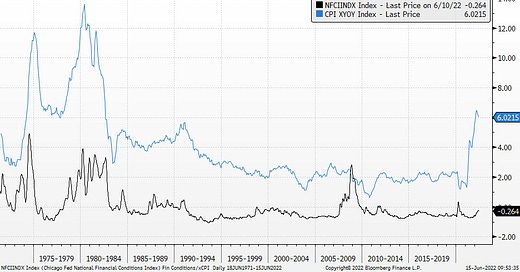

Since the Monday (presumably true) news that the Fed will hike 75bps today, the market has noticeably relaxed. Everything will change after today’s press conference, but for now the leak was a tourniquet to stanch the Fed’s hemorrhaging inflation credibility.

At the May 4th press conference Powell said:

Our policy affects financial conditions, and financial conditions affect the economy. So we’re going to be looking at the effect of our policy moves on financial conditions. Are they tightening appropriately? And then we’re going to be looking at the effects on the economy. And we’re going to be making a judgment about whether we’ve done enough to get us on a path to restore price stability. It’s that. So if that path happens to involve levels that are higher than estimates of neutral, then we will not hesitate to go to those levels. We won’t.

That’s all well and good, but is it obvious that tightening financial conditions lowers inflation? Maybe, but why carpet bomb the Ruhr instead of using precision munitions.

Prior to the Volker policy change, the Fed had in essence been controlling the price of money for a number of decades—not always being very explicit, even to itself, about that or about which particular rate. In any event, with the price of money controlled, the amount of money in the economy depended on how much was needed by businesses and consumers at that interest rate…if an inflationary amount of money was demanded because the public wanted, for example, to purchase more goods and services than could be easily produced, the Fed willy-nilly supplied it.

Under Volker…the Fed stopped aiming at the price of money and instead concentrated on deliberately limiting the amount of money in the hands of the public in a single-minded effort to curb upward pressure on prices of goods and services. As a result, if the public needed more money to finance spending than the Fed had targeted, interest rates would promptly rise…

This new policy approach was “practical monetarism” at work.

—Inside the Fed, Stephen Axilrod.

Why can’t the Fed even talk about targeting the money supply anymore?

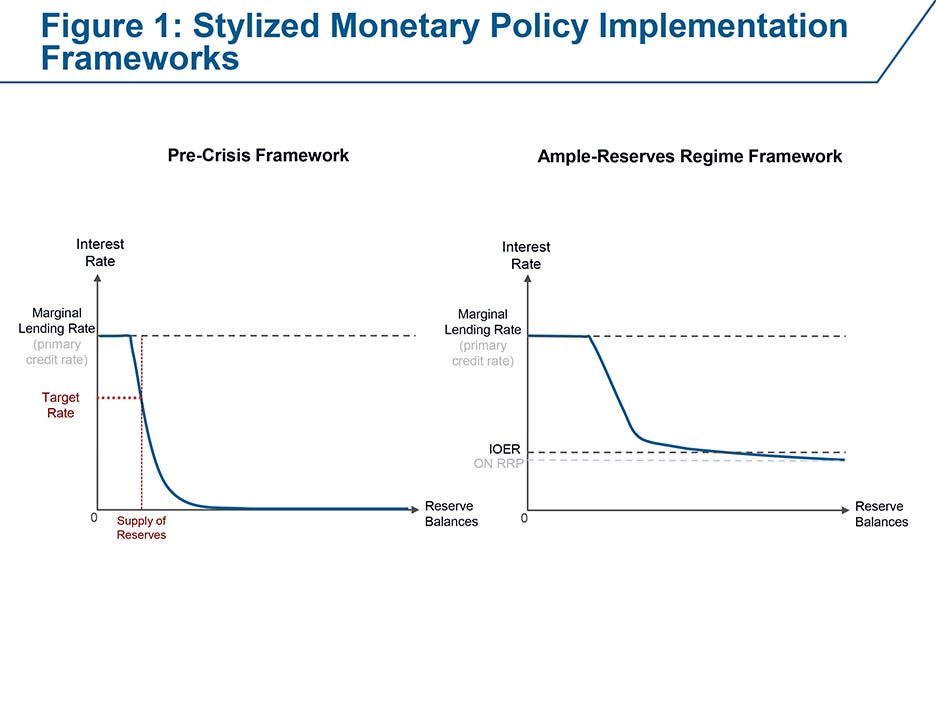

Because the Fed is obsessed with the effectiveness of monetary policy at the zero bound and instituted a floor system so they can fund QE when rates are above zero.1 In the old scarce reserve regime, Fed open market operations would adjust the supply of reserves to balance supply and demand at the target rate. Now the Fed is committed to over supplying reserves with its Ample-Reserves Regime.

I understand why the Fed prefers ample reserves. They want to avoid incidents like the 2019 spike in repo rates. Ideally, policy makers would address the regulatory drivers, e.g. LCR. But the Fed would rather make sure 2019 doesn’t repeat by committing to Ample reserves, which they can do without coordinating with other parts of the government.

Ample reserve policy blunts the effect and reduces the feedback of a Fed hike. In olden days, if there was excess demand for Fed Funds because a bank was growing its balance sheet the effective fed funds rates traded above the target. The Fed would buy securities to increase the supply of reserves and bring effective back to target. That purchase incrementally eased policy by growing the balance sheet, but it gave the Fed tactile feedback about the impact of a given target rate on demand for money. If you were constantly having to add reserves because of demand, you probably need to hike the rate. Maybe the the Fed is surprised about current inflation because they don’t have that information. Banks are so oversupplied with reserves that they can lend money at higher nominal prices and grow the money supply without the Fed even knowing.

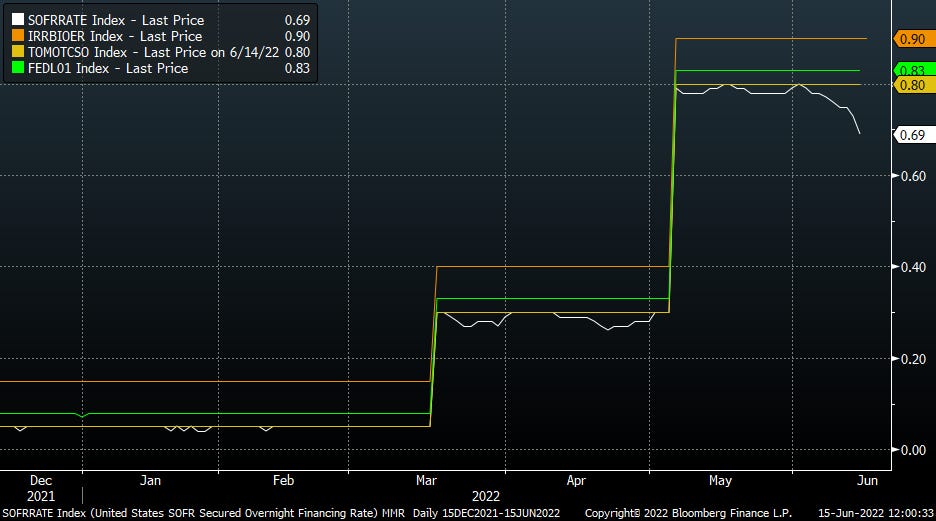

Theoretically we are in a hiking regime and the repo rate is collapsing against the target rate.

There is way more to the Fed’s helicopter parenting of the front end that I will have to revisit after the announcement.

The main point I am trying to put across is that more of the same from the Fed (“ we’re raising rates and we’re super duper serious about inflation”) is necessary, but not sufficient, to curtail what is a very serious failure of monetary policy. The Fed needs to tell us what FAIT really means and what the meaningful observation period is. The Fed needs to address how the front end really works and tell us plainly how their plans will reduce the money supply. If the Fed accelerates QT and doesn’t tell us more about how Ample reserves will need to be, then it’s like buying a put that gets knocked out at lower levels.

The market has been rather relaxed in forward rates and inflation, give the magnitude of CPI/PCE—it won’t be forever if the Fed doesn’t give us more than higher rates.

Good luck.

Nate

post script

I’m attaching the questions that Bill Nelson, at BPI, said he would ask if he were at the press conference, which are pretty good

You and your colleagues have pointed to the tightening of financial market conditions – the rise in longer-term rates and the fall in the stock market – since last fall as an indication that your words have tightened policy even though you did not start raising your target for the funds rate until March. But a central bank that is behind the curve is also expected to raise rates, just later, more rapidly, and in pursuit of rising inflation. Was the financial market tightening that took place at the end of last year and early this year more in reaction to your words or in reaction to the incoming data?

When the funds rate is at the zero lower bound and you want to provide more stimulus, you use forward guidance to push down market expectations about where the funds rate will be in the future. But there is no upper bound on the funds rate. If you want financial market conditions to be tighter, why not just raise your target range by more now rather than indicating that you will do so in the future?

What is your estimate of the current actual real federal funds rate (not the neutral rate, just the current real funds rate)? Is monetary policy currently stimulating or restraining aggregate demand?

Has the Fed initiated a review of whether the conduct of monetary policy viewed in real time, not in hindsight, contributed to the rise in inflation? If so, will the results be shared with the public? (If not, why not?).

Some of your colleagues have characterized the FOMC’s current plan as raising interest rates rapidly until the level of inflation falls. Isn’t this a strategy that will result in overshooting rather than a soft-landing? No policy rule suggests the change in the interest rate should depend on the level of inflation.

Given the illiquidity and extraordinary volatility in financial markets, are you concerned that QT will make things worse? If the Treasury market needed support, how would the Fed respond? Would you stop QT? Add reserves through term repo? Lower the Standing Repo Facility rate?

In March 2020 the Fed said it would soon fix the binding leverage ratio that all agree is impairing Treasury market functioning. Is a fix imminent?

How confident are you that the Standing Repo Facility will work given how few banks have signed up? Is there a stigma associated with using the SRF?

https://www.cato.org/books/menace-fiscal-qe

https://bpi.com/the-fed-is-stuck-on-the-floor-heres-how-it-can-get-up/

Wow another skill I didn’t know your had!

Great read!