Weekend Reading

2025 #21 (June 13)

Everything is kind of beside the point except the situation in the Middle East at the moment, but if you want to take a break from Monitoring the Situation, here are some things to read.

Markets / Econ

The Fed may be moving away from FAIT in name, but the underlying motivation—to correct past inflation misses and foster a credible nominal anchor—remains embedded in the emerging framework. The spirit of makeup policy lives on, quietly influencing how the FOMC thinks about persistent inflation gaps. Anchoring FIT to a stable path of total dollar spending offers a coherent way to formalize that spirit without the baggage of overshoot promises.

Macro hedge funds outpace trend followers amid market volatility

Among the winners, EDL Capital posted a 24% gain, Rokos Capital Management returned 9.5%, and Brevan Howard’s Alpha Strategies advanced 4.3%, although its flagship fund remains down 2.1%.

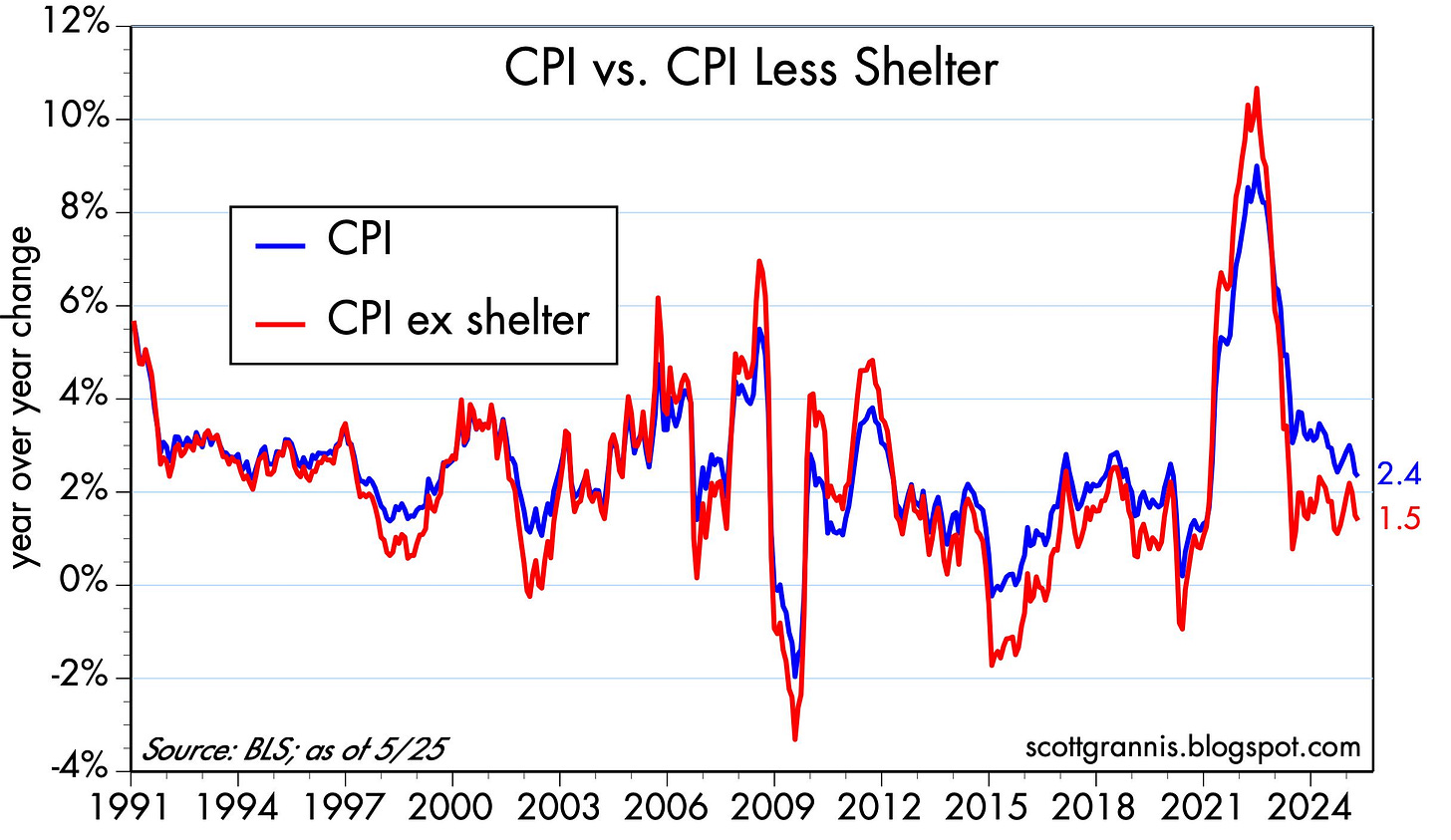

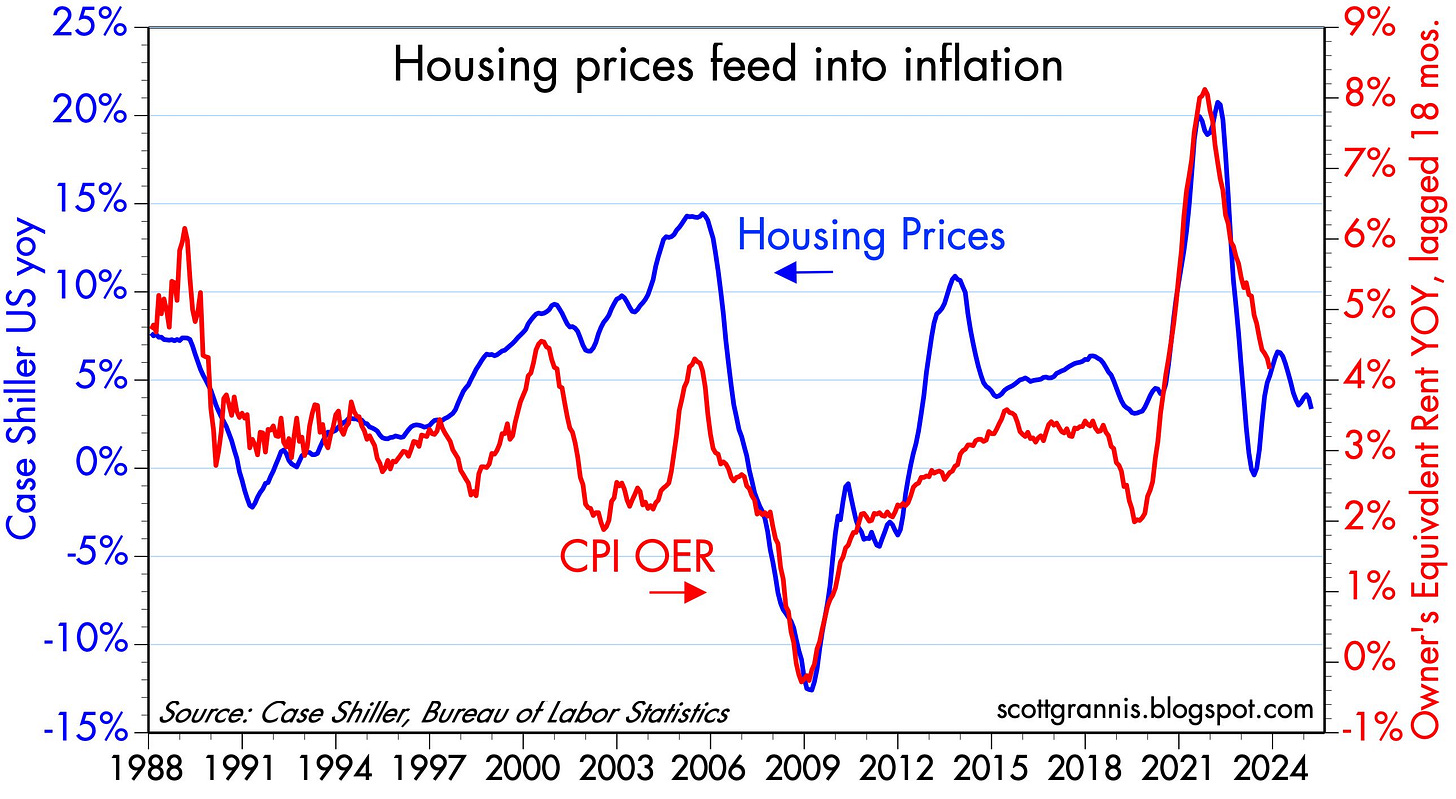

Memo to Fed: lower interest rates are overdue

Ted Cruz Intensifies Push to End Fed Interest Payments. I completely agree that the Ample Reserve regime should end (see George Selgin’s Floored, which persuasively argues for a return to a corridor system). But if you just stopped paying interest on bank reserves and the RRP without shrinking the balance sheet, you’d go well beyond ‘running it hot.’

Private Credit & Systemic Risk. If a tree falls in the forest and no one is there, does it make a sound?

Private credit funds do not yet appear to be systemically important entities compared with other large systemically important financial institutions, but given the industry’s rapid growth, opaqueness, and role in making the financial network more densely interconnected, it could disproportionately amplify a future crisis. The interconnected financial system has a dual nature: It spreads risk under normal circumstances, arguably making the system more resilient to small negative shocks, but it also means that once thresholds are breached, the system can experience contagion.16 The experiences of the GFC and the pandemic bear this out, and private credit will likely be involved in any future crisis.

How Goldman Sachs turned financing into a US$9 bn powerhouse. Finally, a win for the guys at GS.

Goldman’s financing push reflects a broader transformation that some have dubbed the "re-tranching" of the banking system in the wake of the 2008 financial crisis. Regulators forced banks to hold more capital against risky activities, prompting much of this business to migrate to the so-called shadow banking system of private equity and hedge funds.

The rise of private debt funds is a case in point. These investors have seen their assets nearly quadruple over the past decade to about US$2trn, according to PitchBook, as they have taken over parts of the traditional bank business of lending money directly to companies. They also frequently require leverage to boost their returns – and banks are happy to oblige.

Comments on the Shift from Public (Quoted) to Private (Unquoted) Markets

Although private markets have experienced significant expansion and play a critical role, the magnitude of this growth is frequently exaggerated. This paper examines some of the implications of this modest shift from public to private markets and reviews contemporary literature on the societal externalities of private equity activities.

We’ve looked before at how a few great individual stocks explain almost all cumulative wealth gains from equity market investing. Investors with the

lucksmarts to identify, buy, and hold these stocks did very well. But how bumpy was the ride?Michael Mauboussin and Dan Callahan took a look at the data for 6,588 US stocks since 1985 in a report last month for Morgan Stanley. We’ve belatedly got around to reading it properly, and the results are interesting.

As a reminder, Professor Bessembinder of Arizona State University studied around 28,600 companies listed in the US between 1926 and 2024. As well as finding that most stocks failed to match returns from US T-bills, he found that 2 per cent of them produced 90 per cent of the market’s aggregate wealth creation.

Powerlifting through Hysteresis

One of the most important and unresolved questions in bank supervision today is how much failure we should be willing to tolerate in the banking system. So I asked Peter: how should policymakers decide when to let a bank fail and when to step in?

“My cynical answer is, your intuition about how much failure is appropriate—I’m speaking to the bank regulators—it needs to be increased. You need to be much more tolerant of failure. This isn’t just hindsight bias, as you know, I have talked about on this show before. I think the Fed and Treasury and FDIC mishandled the 2023 crisis in about seven different ways. I’ve thought that throughout. There is a new piece by Jonathan Rose and Steven Kelly that, I think, is probably the single best piece of writing on the 2023 crisis that really goes through this argument that you’re talking about… I think we can say that the Biden administration’s tolerance for bank failure should have been expanded. It was way too low.”

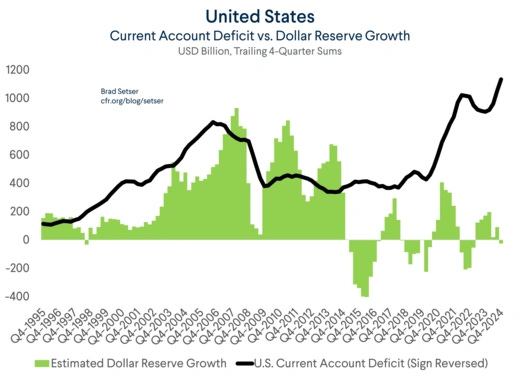

The Dollar’s Global Role and the Financing of the U.S. External Deficit

The actual data—from both the main creditor countries and the U.S.—is quite consistent: the flow into dollar assets in the last few years has largely come from private investors seeking yield, not state investors who are compelled to hold safe assets.

Brad Setser Says Smart Things on Exorbitant Privilege Unearned & Earned

Here is the idea. The United States remains the only country in the world where nearly everyone rich would not be unhappy to place their money. This holds even those who fear the United States. And this holds even for those who see the United States in relative decline. Have enough American partners who make large enough campaign contributions to senators, and your money in the U.S. is safe.Whether it is the billionaire flying into LAX on a Lear Jet or the oligarch's cousin arriving via a coyote and a rubber boat, the U.S. legal and financial system remains insurance—not just against inflation or depreciation, but against capricious autocracy, kleptocracy, and the systemic chaos of states elsewhere, where rule of law is at best aspirational.

Consider also the intergenerational angle: global elites are not just seeking return or refuge for themselves, but for their heirs and heiresses. If the great-grandchildren of the world’s rich plan to live in Los Angeles or New York, then buying dollar assets is part of family planning, not just portfolio management.

All of these seem to me highly likely to give the inflows a surprising durability—but only so long as the U.S. remains the preferred future.

Covenant Lite #23: The Private Credit Performance Illusion

Global Housing Returns, and the Emergence of the Safe Asset, 1465-2024

Overall, we should be very skeptical of stories that say cutting off your arm will be good for you. It’s possible it happens sometimes. People overcome adversity, which motivates them to great things. But as a general approach to policy, the more straightforward idea that raising the cost of things means you can do fewer things is a helpful guide.

Are We Going to Legislate Mass Evictions?

Among the progressive left, the blindness can be acute, because progressive prejudice is in the service of an egalitarian ethic. It is punching up. Punching up means never having to say you’re sorry. So, this blindness along with the cruelties and inevitable self-harm that come from it, are frequently laid out plainly for anyone with non-prejudiced eyes to see.

“Humans over Private Equity for Homeownership Act” is a shameful example of this.

The act calls for firms that own more than 50 single-family rental properties to divest their properties. Merkley claims that this would affect about 700,000 homes today and 40% of all single-family rentals by 2030. (That would be about 5 million homes.)

Foreign

Iran Should Use Oil to Urge the US to Sue for Peace

A more reasonable attack on the U.S. will target its economy. Iran can stop its production of oil. It has various means to stop oil and gas production in U.S. allied countries situated in its neighborhood. It can close down the Strait of Hormuz through which 25% of the global hydrocarbon productions is flowing. There is the little the U.S. could do to prevent Iran from sustaining such a blockade.

As I have stated previously:

“Trump wants lower oil prices and freedom to pursue his domestic agenda.”

A few month of oil prices above $200 per barrel would devastated the chances for Republicans to keep the House and the Senate. It would ruin Trump's presidency.

All About the €€€: How Bulgaria’s Euro Dreams Could Become a Nightmare

Europe’s Zombie Armies — Or How to Spend $3.1 Trillion and Have Precious Little to Show for It

Waste at this level is not merely a matter of absent mindedness or “inefficiency”. When you “misallocate” trillions of dollars, it has a logic. In this case, to put it politely, the logic was conservative. A less polite version would be to say that they were zombie armies. Europe’s military establishments were shriveled and dysfunctional but they abided. Europe’s military producers were inefficient in terms of delivering weapons. They did not play in the big leagues with their massively consolidated American rivals, but they continued to make profits. Not rationalizing and not consolidating avoids painful conflicts. States and politicians could maintain the pretense of sovereignty without actually facing the facts of disempowerment and incapacity.

The Next World War Might Start in Brčko

Pretending Bosnia and Herzegovina is a functioning country won’t prevent a war, but letting it break up just might. The West clings to a fantasy held together by foreign troops, ghost institutions, and maps no one believes. But fantasies break. And when they do, it won’t be Gaza or Donbass or Taiwan that pulls the pin. It will be Brčko: a sleepy river town where the roads all cross, the flags all clash, and one checkpoint too many could do what a bridge down the road in Sarajevo once did – ignite a chain reaction. But this time, the trenches are digital and the battlefield global.

Why OnlyFans Has Young British Women in Its Grip

Britain is host to 280,000 creator accounts, giving us one of the highest concentrations in the world. Eighty-four per cent of those accounts are run by women, and if they are all (give or take) between the ages of 18 and 34, then we can estimate that just shy of 4 per cent of young British women are selling their wares on OnlyFans.

I’m reliably informed by various male writers – Sophocles, Kingsley Amis, Russell Brand – that being possessed of a young man’s libido feels like being chained to a lunatic. And that’s in normal circumstances, without the addling effects of tech.

The online super stimulus that really knocks women sideways is not the consumption of sexual content, but the production of it. Women want to be beautiful as fiercely and obsessively as men want to get laid. I’m generalising, of course, but if you’re in any doubt about the strength of this kind of female desire, look at the size of the cosmetics and fashion industries.

Most women are not vulnerable to this temptation, in the same way that most men are not vulnerable to becoming porn addicts. But thanks to the technological sophistry of OnlyFans, men and women with the same kind of psychological weakness can now find their counterparts and mutually exploit one another online.

Politics / Culture

The Plastic Surgery Procedure Booming Among Washington Men

“I think people tend to connect a strong chin with authority, trustworthiness, leadership, honesty,” says New York plastic surgeon Darrick Antell, who embarked, about 14 years ago, on a study to find proof. He collected Google images of the mostly-male CEOs of Fortune 500 companies, measured their faces, and determined that 90 percent of them had strong jawlines and chins, compared to 40 percent of the general population. Today, Antell says, he performs about 150 chin implants per year, inserting a horseshoe-shaped piece of silicone that enters through a tiny incision beneath the chin and stays in place by virtue of scar tissue. His website trumpets: “LOOK LIKE A CEO WITH CHIN IMPLANTS IN NEW YORK.”

“It’s ironic … that they’re so against trans-ness and gender-affirming care for trans people,” he said of the MAGA set. “Because, you know, they’re all doing their own gender-affirming care.”’

Gamblemerica: How Sports Betting Apps Rewired a Generation’s Relationship to Risk

Not everything that's fun should be legal, but I think gambling does happen to be fun. The question is like “Okay, just because something's fun, should that mean that you should be able to bet in the middle of the night on like Malaysian women's doubles badminton through the state of Colorado?”

That to me is where you get past the point of oh, this is inevitable, so we might as well legalize and make money off of it. We are now inculcating gambling and creating a new generation of gamblers and soliciting gambling that wouldn't have been happening otherwise.

Many people compare it to other vices, but Jon points out that gambling is a very specific type of cognitive capture.

Kyla: That's the loop of gambling, right? You're like, “oh, I'm in the hole. I just need to gamble some more and I'll get out of the hole.” It's such a nasty cycle.

Jon: It’s unlike drugs or alcohol in that way. There's no reason that you'd expect “oh, if I have another shot of vodka, it will cure all the negative effects of my alcohol addiction”. Theoretically, like if you hit the Milwaukee Bucks over tomorrow night, it could wipe out all of your debt. So you just keep chasing and keep chasing

Private Equity, UnitedHealth Take a Huge Loss as Oregon Bans Corporate Control of Doctors

We’ve known about this problem for awhile, and every few months a new book comes out pointing out that Wall Street institutional control of medical practices and hospitals costs us lives and money. And yet, there’s been little progress. So why did Oregon act? Why didn’t private equity and UnitedHealth Group’s lobbying succeed in this small Western state, when it has everywhere else? Well, part of the story is that it did succeed; in 2024, they were able to ward off this same law, which nearly passed but was not able to overcome fierce objections from state Republicans. But this year, something changed.

And we can actually thank UnitedHealth Group, which provided Oregon with a particularly noxious experience in health care, and the political culture to do something about it. Because UHG’s tactics are so brazen and extensive the company actually screwed over two separate Oregon state representatives, both of whom have cancer, and both of whom in turn testified on behalf of the bill.

The Court can create an exception for the Federal Reserve. Indeed, the Court in Trump v. Wilcox recently indicated it may do so. It claimed that the Federal Reserve was “a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States.” This Article argues that such an exception is illogical. No historical basis exists: The Federal Reserve is not sufficiently analogous to any Founding-era entity, including the First or Second Banks of the United States or the Sinking Fund Commission. None of them conducted discretionary monetary policy. No functional basis exists either: The Federal Reserve exercises executive power. And no other constitutional provision clearly justifies its independence. It is ultimately not meaningfully different than any other administrative agency. The Court should tread carefully before growing the removal power further. Reducing agency independence exposes the Federal Reserve to material risk.

Don’t Mourn Regulatory Independence

The fact is, while these regulators may have been independent from the White House, they weren’t from Wall Street and Silicon Valley. For decades, “independent” financial regulators have repeatedly sided with powerful interests over ordinary Americans, even when Democrats controlled the White House. In the absence of presidential accountability, regulators came to view financial institutions—not the American public—as their clients.

Now that the world had the printing press, the monasteries’ primary reason for existence – the core justification for both their prestige and their accumulated wealth – no longer applied. They had outlived their usefulness, making them nothing more than an irritating thorn in the king’s side and a tempting concentration of loot. Henry VIII lost nothing whatsoever by dissolving them, and gained a great deal.

Our own university system is on the cusp of a similar collapse. This may seem outrageous, given the size, wealth, and massive cultural importance of universities, but at the dawn of the 16th century, the suggestion that monasteries would be dismantled across Europe within a generation would have struck everyone – even their opponents – as absurd.

The Hidden History of How America Built—and Broke—Its Government

Today, decision-making is distributed across a complex web of career executives, political appointees, contractors, and oversight bodies. Everyone needs information, but they need different kinds of information for different purposes. A budget system that tries to serve everyone serves no one.

The same logic applies to personnel. The SES was designed to serve multiple masters: agencies that need deep technical expertise, the White House that needs political alignment, Congress that wants oversight and accountability, OPM that needs systemic coherence, OMB that needs managerial efficiency, and a public that simultaneously demands both competence and fears "politicization." Meanwhile, countless laws impose different types of accountability on SES executives while few give them the executive decisiveness to take risks and implement solutions. A personnel system that tries to optimize for everything optimizes for nothing—and creates executives who can satisfy process requirements but struggle to actually execute.

Science / Tech / Health

They Asked ChatGPT Questions. The Answers Sent Them Spiraling.

She told me that she knew she sounded like a “nut job,” but she stressed that she had a bachelor’s degree in psychology and a master’s in social work and knew what mental illness looks like. “I’m not crazy,” she said. “I’m literally just living a normal life while also, you know, discovering interdimensional communication.”

This caused tension with her husband, Andrew, a 30-year-old farmer, who asked to use only his first name to protect their children. One night, at the end of April, they fought over her obsession with ChatGPT and the toll it was taking on the family. Allyson attacked Andrew, punching and scratching him, he said, and slamming his hand in a door. The police arrested her and charged her with domestic assault. (The case is active.)

Apple’s LLM Debunking Has the AGI Faithful Sweating

More strikingly, these models don’t even understand how to apply a solution they have been given outright. As Gary Marcus discusses with one of the researchers, in one of the experiments in the paper, “we give the solution algorithm to the model, and all it has to do is follow the steps. Yet, this is not helping their performance at all.”

All of this matters for practical reasons, obviously, because it shows that continued investment in larger data sets and more compute won’t make these tools into general-purpose reasoners usable for high-stakes decisionmaking. More philosophically, these findings matter because they show that scaling compute will never turn LLMs into Artificial General Intelligence, a.k.a. The God AI, a.k.a. The Singularity, which has been pushed aggressively by entities like OpenAI and (less loudly) Anthropic.

Are Ultra-Processed Foods the Problem?

As soon as we start thinking in terms of UPFs—21st Century nutritional thinking, for better or worse—we lose all the distinctions regarding macronutrients.3 As soon as the nutritionists came to think of their research as trying to determine what it is about UPFs that might make them seemingly unhealthy, they skipped over the stage in which they actually test the validity of the UPF concept itself.

But maybe it's not the UP-ness of a food that makes it unhealthy? Maybe it is the 20th Century thinking of macronutrients, sugar, fat, glycemic index, etc. Maybe all the rest—the whey proteins, lecithins and flavorings and dyes—is window dressing. Even if these additives are harmful, maybe they're very minor insults in this context of much greater harms.

So if we think UPFs are making people fat and sick because of the industrial ingredients and the number of ingredients, how about we do the kinds of experiments that can establish if that is true. Then we can move on to maybe learn something meaningful.

Brain Implantation of Soft Bioelectronics via Embryonic Development

Here we introduce a tissue-level-soft, submicrometre-thick mesh microelectrode array that integrates into the embryonic neural plate by leveraging the tissue’s natural two-dimensional-to-three-dimensional reconfiguration. As organogenesis progresses, the mesh deforms, stretches and distributes throughout the brain, seamlessly integrating with neural tissue. Immunostaining, gene expression analysis and behavioural testing confirm no adverse effects on brain development or function. This embedded electrode array enables long-term, stable mapping of how single-neuron activity and population dynamics emerge and evolve during brain development. In axolotl models, it not only records neural electrical activity during regeneration but also modulates the process through electrical stimulation.

How PUFA Contributes to ROS Production (Part 1)

Over-Certainty of Polygenic Scores

One reason, which we discussed at length before, is that, with only small exceptions, there aren’t many single genes exceptionally for particular traits and for none other. Sex is an exception with chromosomes, and so are the odd diseases which are gene-singular. Genes don’t exist as separate things in you anyway: you are not a machine and therefore not built like one. Genes and you and everything else are you. There are tremendous redundancies and feedbacks built into the whole genetic apparatus, which is to say, into you. Knock out one gene and others step up. This is not to say, or even suggest, genes are not important, because of course they are. But teasing out causality is most difficult, and control is not always going to be possible.

This isn’t the place to rehash all those arguments: go to the link for that. The takeaway point is that things are far more complex than generally believed. Over-certainty, as in AI, abounds. It would, however, be far worse if there was no uncertainty, and we were able to pick just those traits we thought we wanted. One minute’s surfing the internet ought to convince you of the abominations that await us if we really could design babies to our fickle and bizarre liking. “I’d like a dozen fat furry deaf non-white trans lesbians, please.”

Passing by the morality of ruthlessly killing all the unpopular, non-wee-P proto-babies, a true utilitarian act, there is anyway a superior and well tested version of eugenics to get the kind of babies you want that you can practice at home. For free! And a lot more enjoyable. Find yourself a mate that is as hot, healthy, intelligent, sane and compatible as you can manage. Eat well and have kids young.

What Methylene Blue Can (and Can’t) Do for the Brain

Enter methylene blue, who can accept the lost electron, bypass the broken part of the hot potato game, and thus prevent the appearance of free radicals. What’s more, it appears that methylene blue can increase the activity of cytochrome C oxidase, and even increase the expression of the genes responsible for making it. This is a glimpse behind the “it boosts mitochondria” curtain.

RIP Harris Yulin and Brian Wilson