Weekend Reading

2025 #9 (March 7)

Markets/Econ

GDP is a good measure. Don't mess with it for political reasons.

Here’s the most bewildering part of this proposal: we already have exactly what these officials are suggesting. The BEA regularly publishes measures of private sector output that exclude government spending. The BEA publishes this data alongside GDP in its national accounts. Anyone who wants to track private sector performance separately from government activity can already do so.

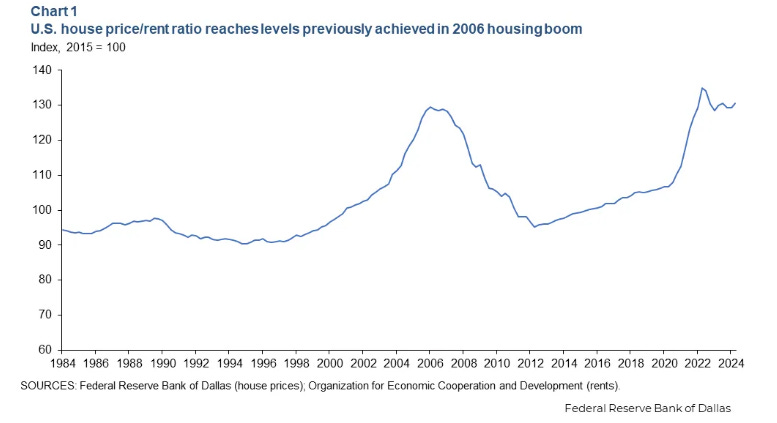

Some further thoughts on housing

In the past, I pointed to Austin as an example of how housing construction could reduce rents. New data suggests the gains were even larger than I had imagined, far larger: “Nowhere in the country have rents declined as much as they have in Austin — now 22% off the peak reached in August 2023, according to Redfin. The median asking rent is $1,399 per month, down $400 in less than three years. . . .”

Inflation, trade, and the fallacy of composition

Many of my readers are familiar with the distinction between relative price changes and movements in an aggregate price index. Explaining inflation by looking at individual price changes is a classic example of the fallacy of composition. A similar fallacy occurs when people try to explain overall trade imbalances by looking at imbalances in specific product categories, or specific bilateral trade relationships. These two fallacies can lead to public policies that are both ineffective and counterproductive, such as price controls and import tariffs.

Comparing Apples to Apples: “Synthetic Real‑Time” Estimates of R‑Star. Basically astrology.

In the HLW and LW models, r-star is determined by the trend growth rate of GDP as well as a second, unobserved factor, called “z,” which encapsulates the effects of all other determinants of r-star beyond trend growth. Although not specified in these models, the determinants of z may include demographics, the relative demand for safe assets like Treasury securities, and government indebtedness, all of which affect the global demand and supply for savings.

America’s big, beautiful . . . liability management exercise? None of this stuff is going to happen, but people are having fun talking about it.

Cue the “Mar-a-Lago accords” – a classic cram down. This is right up Trump’s alley of experience, what to do when firms become too leveraged to generate the cash flow needed to repay the debt and run the business. One could argue the US is in this position... The cram down solution is to force debt holders to recognize they own equity disguised as debt and make them swap their holdings for debt with new terms (much longer maturity, for example) or take in equity, meaning giving up their standing in the stack of creditors in the event of liquidation. The US is not going bankrupt, and it could tax itself enough to run a balanced budget by raising taxes, but chooses not to, believing instead that lower taxes generate the growth to pay for forward obligations. History has proven otherwise.

European Bank Momo Report: Yes, They’re On Fire, Are they Blanket Buys?

The Takeaway—

U.S. banks? Overextended. Technicals stretched. Short Scores flashing red. If you’re long, be careful. If you’re short, the setups are there.

European banks? Absolute strength. Low Short Scores. Heavy momentum. Big money is here, and the tape confirms it—these are not short candidates.

Big picture? This rally wasn’t built on fluff. Fundamentals kicked it off. The weak dollar just threw fuel on an already burning fire. Smart money saw it early.

Not a blanket buy. Disclaimer again, not a blanket buy. Think for yourself. But look at what the numbers are telling you.

Apollo’s Athene Turns to Note Sales as Pension-Risk Deals Dry Up

The plunge in risk-transfer deals last year followed lawsuits that challenged the transactions Athene carried out with eight large companies. The legal complaints allege that the plan sponsors breached their fiduciary duty by shifting pension liabilities to Athene because its links to the private-markets investment manager put their benefits at greater risk.

Athene, which isn’t named as a defendant in any of the lawsuits, has said the claims have no merit. All eight defendants have asked that the lawsuits be dismissed, but courts haven’t ruled on any of the requests yet.

Once we account for this security externality, standard economic thinking gives us clear guidance. Markets underinvest in resilience because they fail to price the strategic value of certain productive capabilities. Society overall would accept lower economic returns for investments that only pay off in crisis scenarios, but businesses do not (Murphy and Topel, 2013). Excess capacity in healthcare or defense appears inefficient in normal times but is invaluable during emergencies.

How can governments intervene effectively without risking ‘anything goes’? The basic rule is that policy interventions should target sectors where production capacity would become scarce during the conflict, as measured by potential price increases relative to peacetime (Kooi, 2025). The optimal subsidy is proportional to how much the price of a sector's capital goods would increase during the specific conflict being prepared for.1

rather than reshoring everything, the goal should be avoiding extreme dependency on any single foreign supplier for essentials. This approach preserves most of the efficiency gains from global trade, while effectively addressing strategic vulnerabilities.

Remarks on "Monetary Policy Transmission to Real Activity" and the Recent Experience. Bowman.

…monetary policy tools other than the policy rate, including forward guidance and the amount of securities holdings in the central bank's balance sheet, are also important for the transmission of monetary policy since they can more forcefully affect the expected path of the federal funds rate, term premiums, and risk spreads.

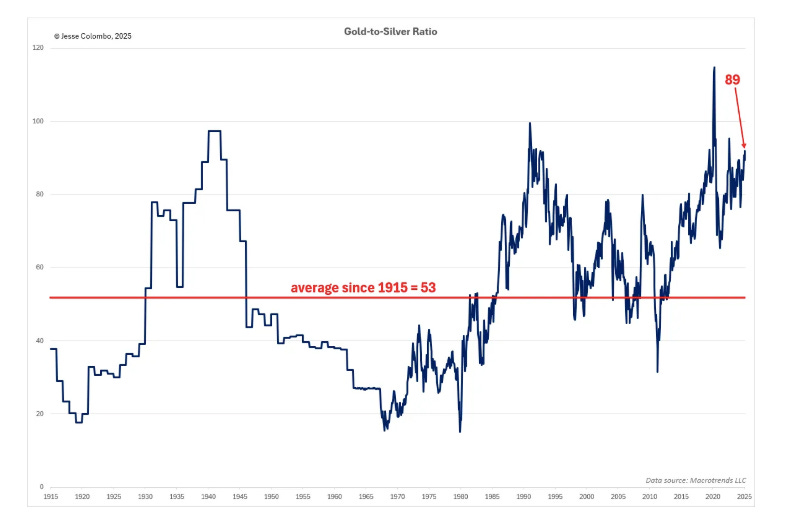

Why It's Silver's Time to Shine Now. Everyone still loves silver. I don’t see how it can rally with so many people talking their book.

Research Exchange: February 2025—Bank Policy Institute rundown of recent research

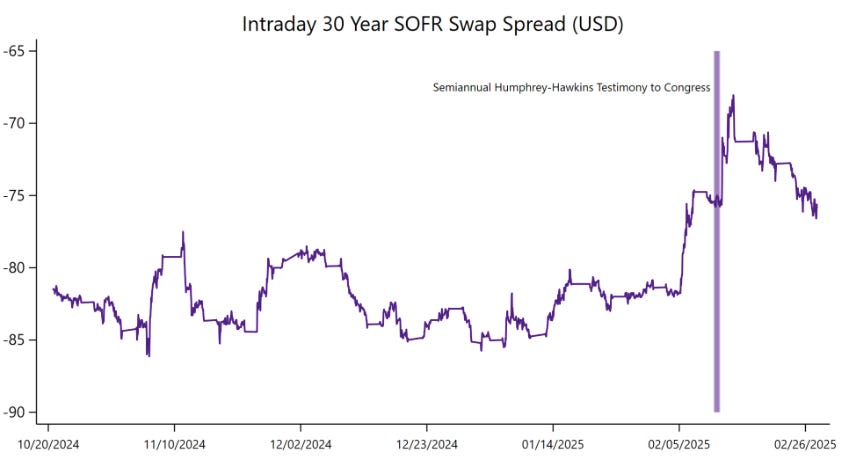

The chart shows a significant widening of the long-maturity SOFR swap spread, defined as the difference between the 30-year swap rate and the 30-year Treasury yield, following the Federal Reserve Chairman Powell’s remarks during the semiannual Humphrey-Hawkins testimony. Powell indicated that the Fed is considering recalibrating the supplementary leverage ratio (SLR). This widening reflects an expected easing of balance sheet constraints at banks due to anticipated changes to the SLR.

Bitcoin’s transparent ledger isn’t just dystopian—it’s a bureaucrat’s wet dream. Every donation, purchase, and transaction, logged forever—ready to be used against you at any time.

Every purchase, donation, or transfer could be monitored by governments, corporations, or even nosy acquaintances.

Bitcoin is Venmo for the Surveillance State™. Every coin comes with a history, every transaction is public, and every mistake is forever. Might as well use your checking account at this point.

The GENIUS Act: Insolvency Risk with Stablecoins

After Silicon Valley Bank can one really have confidence that they won't get a bailout? Will banks be allowed to support their insolvent stablecoin issuer subsidiaries? Will the US Strategic Cryptocurrency Reserve (if created) be used to bail them out by buying their stablecoins at 100¢ on the dollar?

The GENIUS Act creates an implicit government guaranty of stablecoins. That means that taxpayers will be implicitly subsidizing the DeFi transactions that rely on stablecoins and that generally sit outside of the reach of anti-money laundering enforcement: taxpayers are going to be implicitly subsidizing money laundering. Is that really a desirable policy outcome? I fear the consequences of the GENIUS Act haven't been fully thought through.

News you can use—Buying a $250 Residency Card From a Tropical Island Let Me Bypass U.S. Crypto Laws

Federal Reserve Earnings Still Running Negative; No Remittances to Treasury for a While

As of 2/26/2025, the Fed’s “deferred asset-remittance to Treasury was -$223.98 billion. Note that (1) this balance has continued to grow in the first 8 weeks of this year, suggesting that Fed net income was still negative over this period; and (2) the growth in the negative balance has slowed, suggesting that net losses are shrinking. This of course is not surprising, as the funds rate is 100 basis points lower now than prior to mid-September of last year.

Trying to predict Fed net income over the next year of two depends very heavily on projections of the federal funds rate, and depends somewhat on the pace of balance sheet reduction and the Fed’s reinvestment strategy. However, it is highly likely that the Fed will not be remitting any funds to Treasury anytime soon.

Mortality Classics: Broken Heart Syndrome

Foreign

Half a century ago, Le Pen called for an uprising against a dawning era of human rights, abortion, sexual liberation, transnational governance, and—above all—mass migration. He won the near-unanimous loathing of his country’s journalists and intellectuals, who accused him of racism, sexism, and anti-Semitism. For a time he was the most despised major politician in the West, rivaled only by Britain’s Enoch Powell. Not all of his views have been vindicated—far from it. But his general vision, which passed through Pat Buchanan and Ron Paul and Brexit on its way to Donald Trump, has triumphed. It is worth looking at what he got right and what he got wrong.

The Europeans Should Give Russia's Reserves to Ukraine Now

In the aggregate, people in the reserve-buying societies are living below their means in exchange for the promise of a floor on future living standards, while people in the reserve-issuing societies are spending more than they produce (often by producing less than they could) and racking up ever-increasing debts, which could—but probably will not2—be exchanged for claims on future production. This is a worse outcome for almost everyone involved compared to a world where countries did not need to self-insure.

Besides which, building a financial war chest to prepare for emergencies does not even work much of the time, because the best hedges are real investments in spare productive capacity and stockpiles of critical goods. This was as true for the Russians—who ended up leaving much of their reserve hoard under the control of the democracies—as it was for the Germans who were unreasonably pleased with their low levels of public debt even as they let their infrastructure and defense capabilities deteriorate.

People, ideas, machines X: Freedom's Forge - the story of American business and industrial production in World War II. Dominic Cummings. It’s hard to imagine a scenario where the UK would use nukes against the advice of the US, but the fact that they likely can’t use nukes independently seems underappeciated.

They’ve let the nuclear enterprise rot as I’ve recounted many times since 2021. It now relies on vast Pentagon subsidies of money, materials and intellectual property. Which also gives DC vast leverage over a British PM. The nukes are already in an over £50B secret black hole. Having to recreate all the infrastructure without US support would be over 100B. The odds of Starmer facing this openly and explaining how taxes will have to rise by vast amounts so we can bounce more Ukraine rubble are close to zero. MPs and regime media do not understand how constrained a UK PM now is and what a disaster one phone call from the Pentagon to the Cabinet Secretary would be.

Ukraine has shown that NPCs have very strong nationalist emotions but they just cannot attach them to their own nation, they care about borders but not OUR borders. Nationalism for Ukraine and ‘the European project’ allow them to indulge in nationalist emotions without seeing themselves as nationalist. It’s perfect.

Related—What if America turned off Britain's weapons?

…regardless of what one thinks of Putin and Russia, it is not in the American national interest to get into a war with them–not even a proxy war that absorbs relatively modest resources, let alone a full-out conflict. It is certainly not in American national interest to get into a conflict over Ukraine, sorry. The US (and Europe!) survived for decades when Ukraine was part of a much more dangerous adversary, the USSR. Russia is a declining power that cannot decisively defeat a never was power with 1/5th its population and less than 1/5th of its economy. And if the Europeans can’t deal with that, well that’s a fate they’ve chosen.

America’s preeminent interests are now in Asia, and China is the only adversary that matters right now. Getting bogged down in a war in eastern Europe severely constrains the US’s ability to respond to that threat. Kellogg made this point explicitly:

“I’m reminded of what Professor Paul Kennedy from Yale University wrote in a seminal work, The Rise and Fall of the Great Powers, when he noted that great powers historically fail when they involve themselves in strategic overreach. He called it imperial overreach. But I’ll make it simple so you don’t have to buy the book. When a nation is concerned about filling somebody else’s potholes when they have their own potholes, they fail.”

Vance’s Real Message to Europe: Give Up the Information War and GTFO

In short, the transatlantic alliance has for years been waging a hybrid information war on the American public (among other nations). Above all, the objective of this politics by other means was to stop the rise of Donald Trump and the populism he represents. But that war failed; now Trump is back and, as Vance warned the political and military leaders assembled in Munich, “there is a new sheriff in town” in Washington. Much as they risk being abandoned and left standing alone holding the bag in Ukraine, the allies of former president Joe Biden across the pond have been left stranded in the digital trenches of America’s cold civil war, still combatants on what’s now distinctly the losing side. Vance was politely informing them that their cyber-soldiers had better pack up and leave the conflict zone immediately.

With the end of WWII, the U.S. was primus inter pares in the Atlantic and Pacific because it won the war. But by trying to induce deadly rivals to join it in a multilateral system, the United States was offering to neuter itself. And that’s exactly what happened when Nixon met Mao.

Colby’s foreign policy ideas are the same as Obama’s and Biden’s on the issues that President Trump has identified as the top threats to America—China, Russia, and Iran.

Policy/Domestic

Two Americas, one bank branch, and $50,000 cash

Socioeconomic class, unfortunately, has a great deal of bearing on how a bank would choose to interact with an individual. This is particularly true as one approaches either end of the socioeconomic spectrum, away from the mass market that most people assume banks must be serving at all times. We have often discussed discontinuities in service at the lower end of the spectrum in Bits about Money. There exist… other discontinuities.

Less Is More: The United States Must Stop Stretching Its Navy Thin

The Navy certainly needs more ships to meet mounting threats across the Pacific (and beyond), but meaningful growth is at least a decade away. In the interim, the service must pivot to a proactive, resource-efficient approach that upholds a credible deterrent. Operational restraint, sharing presence missions with allies, improved services and technologies, and a preference for strategy over symbolism would position the Navy to thwart China’s rising assertiveness and, if conflict arises, decisively prevail. Doing less with more in the next several years may be the key to victory.

Navy Shipbuilding Crisis: GAO Finds Billions Spent Without Strategy as Fleet Goals Remain Unmet

The U.S. Navy continues to fall short of its fleet expansion goals despite investing billions in private shipbuilding and repair companies, according to a new Government Accountability Office (GAO) report.

The report, titled “Shipbuilding and Repair: Navy Needs a Strategic Approach for Private Sector Industrial Base Investments,” reveals a concerning disconnect between the Navy’s ambitious fleet expansion plans and the industrial base’s capacity to deliver.

Over the past decade, the Department of Defense has poured over $5.8 billion into shipbuilding infrastructure and workforce improvements, with plans to invest an additional $12.6 billion through fiscal year 2028.Yet these massive investments lack proper coordination and performance metrics to ensure effectiveness.

Weld, baby, weld: White House to create an ‘office of shipbuilding’

Trump is hardly alone in his concern. Navalists have been sounding alarms for years, but the issue leapt to the fore in summer 2023, when a briefing slide prepared by the Office of Naval Intelligence reported that China’s shipyards can build around 232 times more tonnage than their U.S. counterparts.

Childhood and Education #9: School is Hell

Scott Alexander asks, given Americans clearly do not know basic facts that were supposedly taught in school, but do remember things through cultural osmosis, what is even the point of school? If you learn via spaced repetition, isn’t school failing rather miserably at that? The unstated question there is if you actually wanted to teach things, wouldn’t you used spaced repetition, which schools don’t use in any systematic way. The answer to the puzzle, of course, is that school is not about learning.

Bryne Hobart: Discussions about school vouchers, homeschooling, etc. make me feel grateful that it's legal for us to cook for our kids, even though neither my wife nor I went to culinary school. Things could be very different.

China Tests World’s First Oblique Detonation Engine

Using the common commercial jet fuel RP-3, they successfully achieved sustained oblique detonation waves. The research, published in the academic journal “Experimental Fluid Mechanics,” shows that the engine’s combustion rate is 1,000 times faster than that of traditional supersonic combustion ramjets and can operate within a range of 6 to 16 Mach, speeds that are difficult for traditional air-breathing engines to achieve.

US Army to deploy 1st Dark Eagle hypersonic missile, can hit 1,725-mile away at Mach 5. We’re back in the game.

Science/Health

Maybe it's just YOUR testosterone that's low

If you’re on X you almost certainly have seen the claim that the global testosterone levels have declined. It’s everywhere, something people attribute to microplastics or obesity or seed oils, and much else, a claim I very recently casually contested as being likely actually the result of a change in the way we measure testosterone. I will once again reiterate my claim here: I don’t think the huge drop in testosterone is the result of anything other than a change in how we measure stuff. Below is my defense of this position focused primarily on the ways measurements have likely skewed our “testosterone crisis” that everyone on X is so worried about.

Like the trip to Mars, the trip back to Earth will be shortest roughly every two years. As an Australian, it amuses me that the time taken for physically plausible journeys to and from Mars on a chemically-propelled monster rocket like Starship is similar to the time taken for my ancestors to sail from Great Britain to the colonies about 150 years ago. Unlike them, though, voyagers in Starship will not have to endure hunger, disease, infant mortality, and navigational errors.

Can the Human Body Endure a Voyage to Mars?

Mitochondria that were fortified with supplements were much less likely to lose their integrity and die; in some cases, they worked nearly as well as mitochondria that hadn’t been irradiated. Beheshti and Schwartz suggested that supplements might one day help astronauts stave off the worst effects of radiation. Even earthbound humans could benefit. “Mitochondrial dysfunction is a global process that underlies a variety of human diseases,” Schwartz said. “This opens up an entirely different way of thinking about how one could go about treating any number of disorders—cancer, aging, infectious disease.”

I’m not sure why the author didn’t include which supplements they tested, but they were:

N-acetylcysteine (NAC): A precursor to glutathione, an antioxidant that helps neutralize free radicals, reducing oxidative stress. NAC is known for its role in liver protection and respiratory health, and its application here extends to radiation protection.

Alpha-lipoic acid: A compound that plays a dual role in energy metabolism and antioxidant defense, helping to regenerate other antioxidants like vitamin C and E. It supports mitochondrial function by enhancing energy production and protecting against oxidative damage.

L-carnitine: An amino acid derivative that facilitates the transport of fatty acids into mitochondria for energy production. It also has antioxidant properties, potentially shielding mitochondria from radiation-induced damage.

It’s time to simplify the EV recharging process and make it more cost effective. But that surely won’t happen without a discussion of galvanic isolation in the technical community. So let the discussion begin! We’re convinced that eliminating the isolation link should be the first step toward the robust charging infrastructure that the EV transition so desperately needs.

The FDA Finally Removes a Huge Barrier to an Effective Schizophrenia Medicine

Up to 20 percent of homeless people have schizophrenia, and clozapine might help them turn their lives around. Unfortunately, the FDA has required clinicians, pharmacists, and patients to comply with onerous, one-size-fits-all rules. These rules help explain why, with an estimated 30 percent of schizophrenic patients not responding to first-line antipsychotic drugs, clozapine is only prescribed to 4 percent of schizophrenic patients in the US.

Will Boom Successfully Build a Supersonic Airliner?

I hope Boom is successful, because it would be great to have supersonic airliners (and to have another US company capable of building commercial aircraft). But to me it seems the odds are steep, and they have a very long way to go.