"No Headstone on my Grave" [LIVE AT GILLEY'S JULY 4th 1982]

Josh Morningstar’s Jerry Lee.

Econ/Markets

A dead cat bounce 250 years in the making.

1788 was an interesting year. France itched for revolution, King George III was adrift, and New York marked becoming the eleventh US state by hosting America’s first recorded riot, which was over grave-robbing in Manhattan for medical cadavers. It was also the last time 10-year US Treasuries did as badly as they’re doing now.

The Big Tech Hiring Slowdown Is Here and it will Hurt.

Well, Big Tech has hit the brakes: hiring freezes are in place and I am, indeed, worried.

Reviewing Three of the Scariest CRE & CMBS Storylines in Time for Halloween 2022—Refinancing Risks for Maturing CRE Loans, Office Properties With Expiring Leases, and Housing Question Marks in the Single and Multi-Family Markets.

The Revival of Credit Suisse First Boston—A brief history and current assessment of CSFB.

Inflation Adjusted House Prices 2.3% Below Peak.

Scott Sumner—Persistent inflation is always and everywhere a monetary phenomenon and In One Way, All Recessions Are Alike.

Over the past decade, I’ve been arguing that trend RGDP growth has fallen to about 1.5%, mostly due to slower labor force growth (retiring boomers and fewer immigrants.) In that case, the Fed needs to generate roughly 3.5% NGDP growth to maintain its 2% inflation target.

The new GDP figures continue to show wildly excessive growth in nominal spending, with NGDP soaring at more than a 6.7% annual rate. (Please wake me up when the Fed begins its tight money policy.)

What we are seeing in diesel (and in other energy markets as well) is their efficient operation in the face of extreme supply and demand shocks. You may not like the message that prices and stocks are sending–that fundamental conditions are really tight–but suppressing those signals, or other types of intervention like export bans–will make the situation worse, not better.

And yes, energy market (and commodity market generally) conditions should definitely be considered when evaluating how to handle Russia and the war in Ukraine. But that evaluation is not advanced by hysterical statements about the nation grinding to a halt at Thanksgiving because we’ll be out of diesel.

Mark Zuckerberg Is Going To Kill His Company

And that’s the ultimate con of Mark Zuckerberg. He is a liar and has created very little. Every major product that Meta sells (other than Facebook itself, and even then…) was acquired - FriendFeed, Friendster, Beluga, Instagram, Oculus, Face.com, every part of this company is some taped-on acquisition. It worked for a while, but no part of this narrative suggests Zuckerberg is the true architect of this company’s success.

He is, however, clearly the architect of its destruction. Zuckerberg mishandled the entire Cambridge Analytica situation, which I would argue was the first real executive test. Facebook’s revenue has been stumbling, and now he has now invested $15 billion into “the metaverse” without it being immediately obvious where that money went or why it went there.

Federal Reserve: High Pay, Low Performance.

The Federal Reserve System includes the Board of Governors and 12 regional banks. In 2021, the Board had 2,973 employees who earned an average wage or salary of $168,786. The regional banks had 20,141 employees who earned an average wage of $127,999.

On top of those wages are the Fed’s generous benefits, which pushed average Board compensation up to $215,338 in 2021, and average regional bank compensation up to $193,123.

This Earnings Season Vindicates The Value vs Growth Hypothesis.

Investors in growth stocks were double counting - the companies were over-earning and these earnings were being capitalized at high multiples. Now that they are past peak cycle, the earnings are falling and they are being re-rated, and the shares are plunging. The NASDAQ is down 31% year-to-date. (Interestingly, the equal weight S&P 500 is down 14% YTD and SPY is down 19%.)

So those are the big three "growth" examples. We have to put that in quotes now because their earnings are declining. They still have a combined $2.6 trillion market capitalization (down from $5 trillion at the peak!) and collectively they do not generate much cash (thanks to Amazon's cash burn and Facebook's "Metaverse" bet).

Someday, the ex-growth companies expenses will be slashed, their earnings will bottom, and by then they will undoubtedly trade at cheap multiples. But that may take a long time since Facebook and Google are dual share class corporate governance disasters. And the knock-on effects of those SG&A cuts will ripple far and wide - any prospective investment should be evaluated for such exposure.

Multi-strategy hedge funds are the new, superior fund-of-funds.

Of course, there’s a fair bit of variety in the results. To take some examples we’ve seen in the press and investor documents lately, Citadel, Millennium, and Brummer are up 29 per cent, 9.7 per cent, and 15.3 per cent respectively this year through September, Weiss Multi-Strategy was flat by the end of August, while Sculptor Capital (formerly known as Och-Ziff) was down over 10 per cent.

An old story in modern times. Duncan Mavin's pretty darn good book on Greensill.

As an equity guy this has bugged me all my life…

Fixed income seems more complicated than equities. It sometimes involves impenetrable math. And backing the air of difficulty is the simple fact that lots of this stuff isn't quoted - and when it is the spread is wide…

This illusion that the fixed income guys are smarter has always grated at me - as I am faced with what I sometimes think are a bunch of empty suits with fancy jargon.

Variance explained is mostly bad

Supposing that you want to stick with the standardized effect sizes, there is a common practice of reporting r² values, that is, squared correlations, which is the same as the proportion of variance 'explained' (associated with) in the outcome by the predictors. When it's a correlation, you can simply square it. However, thinking in terms of variances is highly misleading when making comparisons between predictors. Consider this great example of coin flipping:

Foreign/International

Why I think an invasion of Taiwan probably means WW3

Sound and Fury. Assessment that WW3/nuclear escalation is unlikely in Ukraine, followed by a short history of the Egyptian/Hittite Battle of Kadesh.

Two Wars: Ferguson’s and Malmgren’s.

Niall Ferguson, the renowned historian, says we are edging towards WWIII, but we are not yet in it. In October 2021, I wrote WWII Has Already Started. He is a brilliant historian and observer of diplomacy. I ask myself, how can he not see that we are already well into a truly global conflict? Is it possible we are both seeing two very different wars?

The end of the system of the world.

The decoupling between China and the developed democracies, so long a topic of conversation and speculation, now appears to be a reality. A critical point has been reached. The old world-economic system of Chimerica is being swept away, and something new will take its place.

Well, oh ho ho, now we know: many have fallen, but the Wang remains! And Common Prosperity is back too. So I feel justified in taking a quick victory lap and suggesting that you read or reread my essay from almost precisely a year ago on Wang Huning, The Most Interesting Apparatchik in the World.

Folks are worked up for the Brazilian election on Sunday—The cannibal vs. the Satanist: Toxic politics is poisoning Brazil and Brazil’s Presidential Election Will Determine the Planet’s Future.

Denmark is a Right-wing paradise.

The Truss Fiasco: Various Takes—Francisco Toro; Andrew Sullivan; Joanna Williams; Theodore Dalrymple; Matt Goodwin; Gerard Baker; John Cochrane.

Abandoned Russian base holds secrets of retreat in Ukraine. When Russian troops fled the Ukrainian town of Balakliia last month, they left behind thousands of documents that detail the inner workings of the Russian war machine.

End of Empire - 3: The US will join the UK as a failed first-world state

But the facts suggest that the US will join the UK as a failed first-world state, a Somali with nukes.

Domestic/Culture/Miscellany

Shot: Navy Needs to Fill About 9,000 At-Sea Billets in More than a Dozen Ratings, Says Personnel Command. Chaser: Navy COVID-19 Vaccine Refusal Separations Nears 2,000.

Getting back on track with the Latino vote—“…there is no such thing as the Latino vote. There are Latino votes.”

Since COVID, the Government Has Gotten Worse at Core Functions.

One major reason service quality is declining is that government agencies are having problems with staffing, both quantity and quality. In this environment of high inflation, public sector wage growth hasn’t kept up with the private sector.

Especially in blue states, government agencies typically have a mix of underpaid and overpaid workers. Benefits are generous, especially for full-career workers, and salaries can get pretty high over time. But entry-level pay is often low — starting salary for NYPD officers is just $42,500 — and the promise of job security and a generous pension isn’t necessarily attractive to young people who don’t know what they want to do for the next 20 years, especially in the current labor market environment. (You also can’t pay rent on an apartment today with the promise of an excellent pension in 30 years.)

The demographic transition is like an antibiotic. And fertility is like antibiotic resistance.

If everyone has lots of kids, then wanting to have kids is not selected for. But if nearly everyone has very few children, then intrinsic desire to procreate is one of the most important things we select for.

However, since the demographic transition, the fertility of different generations of particular families has begun to correlate substantially. Children from families with four children tend to be more likely to go on to have four themselves.

*A Man of Iron*—Grover Cleveland is very underrated as a President.

May God Save Us From Economists.

Why was three decades’ deliberation necessary to impose such a commonsense safety precaution? Because Mansfield met her fate just as the economics profession was advancing, like an occupying army, into noneconomic agencies of the federal government. The result was a mindset—an ideology, really—that dominates public policymaking to this day. The Marxists (of whom I am not one) have an excellent term for this ideology: Economism. At a time of extreme political polarization, an Economicist bias (pronounced eh-co-nom-i-sist) is practically the only belief that Democrats and Republicans share.

Middle-aged women don’t want sex.

But while it’s of course true that older people get horny, in truth the premise of Leo Grande doesn’t challenge what’s behind female invisibility at all. Rather, it entrenches it. For it has very little to offer all those women for whom not having to be sexy any more is not a bug, but a feature. If, unlike the Paulina Porizkovas of this world, you’re among the far larger body of women who’ve made something other than looks the focus of your life, you may well find it a blessed relief when the gaze of male strangers begins to skip you in favour of younger, perkier women. In that context there are many upsides to ageing, including dressing for comfort, men talking to your face rather than your boobs, and (joy!) having lunch solo without being buttonholed by horny weirdos.

The Illuminati Has Officially Chosen To End Our Partnership With Kanye West. Parody or Illuminati disinformation?

Book Review: Malleus Maleficarum → Witches Get Stiches

Can Psilocybin Break Alcohol Addiction?

Our Palaeolithic ancestors did not eat a ‘Paleo’ diet. This is so weird. The EU paid 1.5mm euros to fund research to prove that Paleolithic people in Europe ate plants. Then they use that fact to attack a strawman version of the paleo diet and low carb diets in general.

Contrast that waste of time and money with this impressive display—A Wolf in Sheep’s Clothing: Spreading Deadly Pathogens Under the Disguise of Popular Music. Where the authors prove that the differential pressure sensors used in biolab negative pressure rooms can be compromised by piping in music of a specific frequency.

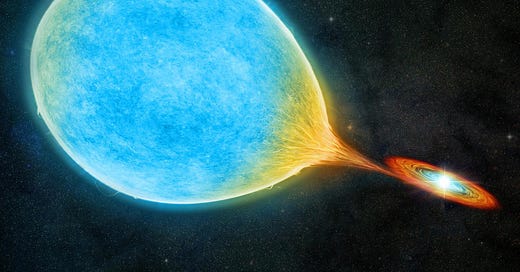

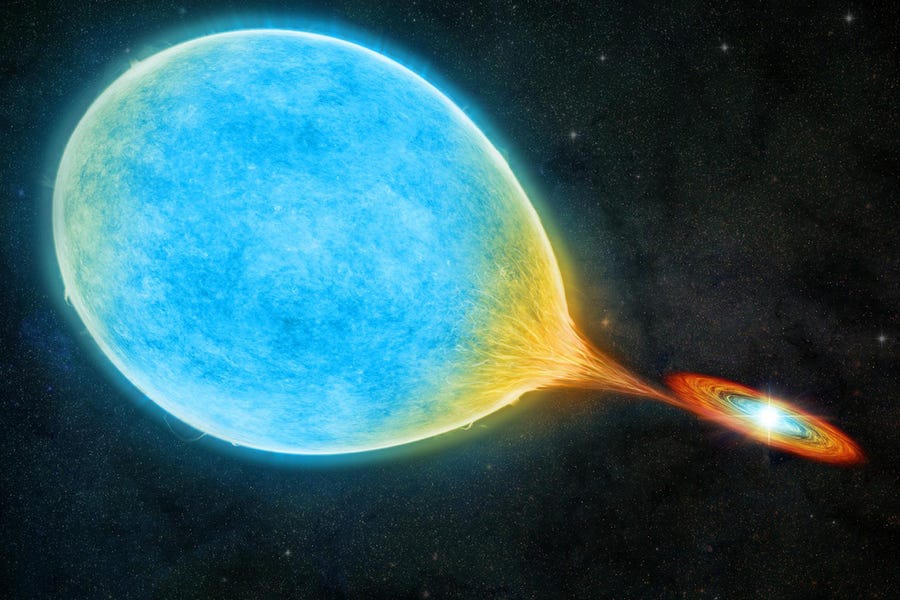

Astronomers find a “cataclysmic” pair of stars with the shortest orbit yet.