asked whether the Fed waited too long to hike, Powell sounded like a dental patient getting asked about his flossing habits.

But did it matter in the end? If you look at-- I really don't think it did, I'm not sure it would have mattered if we'd been raising rates three months earlier, does anybody think that would have made a big difference? I mean, lots of central banks were raising rates three months earlier and it didn't matter. I mean, this is a global phenomenon that's happening now. Admittedly, different in the United States. But anyway.

He can’t really believe that, because he goes on to say:

Broader financial conditions have tightened a good bit. The way this works is we set our policy and financial conditions react, and then financial conditions are what affects the economy. And we don't control that second step. We're just going to do what we think needs to be done.

we'll be watching financial conditions to see that they are appropriately tight

The hawkish June 15th Fed elicited easier financial conditions and so far the neutral Fed of July 27th is doing the same thing. But, if the hawkish June 15th Fed drove financial conditions easier, by lowering expectations for future growth and inflation, the easier neutral Fed may do the opposite.

But while a more dovish Fed could, counter-intuitively, tighten financial conditions, I believe its more likely that the Fed will re-calibrate their rhetoric. Especially if inflation expectations break higher.

Already:

Bostic said on Thursday that the economy was ‘a ways’ from a banana.

Kashkari is in the NYT talking tough— “a long way’ from backing off inflation fight.”

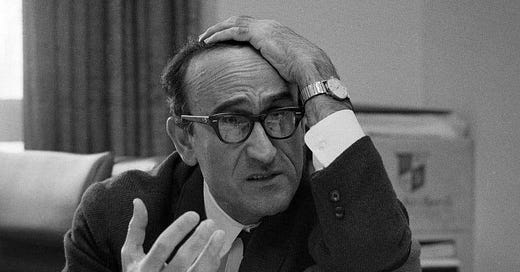

Current S&P bear market compared to 2007, 2000, 1980, and 1972 (all indexed to 100 at the peak). I hadn’t realized that before this rally we were outpacing these other episodes. Light blue is Volker smashing inflation, orange is Arthur Burns earning his reputation.

Russia

Pathways to Russian Escalation—Rand Corporation with some decent advice for the US Government on avoiding intentional Russian escalation.

Walter Russell Mead interviews Robert Kagan, Victoria Nuland’s husband.

I think if Putin were allowed to succeed in Ukraine, that would be the beginning of his efforts, not the end. I think other countries in Europe would be at much greater risk.

This is really the dividing line on Russia/Ukraine—given that Russia is territorially ambitious, do you think that negotiating with Russia will give us Disraeli’s Peace with Honor from the Congress of Berlin1 or Chamberlain’s “peace for our time.”

Putin is such an odious and ideologically antiliberal that it’s sort of easier for Democrats, even of a progressive nature who ordinarily would be very wary of involvement, it feels like a very moral cause which is very similar, by the way, interestingly to the liberal response to the Spanish Civil War when a lot of progressives who had been anti-war or anti-intervention began leaning in a different direction.

I understand why, as a interventionalist, he would equate Putin with Hitler. But I certainly hope his analogy between the Spanish Civil War (the dress rehearsal for WW2) and the Ukrainian conflict is only wishful thinking.

And this is why the battle for Kherson is important. Ukraine is anxious to recover its territory and justify the confidence of its people that this war can be won. In the process it seeks to encourage its Western partners to keep the faith.

Yale School of Management study claiming the sanctions have crippled the Russian economy much more than commonly perceived (press release). This is what Putin is talking about when he talks about the US weaponizing ‘cancel culture.’

Russia is way behind in the propaganda department, see this video. It’s so bad I can’t decide which side made it.

Links

Neutral is the new transitory. Larry Summers says Powell referring to 2.5% as neutral is “analytically indefensible.” Larry Summers on a podcast with Andrew Sullivan here.

Very good discussion of the Beveridge curve here.

BIS report raising the alarm about ‘high inflation regimes.’ People were pointing to this a reason that the Fed wouldn’t pivot.

The Fed modeling its losses on SOMA if they keep hiking, part 1 and 2.

A Substack getting attention for predicting a civil war in Montana. To me, it reads like the author is a creative-type LA hipster trying to not associate himself with the neoliberal gentrifiers but also absolutely terrified of the animalistic muzhiks.

A woman eyes me from a porch swing, sees me clacking on my laptop and says to her family, “Think about our ancestors sittin’ out here with books. Now people have laptops!” No elevator at this hotel. No disabled access. No concierge even. Just a “fine dining” restaurant that serves dressed up versions of the food from the basement bar, a local’s hangout, one of three dives in the span of maybe 1000 feet.

No concierge!!!!!?????

This is the ultimate luxury belief: wanting average for everyone else while wanting the best for ourselves…Elites throw a fit about getting homeless people off the streets, while moving to neighborhoods where they will never see any homeless people.

Crypto hedge fund IR letter that moves past denial and into the ‘bargaining’ stage of grief.

Breathless pearl clutching from the Intercept that Bank of America published a research report that advocated for the Fed to cool the employment market.

Chinese spies infiltrate the Fed? My question is—why would you stop this?

Another employee "with sensitive access to Federal Reserve Board data provided modeling code to a Chinese university with ties to" China's central bank in 2018, the report alleges.

In honor of my older son’s absurd Zoomer haircut.