Markets/Economy

Notes on the Macro-Finance Sitch for 2025-01-13.

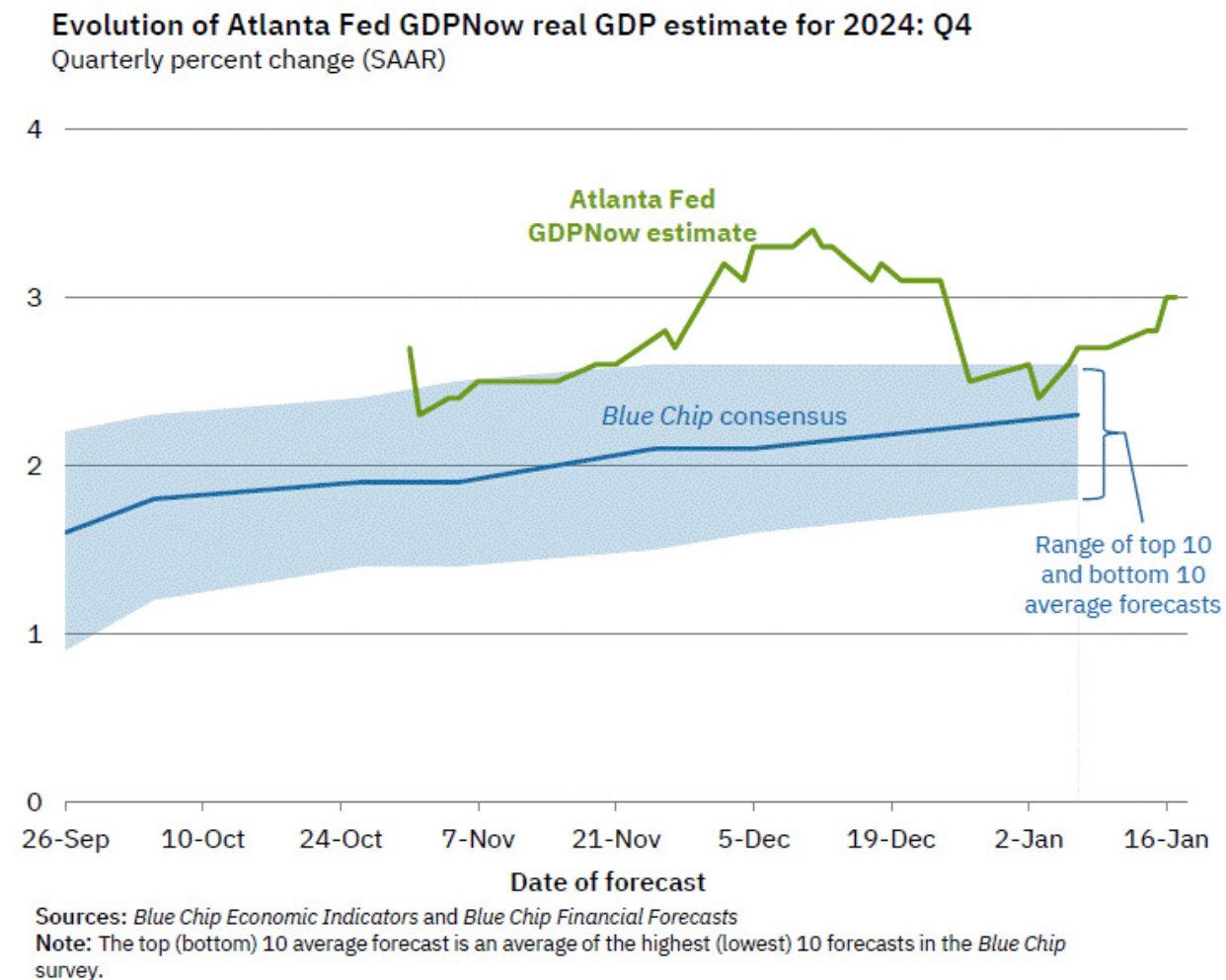

The interesting analytic question raised by the most recent jobs report is whether my belief that “neutral” is in fact a 3%/year Federal Funds rate is correct. At the moment I still take refuge in the belief that (a) fiscal stimulative multipliers are somewhat higher than I had thought, and (b) irrational financial exuberance driven by the failure of investors to understand that an extra dollar of NVIDIA profits today is not a signal of rapid future economic growth driven by “AI”, but rather a transfer from tech platform oligopolists to NVIDIA driven by their belief that they have no choice right now but to pay NVIDIA through the nose to build “AI” capabilities to purchase insurance against the disruption of their platforms and the erosion of their platform-oligopoly profits. But that is a point for another day.

However, let me set a timer: if what I regard as substantially restrictive interest rates do not bring signs of labor-market slowing, I am definitely going to have to rethink my views about what the American economy’s current neutral rate of interest is.

I don’t understand how you can think the neutral rate is 3% when real GDP is hitting 3%, AGI is coming, and the Fed targets (floors) inflation at 2%.

National Debt on Track to Reach Record High in Just Four Years

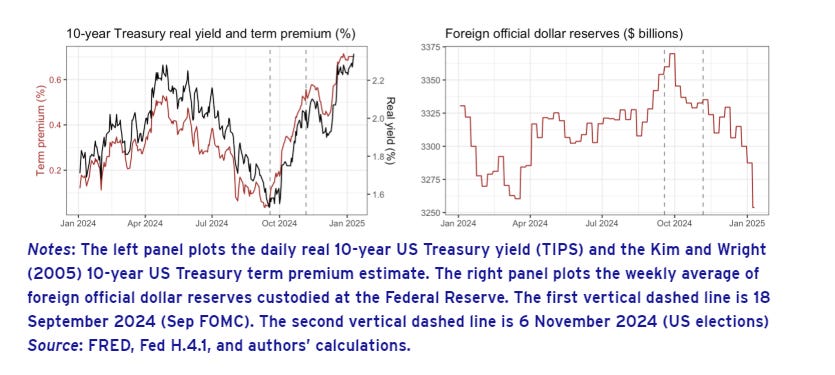

A ‘Trump conundrum’ and foreign official demand for US Treasuries

Related? Weaponizing the US Dollar. Can It Work?

The United States got the Bank of England to confiscate Venezuela’s gold supply and offer it to the right-wing opposition. That worked. And the EU and United States together confiscated Russia’s $300 billion of foreign dollar holdings. That worked, and the EU just gave the interest (about $50 billion that had accumulated) to Ukraine to help fight Russia.

But first, the United States seized all of Ukraine’s monetary reserves as safe keeping, ostensibly to help it pay back the debts it has been running up. I don’t think this gold will be made available for Ukraine’s rebuilding. It simply reflects a U.S. pattern of asset grabs. The U.S. military grabbed Libya’s gold supply when Gaddafi tried to use it to create an African gold-based alternative to the dollar for central banks to hold. And the US also grabbed Syria’s gold supply on its way out, leaving only the oil exports as a U.S. trophy of its conquest. It did the same with Afghanistan’s gold reserves on the way out. So obviously the United States anticipates gold returning to a major role in the world’s monetary system.

P-Star Reloaded: Trump’s Tariffs, Powell’s Policy, and Inflation’s Next Act

This essentially shows how strong the pass-through is from excessive money supply growth to inflation and that this clearly is regime dependent.

During periods of well-defined monetary rules – e.g. during the Bretton Woods period or the inflation targeting period – the pass-through is weaker than during periods of low credibility. This was the case in the 1970s, but was also the case during the monetary expansion in 2020-2022.

The strength of monetary transmission tends to increase during periods of fiscal dominance and regime uncertainty. This pattern makes the current Trump/Powell dynamic particularly concerning, as it echoes aspects of the Nixon/Burns era when monetary policy became subservient to fiscal priorities.

Powell needs to thread a very narrow needle in 2025.

The P-star model suggests he should resist premature easing. History suggests he should fear regime change above all. Markets suggest he has a difficult job ahead.

Unsolicited Advice. Cochrane advice for DJT.

eliminate the personal and corporate income tax, estate tax, all taxes on rates of return (interest, dividends capital gains) and replace them with a consumption tax. The same rate for all goods: don’t transfer income by mucking with prices. No deductions, no exclusions, not even mortgage interest and charitable deductions. Lower the rate, broaden the base. I prefer a VAT for various reasons, but the mechanism doesn’t matter so much. The “fair tax” was already introduced into Congress. Detailed consumption-tax proposals have been around since the 1970s. This could happen.

The Dodd-Frank Reforms failed. See SVB, an elephant in the room which the regulators did not see. And now they want to regulate “climate risks.” Big banks are still too big to fail and count on bailouts. The Fed refused to let corporate bond prices fall in the last hiccup.

Enough. We know the answer: with equity-financed banking and narrow deposits, we need never have a private sector financial crisis again. all your objections.

The Origins of the Modern Era of the Federal Reserve. JK Galbraith.

Monetary policy has become an empty set of rituals. When interest rates rise, the press reflexively reports that inflation is being fought; when they fall, the Fed is supporting growth and the labor market. But the gears are disconnected from the engine; the supposed causes no longer bear on the supposed effects.

In the era of interest payments on bank reserves, raising rates is a direct subsidy to the very rich, as well as a deterrent to loans for risky, long-term commercial, residential, and technical investments ... If Trump’s Department of Government Efficiency wants to save real money in the federal budget, getting Congress to order the Federal Reserve to fix the federal funds rate at zero would be the right way to start. —This would be even better for crypto bros than the Bitcoin Strategic Reserve, although both ideas are equally retarded.

The 'grossly overvalued' American dollar

But Alphaville can’t shake the feeling that many of the weird phenomena — such as US gas station managers seemingly commanding bigger salaries than many European doctors, or Jane Street interns making more than the UK prime minister — are simply evidence that the US dollar is wildly overvalued.

The Fed Must Adopt a Monetary Policy Rule

As Figure 1 shows, policy recommendations across the various rules closely align. (NGDP targeting is slightly more volatile than the other rules.) The key observation is that any of these policy rules would have helped the Fed avoid its costly post-pandemic mistakes. All rules recommended raising the FFR well before the Fed did so in early 2022. Instead, discretionary monetary policy led the Fed to incorrectly label inflation as “transitory” and its sluggishness in tightening its stance likely allowed inflation to become entrenched. Once it realized its mistake, the Fed had to execute a series of rapid rate hikes and has since kept its rate target higher than all the rules recommend. Had the Fed followed such a rule, it is likely that Americans may have experienced a stable increase in rates and avoided suffering the highest bout of inflation in at least 40 years.

Foreign

A Spymaster Sheikh Controls a $1.5 Trillion Fortune. He Wants to Use It to Dominate AI

In the multiplayer game of strategy that is the AI arms race, the US controls the board right now for a pretty simple reason. A single American hardware company, Nvidia, makes the chips that train the most competitive AI models—and the US government has moved to restrict who can buy these Nvidia GPUs (as the chips are called) outside the country’s borders. To take advantage of this clear but jittery lead over China, the CEOs of America’s AI giants have fanned out across the globe to sweet-talk the world’s richest investors—people like Tahnoun—into financing what amounts to an enormous building boom.

How German Industry Can Survive a Second China Shock

…by some accounts, China’s production capacity – EVs as well ICEs – approaches 50 million cars.21 That is roughly half of global vehicle demand. Meanwhile, Germany exports one million vehicles a year fewer than it did during the pre-pandemic peak.

German firms are struggling to compete. Bound by the logic of capitalism to deliver returns, not just pour out products, and without profits to fuel new investment, they risk falling behind in the technological race.

Europe Needs a Plan B and C on Trump

Russia Marks Completion of Fourth Project 22220 Nuclear-Powered Icebreaker. Related—Our ship game sucks. The U.S. was supposed to get keys to a new heavy icebreaker this year. Instead, construction is years late as costs soar and Competitiveness of Protected US Shipyards Continues to Erode

the local currency debt on the BCRA balance sheet has migrated to the government—as it should. Ideally, this lengthens the average maturity of consolidated government liabilities and formally transfers the interest burden onto the fiscal authorities—so the central bank will not be forced to monetize future interest costs but these will instead to met through a primary fiscal surplus.

Milei’s Key Pending Task: Ending Argentina’s Currency Controls (Part II)

There is also an unstated yet highly likely political motivation for the government’s delay: the government does not want to risk a sudden freefall in the peso’s value, with a corresponding rise in inflation, before the congressional elections in October 2025, when Milei will have the chance to improve his party’s standing from its current, small minority to a significant majority. As the president argues, politics is a zero-sum game; if his party does not wield power, then the statist Peronists will do so once again.

To be blunt, achieving full sovereignty with de jure international recognition at this time would do little beyond incentivizing elite-level pursuit of sovereign rents at the expense of continued political and economic development. What has made Somaliland work is that its elites principally derive their legitimacy from their people, and not the international system.

China

Point—In defense of Chinese deflation

With the largely successful Made in China 2025 project, the ascendency of the Industrial Party and a projected tripling of China’s STEM workforce in the next two decades, the likelihood of China experiencing two decades of supply-driven deflation should not be dismissed.

In fact, that kind of productivity increase – 20 years of deflation – may be the only way to industrialize the Global South, which needs capital and capital goods (i.e., solar, electrical systems, infrastructure, vehicles, etc) far more than it needs market access (see here).

Counterpoint—The China malaise

Causation is an ambiguous concept, which depends on which policy counterfactuals are the most useful. Thus you could say that China’s deflation is caused by an overvalued yuan. Or you could say that assuming a fixed value of the yuan, the deflation is caused by bad supply-side policies. Both claims are defensible. The question is which solution is the most feasible, the most useful?

Ironically, China is really, really good at doing the very hardest parts of development, such as quickly building lots of excellent high speed rail lines, subways, airports and expressways. They also have plenty of housing construction, perhaps too much. Even the US no longer knows how to build enough infrastructure and housing. In contrast, China is increasingly inept at doing the easiest parts of development, insuring that they have printed enough money. Even Zimbabwe knows how to print money.

The Pettis Paradigm and the Second China Shock

So what should countries do to prevent this? Tariffs are one obvious answer. If the world raises tariffs on China high enough, exchange rates will have difficulty adjusting, and Chinese products will have difficulty penetrating foreign markets. Chinese companies will then have to fall back on their domestic market. This will intensify the effect of competition, and reduce their profits much more quickly.

The sooner Chinese companies’ profits collapse, they will cut back on production. They’ll also probably pressure the government to stop subsidizing overproduction, in order to lessen the competitive effect and keep themselves in the black. This political pressure could be what finally pushes Xi Jinping and the CCP to change China’s economic model, reducing incentives for overproduction.

Trading Places: China’s Misdirected Economic Strategy

But as I have argued above, the stock adjustment framework draws the staying power of such a short-term stimulus into sharp question. It’s not just the inevitable payback effects of the durable goods replacement cycle associated with a trade-in campaign. Nor is it the limited clout of the other pro-consumption initiatives noted above such as rebates for digital purchases or government pay hikes. Until or unless Beijing begins to temper the political constraints on social engineering and unshackle the behavioral spirits of the Chinese people, China’s latest pro-consumption policy efforts are unlikely to gain sustained traction.

Politics/Culture

Trump’s Threat to U.S. Intelligence. Ex-CIA author threatening Trump with a new 9/11 if he’s mean to the “IC”.

Should Trump and his team behave with such disregard, their attitude toward the IC will likely lead to weakened information sharing, with agencies restricting the flow of material for fear that it may be misused. Intelligence officials are responsible for the lives of human agents as well as for expensive, irreplaceable collection platforms, and they may worry that the erosion of the protections for their agencies’ information will put those lives and assets at risk. Doing so will make it harder to connect the dots on key national security challenges. The resulting consequences could be dire. For example, the 9/11 Commission report, released in 2004, found that failures in information sharing (particularly between the CIA and FBI) were a major factor contributing to the IC’s failure to uncover and prevent the attacks.

AI #99: Farewell to Biden. Zvi Mowshowitz—the only AI writing you need to read.

Bull Moose versus Weak Horse. Millions for defence, but not one cent for tribute.

The Founders understood that Americans’ wealth and well-being depends upon international trade, which requires that Americans be free to travel relatively unfettered around the globe. They also understood that the best way to avoid war is to make the prospect harrowingly unattractive to prospective enemies. Months before dying, Washington wrote:

“It is unfortunate when men cannot, or will not, see danger at a distance; or seeing it, are restrained in the means which are necessary to avert, or keep it afar off. … no problem in Euclid is more evident, or susceptible of clearer demonstration—Not less difficult is it to make them believe, that offensive operations, often times, is the surest, if not the only (in some cases) means of defence.”

Bring back paternalism for the mentally ill

Community-based mental health will remain central, but nestled within that system must be a more robust stock of psych beds than is currently available to the seriously mentally ill Americans. And many forms of paternalism stop short of hospitalisation, such as programs that mandate outpatient treatment programs, such as mental-health courts and New York’s Kendra’s Law, which gives judges the power to order people to receive care.

Car designs look more like each other than ever. Color is disappearing as most cars become white, gray, or black. From Sydney to Riyadh to Cleveland, an upscale coffee shop is more likely than ever to bear the same design features: reclaimed wood, hanging Edison bulbs, marble countertops. So is an Airbnb. Even celebrities increasingly look the same, with the rising ubiquity of “Instagram face” driven by cosmetic injectables and Photoshop touch-ups.

Murrell focuses on design, but the same trend holds elsewhere: Kirk Goldsberry, a basketball statistician, has shown that the top two hundred shot locations in the NBA today, which twenty years ago formed a wide array of the court, now form a narrow ring at the three-point line, with a dense cluster near the hoop. The less said about the sameness of pop melodies or Hollywood movies, the better.

As we approach the moment when all information everywhere from all time is available to everyone at once, what we find is not new artistic energy, not explosive diversity, but stifling sameness. Everything is converging — and it’s happening even as the power of the old monopolies and centralized tastemakers is broken up.

if the best defense for your behavior is "But she consented to eating her own shit and vomit!," if you find yourself saying anything even in the ballpark of that statement, you need either therapy or Jesus or both. Neil Gaiman gets a big thumbs down from me, he gets zero stars. I would certainly not have sex with him and I don't think you should, either.

The thing is, if women can’t be trusted to assert their desires or boundaries because they'll invariably lie about what they want in order to please other people, it's not just sex they can't reasonably consent to. It's medical treatments. Car loans. Nuclear non-proliferation agreements.

Science/Health

Repetitive injury induces phenotypes associated with Alzheimer’s disease by reactivating HSV-1 in a human brain tissue model. I’m not sure what you can do with that information, but another reason to keep a lid on inflammation.

The Mathematical Reason You Should Have 9 Kids

Because chromosomes are transmitted independently, the probability that all of your autosome pairs are replicated into your children is just the probability that one of your autosome pairs is replicated into your children, raised to the power of 22.

Heritable polygenic editing: the next frontier in genomic medicine? What could possibly go wrong?

The Curious Gems of the River Thames

Hang on, are there ANY lost minerals?

I failed. After a single post (Malachite) I’m taking the decision to retire the Lost Materials series. Why? Because in trying to hunt around for minerals we have run out of, I came to an unexpected conclusion. So far, we haven’t really, meaningfully run out of, well, pretty much anything.

Gene Editor May Have Cured Infant of Deadly Metabolic Disorder

A little-known gene editor, tested with help from a disgraced gene therapist seeking redemption, may have cured a 1-year-old boy of a deadly metabolic disorder. Announced last week by a company developing the therapy, the result could be the first success at stitching a curative gene into a “safe harbor,” a specific chromosomal location where its integration is unlikely to disrupt existing DNA in a way that triggers cancer or other problems. Because the gene should now be integrated in the baby’s genome, in this case within cells of the boy’s liver, it should persist as the organ—and person—grows.

The gene editor, dubbed ARCUS, is a DNA-cutting enzyme known as a nuclease, It is in some ways simpler and potentially better than the more famous CRISPR platform

The Case for Clinical Trial Abundance—A series of short papers outlining reform possibilities for our nation's clinical trials.

On mental health, psychedelics and life. The suicide note of Felix Hill, who was a researcher at DeepMind.

I wish so much that I’d never taken the Ketamine, at least without medical supervision. Without that, I am sure I could have resolved the challenges around alcohol, ambition and being too self-centred. I am sure those fixes are not easy, but they feel easy given my current problem. Ketamine, and the consequent psychosis, converted me from someone who has learned to live with depression on-the-whole pretty successfully to someone who is dead.