Weekend Reading

2025 #8 (March 1)

This was absolutely insane. Zelensky didn’t think he had to take sh*t from JD Vance. But, in the words of Marlo Stanfield—“You want it to be one way. But it’s the other way.” I see a lot of hopium that Europe and Zelensky will come together and lead the Rules Based International Order to victory over Putin. But Zelensky is done. He had one job, he needed to show up in a tie and say ‘yes, sir. Thank you, sir’ and sign the stupid, made-up mineral deal. Had he done that, Trump would’ve been locked into further Ukrainian support and the next step would likely have been to credibly threaten escalation against Russia to try to elicit a ceasefire and the start of peace negotiations. Now Europe and Ukraine will waste a week or two trying to go it alone, but nothing is going to happen until Zelensky is gone. The people that really run Ukraine will replace him with Valeriy Zaluzhny. I am a buyer of this Polymarket contract.

Markets/Econ

sell-off has taken more than $30bn in market cap off of AppLovin in the past week, a notable slide for a momentum-y stock that was (very briefly) talked about in the same breath as the Magnificent Seven.

That raises the question of what, exactly, AppLovin is and what it does. Here are a few things we know:

…This advertising business involves serving pop-up ads to people who play mobile games. The ads themselves are for mobile games.

No longer convenient? Safe asset abundance and r*. Schnabel

The reason is that increases in long-term real interest rates are typically thought of as being associated with improvements on the supply side of the economy, such as productivity growth, the labour force and the capital stock.

At present, however, these factors do not point towards an increase in r* in the euro area.

Potential growth has generally been revised lower, not higher, as many of the factors currently holding back consumption and especially investment are likely to be structural in nature, such as a rapidly ageing population and deteriorating competitiveness.

Overall, therefore, it is becoming increasingly unlikely that current financing conditions are materially holding back consumption and investment. The fact that growth remains subdued cannot and should not be taken as evidence that policy is restrictive.

…doing QE could be like chasing a moving target.

It reduces long-run rates by compressing the term premium.[21] But by making investors willing to pay a higher safety premium when the supply of safe assets shrinks, it may also reduce the interest rate level below which monetary policy stimulates growth and inflation.

Attention Induced Trading and Returns: Evidence from Robinhood Users

Consistent with models of attention-induced trading, intense buying by Robinhood users forecast negative returns. Average 20-day abnormal returns are -4.7% for the top stocks purchased each day.

What is the Future of Alternative Investing? The author is probably correct that more and more AUM will migrate to lower cost index product, which will exacerbate the pro-cyclical bubble price action in assets like MSTR or TSLA.

A diverse portfolio of alts costs at least 3% to 4% of asset value, annually. Institutional expense ratios are 1% to 3% of asset value, depending on the extent of their alts allocation. Alts bring extraordinary costs but ordinary returns — namely, those of the underlying equity and fixed income assets.

From Investment to Savings: When Finance Feeds on Itself

In this interplay between the equity capital that insurance assets create at the bottom of the capital stack and the need for private investment-grade debt origination at the top, Apollo was able to innovate around the traditional private equity model. Apollo CEO Marc Rowan saw something vital in the sleepy old model of insurance. Rowan told investors at the Barclay’s Global Financial Services conference in September,

“That is the single biggest constraint on growth, not capital formation, not how many people you have. It really is built around can you originate enough attractive assets to you to meet your needs. And that’s why we have been so focused and in fact, some might say maniacally focused on really making sure we are building the right type of origination in the right volumes, looking for the right new places to be doing that because our whole business is about delivering excess return per unit of risk.”

To address the origination constraint, Apollo has used the equity that “falls out” of the insurance structure, then raises outside capital in the traditional private equity model to capitalize, purchase, or otherwise finance captive debt origination platforms. Apollo, in effect, leverages their insurance equity via the private equity structure to earn fees and carried interest on the debt those platforms are originating. The portion of that debt origination that qualifies as investment grade can be fed back into the top of the insurance capital stack, dropping down new equity that is used to equitize further debt origination.

This makes the normally capital-intensive nature of debt origination considerably more efficient. Whereas in the traditional model, a dollar of insurance assets may only generate ten cents of equity to invest, Apollo’s model can turn those ten cents of equity into thirty or forty cents of equity by running it through a private equity structure. It introduces “Other People’s Money” (OPM) at every step of the insurance capital value chain. As a hypothetical example, an insurer can pair $5 of insurance equity with $5 of sidecar investment, then use their $5 of insurance equity to create an evergreen fund split 70/30 with outside investors, creating $7 of new equity. That new equity can go into a 50 percent joint venture debt origination platform, turning $5 dollars of insurance equity into $14 of equity that supports the origination of new credit to feed back into the structure.21 This equity is earning fees and carry closer to traditional private equity, but crucially, it is doing so with long-term, fixed-rate capital generated from the growing annuity market. This is an admittedly simplified illustration of the complexity of Apollo’s model, yet it can be reduced to a cascade of leverage, starting with the insurance liability and moving through to the private equity structure, which is itself a form of implicit leverage.

The Long Bitcoin Future. This could all be true eventually, but people don’t publish articles like this at the bottom.

Money has always been corruptible, subject to structures of power rather than the certainty of mathematics. This was true both of various gold and silver-based currencies that were devalued through admixture of less valuable metals into coins as a form of taxation, as well as fiat currencies backed by law and state power. Bitcoin's surge past $109,000 in January 2025, doubling its 2021 peak, may be a signal that this new technology has finally broken this deep historical pattern. As institutional capital flows into the first digital asset, Bitcoin is making good on its promise to become an “internet of money.”

Much as SaaS started horizontal and then went vertical (first Salesforce and then Toast), we’re seeing a similar dynamic playing out in AI: we started with ChatGPT, but are now seeing a proliferation of industry specific tools. Some people have called these startups “LLM wrappers”; those people are missing the point. The O ring model in economics shows that in a process with interdependent tasks, the overall output or productivity is limited by the least effective component, not just in terms of cost but in the success of the entire system. In a similar vein, we see these new industry specific AI tools as ensuring that individual industries can properly realize the economic impact of LLMs, and that the contextual, data, and workflow integration will prove enduringly valuable

From 2005 to 2017, independent pizzerias in the United States saw a decline in numbers as the industry franchised. Then that trend in 2017. By 2023, more independent pizzerias in America than in any other year on record. We think the rise of vertical SaaS is at least partly responsible. From a platform like , dedicated specifically to the needs of pizzerias, new businesses can get a logo, website, payment system, ordering system, marketing toolkit, and branded boxes—basically everything else they need to operate their pizza business (except an oven and the perfect sauce). They can remain independent while still benefiting from a franchisee’s economies of scale.

Eurodollars became very popular among non-US corporations despite being far unwieldier than stablecoins. We expect that stablecoins, as an easier-to-use and more accessible version of eurodollars, will bring similar benefits to a much broader group of actors. We further note with interest that, despite regulatory uncertainty in the United States, early stablecoin adoption has shown a notable US dollar preference, with an estimated of stablecoin balances being USD-based.

Levy Sees Uncertainty Weakening Demand and Lowering Inflation Despite Tariffs

People who detest trump are highlighting and accentuating everything bad that can happen. And so they said, Oh, inflation is going to go through the roof. It could bounce up a touch, but only temporarily. but the broader area to look at is aggregate demand when Trump imposed tariffs in mid-2018, and then ramped up his trade war with China in 2019... Guess what? Inflation actually came down. And it came down because the tariffs had a negative impact on aggregate demand through the uncertainty. So the aggregate demand impact more than offset the one time rise in the general price level the businesses passing on their costs to consumers. So, stay, stay tuned here. I think the biggest negative impact now is the uncertainty.

The fed has this dual mandate. And it has to keep an eye on employment. And so the fed has to face this. Okay, inflation may be drifting a touch lower, and it gets within a stone's throw of 2%. But we could see a deterioration in labor markets. Keep in mind the fed doesn't really care about GDP. It cares about employment and unemployment, and what history shows. Time and time again, is, is, the fed historically responds much more rapidly to unfavorable labor market data, employment and unemployment than it does to higher inflation.

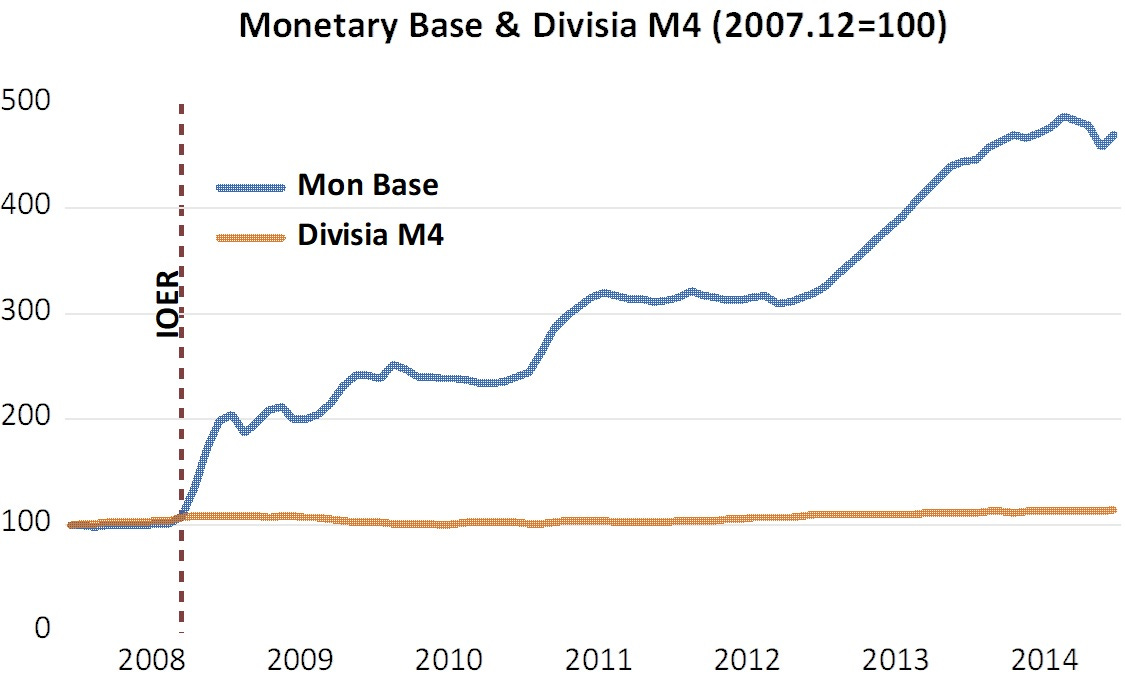

From Krugman´s monetary base and inflation chart above, it appears that monetary policy (not to be confused with interest rate policy) was of no help. But, just because interest rates are extremely low (or even zero) does not mean monetary policy is easy.

In fact, it was extremely tight! Here, the definition of monetary base is important:

The monetary base, often referred to as the "base money" or "high-powered money," consists of the total amount of a country's currency in circulation plus the reserves held by commercial banks at the central bank. To break it down simply:

Currency in Circulation: This includes all physical money—like coins and paper bills—held by the public, meaning anyone outside of the banking system or government institutions.

Bank Reserves: This is the money that commercial banks keep deposited with the central bank (like the Federal Reserve in the US). These reserves include both the required reserves (mandated by regulation) and any excess reserves banks choose to hold.

The money supply in the economy is a multiple of the monetary base. From the chart below, which plots the monetary base and a broad measure of the money supply (Divisia M4), it seems that the monetary base multiplier is not working.

Given I´ve kept the same color code of Krugman´s chart, you could easily think I made an error and just reproduced his chart. No, the brown mostly horizontal line in my chart is Divisia M4, a broad measure of the money supply (if you want to learn about Divisia Monetary indices, click here).

Note that the Divisia M4 money supply mimics the consumer price index in Krugman´s chart. Since the money supply did not increase, there´s no reason for the price level to rise.

Trump-Trade Unwinding: Bitcoin, (Micro)Strategy and Tesla in the Silver Trap

An important difference from previous speculative bubbles is that we no longer have low interest rates to keep the party going. Trump has just imposed 25% tariffs on imports from Canada and Mexico, which could cause inflation to rise significantly.

The problem? If inflation rises, it becomes impossible for the Federal Reserve to lower interest rates further. And that’s a game changer. Bitcoin, Tesla, and other risky assets have benefited from a market where money has been plentiful, and investors have chased returns in a low-interest environment.

If inflation forces the Fed to keep interest rates up, it could accelerate a real risk reduction in the market – and Bitcoin, Strategy, and Tesla are precisely the assets that risk being hit the hardest.

Foreign

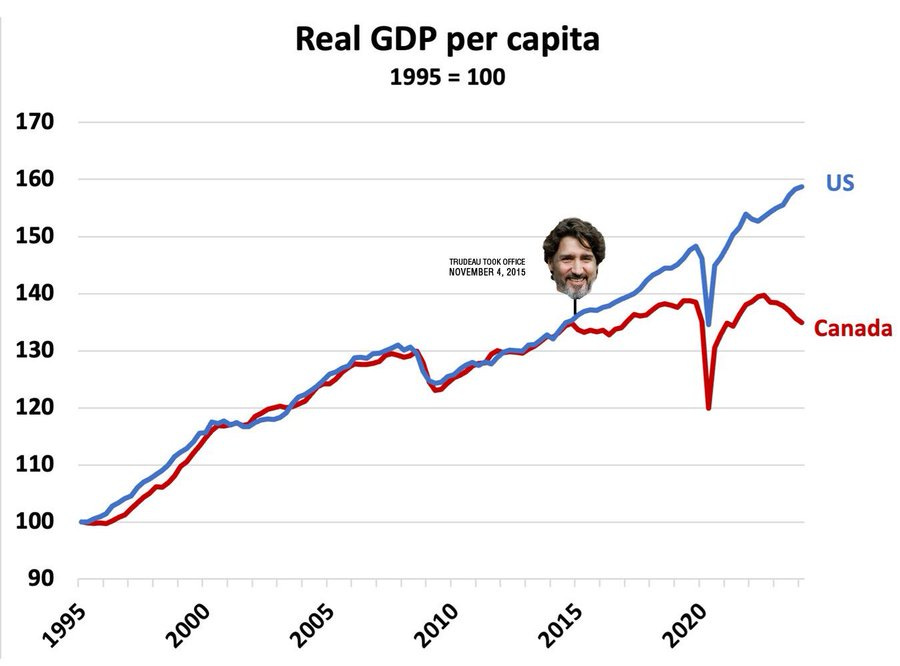

Enormous resource rents plus a tiny population plus having sovereignty guaranteed by the United States is an enviable position to be in. With merely adequate government, Canada could easily have the highest standard of living in the world, an Anglo-French North American Norway or Qatar. But instead of leaning into this, the grand strategy of the Canadian state has, like Britain, been to specialize in low-skill labor-intensive services, real estate, and degree mills6 while legally penalizing resource extraction.

The result of this catastrophe is that Canada is no longer the country of America’s imagination. Rather than America’s calmer, nicer, but slightly less prosperous cousin, Canada is quickly becoming far poorer and a worse place to live. Illegal immigration from Canada used to be nearly nonexistent; why take the risk when you’re already living in a perfectly nice First World country? But with a falling standard of living and an enormous number of people with no non-financial attachment to Canada, this has changed. Since 2020, nearly half a million illegals have been caught crossing the northern border.

Driving up tax receipts through a rapidly growing labour force and a boom in tourism is a great strategy to fund surging pension expenditure. But the reality of being young in Spain is grim:

One in four Spanish youth are unemployed — the highest rate in the European Union

The average Spaniard today does not leave their parents' home until age 30, four years later than their European peers.

Spain now has a total fertility rate of 1.12. (For reference, Japan’s is 1.26)

47% of young part-time workers want but cannot find full-time work, compared to just 19% across the EU.

Housing costs have risen almost 50% faster than youth wages since 2014, with the average rental now equal to over 90% of a young worker's income.

So, dear Ms. von der Leyen, “In Europe” you might think you can mould Balkan states in the shape you want, which is a quiet, obedient and unquestioning shape, but I would suggest you brush up on your history and reconsider. We have a reputation for bringing down empires just by being part of them*. Consider us a pathogen, weakened but very much alive. And your immunity is compromised as a result of your auto-immune disease. You might call it hubris. We call it brutal arrogance. And the American money for orchestrated events for what you like to call defence of democracy and the pro-European path of Bulgaria is gone. Deal with it.

In an Age of Right-Wing Populism, Why Are Denmark’s Liberals Winning?

These working-class voters implicitly recognize an important truth: A restrained approach to immigration is ultimately progressive because it makes possible the kind of society that progressives want. It fosters a sense of community and neighborliness, while prioritizing the values and interests of vulnerable Americans. Recognizing this connection can help the political left emerge from the wilderness where it now finds itself.

Overextended: The European Disunion at a Crossroads

Given the diversity of national geopolitical interests in Europe, there is no way that a centralized European superstate could be held together by Germany as a regional hegemon without a military confrontation with Russia kept alive by the United States. This implies that those who want a more loosely organized Europe—a Europe “à la carte,” one of “variable geometry” if not of “fatherlands,”35 one that is not led by Germany through Brussels on behalf of NATO and the United States—must seek accommodation with Russia instead of confrontation, so as to end the need for militarized centralization. Unless forced together by a common ally against a common enemy, the different interests of European countries will require, and would naturally give rise to, a continental state system that leaves room for national sovereignty. An EU that refuses its member states that room, ignoring the strong centrifugal forces produced by its functional and territorial over-expansion, would under conditions of international peace, unless deeply restructured, turn increasingly dysfunctional—the condition toward which the EU was trending before the war.

The West continues to imitate Dynastic Cycle China

The trouble with adopting the Chinese model of appointment-by-merit bureaucracy—including selection-by-examinations—is that folk failed to take a good hard look at the patterns of Chinese government. This despite the fact that the keju, the imperial examination, was introduced under Emperor Wen of Sui (r.581-604) and was not abolished until 1905, so there was quite a lot of history to consider.

The patterns of Chinese government are much less encouraging, because the quite effective, quite efficient, stage of bureaucratic administration does not last. The problem with appointment-by-merit is that it selects for capacity, but not character. Confucianism tries to encourage good character, but it repeatedly turned out to be a weak reed compared to incentive structures. (Almost everything is a weak reed, compared to incentive structures.)

The tension between the Trump Administration and the EU and British elites is—to a large degree—a Transatlantic class war.

Turkey, PKK Make New Peace Overtures Amid Regional Shifts and Possible Erdogan Power Play

… a peace agreement and reconciliation with the PKK would enable Erdogan’s government to reach out to all Kurdish communities within the country to mobilize their support for the next potential term, and would achieve the disarmament of militant groups along the Iraqi and Syrian border by offering a general amnesty and integrating them into society. With that, he might be able to dissolve the decade-long opposition bloc of the DEM Party and Peoples’ Republican Party (CHP) standing in the way of prolonging his tenure for the next term.

How to Run a Private Military Company

Today’s guest is John Lechner, a writer and researcher. He's here today to talk about his new book about the Wagner Group, a Russian state-funded private military group, or PMC. The book is called Death Is Our Business: Russian Mercenaries and the New Era of Private Warfare, and is out March 4th (you can preorder it here). It’s a crazy read, and draws on multiple trips John took to frontlines in Ukraine, Syria, Libya, the Central African Republic, and Mali. As a mutual friend told me, “John knows more about the Wagner Group than anyone not in the Wagner Group.” I asked John to help me better understand how state capacity works in the particular institution of PMCs.

You may be comfortable with all this, preferring as you do to think solely in terms of anarchy and self-help and all those other harsh realist assumptions. And you may be looking forward to the grand deals you can strike, trading democratic Taiwan for mineral concessions in the Arctic and sub-continental Africa, or what have you, like a NBA general manager trading future draft picks for a center. It’s certainly fashionable, I’ll give you that. Still, you might want to keep at least a few ideals and values in reserve, just in case. They could well prove useful in the fullness of time. They often do.

Domestic Politics/Culture

Our Collective Learning Disability

My diagnosis for this malady is that it comes from the decay of the process of obtaining influence in our society. Having a good thought process is no longer aligned with achieving high intellectual status. Instead, high status comes from the ability to command attention. The intellectually mediocre have achieved hegemony over the intellectually rigorous. We need to adopt better means of conferring intellectual status.

Adults with Disabilities Deserve to Work

So although disability activists argue that all they want is “equal rights” for the disabled, in reality, they’re sidelining the people they say they’re fighting for. We have entered a two-tier era where federally funded disability rights groups focus on full inclusion for those with relatively mild disabilities, while engaging in a willful blindness about the needs of those who are severely impacted, who don’t fit that narrative.

Historically, there has been bipartisan agreement about the value of expanding employment options for those with disabilities. But over the past few years, states like mine have begun to phase out 14(c) programs in the name of advancing the dignity and rights of disabled people.

The Republicans’ Health Care Problem

Even the shambolic Democrats, who can’t figure out a way to dissociate themselves from the unpopular policies that are dragging them down, might not blow this one! As former Democratic operative Evan Barker notes in a piece on Lee Fang’s Substack, the attack ads practically write themselves:

“I predict this is precisely what they will look like: Elon Musk is on stage at CPAC, waving a chainsaw in slow motion, with doom music in the background; cut to a frame with Donald Trump promising no cuts to Medicare, Medicaid, or Social Security, and a final quick transition to a man speaking directly to the camera: "I lost my job, and when I tried to apply for Medicaid, I was turned down. Two weeks later, I got brain cancer. Now I'm homeless because I had to sell my house to pay for chemo." It sounds dramatic—but the drama is how Dems roll. These ads will be blasted in key swing states in 2028, with the numbers of those who lost healthcare coverage since 2024 tallied on the screens.”

Ouch. Of course Trump many times has said he has no interest in making cuts to Medicaid. His cagey political instincts and his “brand” as a working class-oriented populist Republican would appear to lead him against such a move. Judging from the debate in Congress and the views of many in his party, he has his work cut out for him. If he doesn’t succeed, health care really could turn out to be the Achilles heel of his second administration.

The Never-Ending American Eye Exam Racket

In every other country in which I’ve lived—Germany and Britain, France and Italy—it is far easier to buy glasses and contact lenses than it is in the United States. Like in Peru, you can simply walk into an optical store and ask an employee to give you an eye test, likely free of charge. If you already know your strength, you can just tell them what you want. You may even be able to buy contact lenses from the closest drugstore without having to talk to a single soul—no doctor’s prescription necessary.

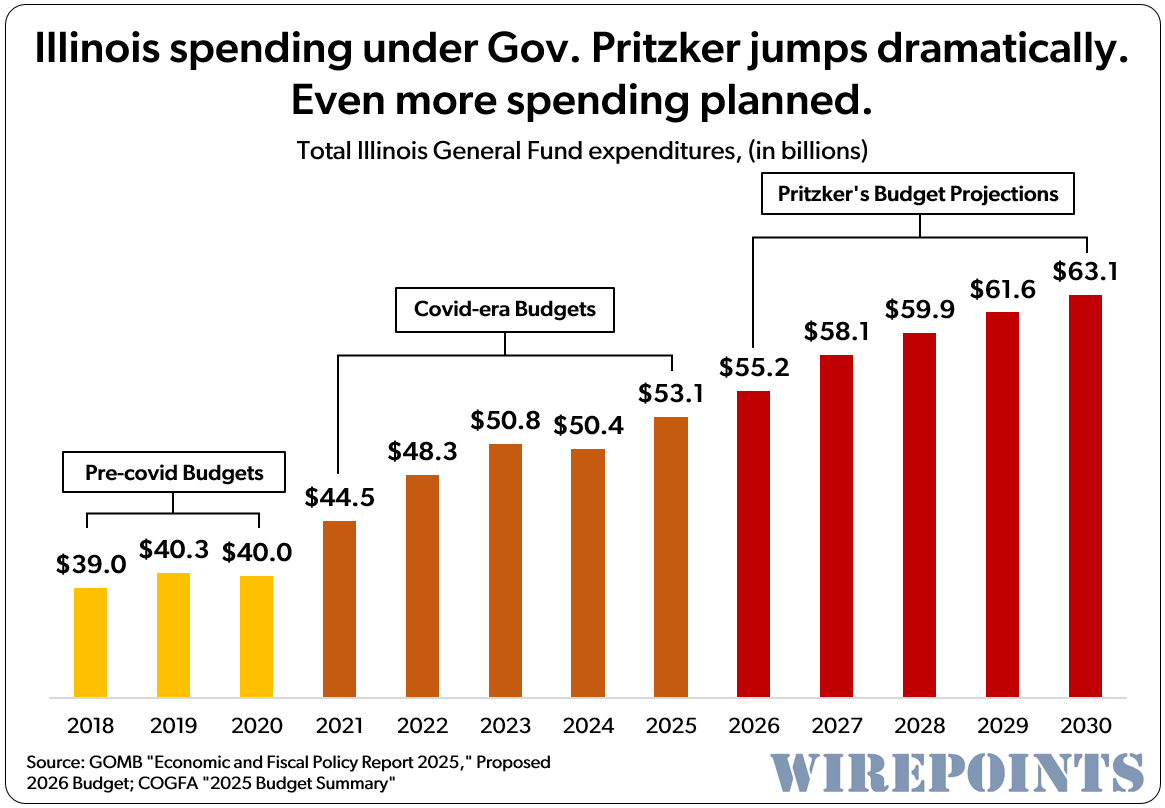

Chicago and Illinois Update: Budget Time in 2025

America’s National Security Wonderland

If one considers that the stated purpose of the Navy today is to build ships and win wars, the Constellation program is a disaster in the making. If, however, one considers that the actual purpose of the Navy is to project an image of credibility, then non-finalized, concurrent, ever-shifting designs that never get done and always seem to be just around the corner, just waiting for the inclusion of some “game changer” bit of technology, is actually rational and reasonable. The constant, obsessive fixation with various illusory “game changers” was never in much evidence in America in the 1930s and ’40s, when it enjoyed true industrial supremacy. Now, it is endemic to every branch of the U.S. military, and it makes complete sense given the institutional and ideological pressures that military leadership faces. For its part, given the impossibility of the military math it is faced with, Navy leadership is increasingly standing under the leafless tree and waiting for Godot. Sacrificing the ability to actually build ships on time is not such a great loss, after all, because no ships that can be built today have the power to upend a basic 200:1 ratio in favor of the enemy. Maintaining a narrative that the next American ship (whenever it appears) will have some sort of radical capability that will transform the basic calculus of war actually carries with it demonstrable benefits and a low amount of drawbacks, compared to all the other alternatives. Especially if the careers and self-image of people in Navy leadership are to be considered, it represents the safest and most reliable choice.

Cargo Cults and the Disorganization of America

British military history provides a hint. Military officers used to come from a class raised from birth to be “gentlemen,” and when the army democratized it sought to just mass produce this ideal. The goal was to have the best of both worlds. The officer ranks would be open to all, and the military would train them in the spartan morality of responsibility and “guts.” The opposite happened. Dixon writes that the officers became more feudal in nature, more elitist toward the enlisted men, and more prone to embarrassing displays of self-aggrandizement. “It seemed that all that remained of his training in the mind of each recipient was a faulty syllogism: Officers are gentlemen; I am an officer; therefore I am a gentleman.” Dixon’s faulty syllogism echoes both Christopher Lasch’s observation that American meritocrats have the vices of an aristocracy without its virtues, and Jeff Bezos’s warning about the process being mistaken for the goal. People come to believe in the process, in the sorting machine, and then become insecure when they rise themselves and realize they do not live up to this fantasy. In a book about the decline and dysfunction of General Motors, John DeLorean wrote that a manager “promoted by the system is insecure” because he knows he was promoted for reasons other than perfect competency.6 The problem with moralistic critiques of meritocracy is that they often rest on the premise that the sorting machine works, that it is even possible to create a machine that selects for capable rulers. Instead, everywhere you look you find a version of Dixon’s syllogism.

Science/Tech/Health

How fraud and bad research derailed years of Alzheimer's progress

In 2006, an apparent breakthrough was found in the fight against Alzheimer’s disease. A protein, awkwardly named 'amyloid beta star 56' or Aβ*56, when injected into rats, apparently caused memory loss and other symptoms of dementia. Its discoverer was Sylvain Lesné, a young scientist at the University of Minnesota. His boss, the neuroscientist Karen Ashe, touted the discovery as 'the first substance ever identified in brain tissue in Alzheimer’s research that has been shown to cause memory impairment', and the excitement was enormous: Nature called it 'a star suspect.' The original paper, also in Nature, has since been cited 2,300 times.

There is a problem, however. Aβ*56 may not exist.

There’s a philosophical view, best associated with the scholar L. A. Paul, that the decision to have children is fundamentally irrational. A rigorous cost-benefit analysis might produce an estimate of a child’s expected value, but the experience is transformative in a way that renders the calculation irrelevant. You will have made a decision by the lights of a person you will no longer be. There’s something inescapably patronizing when parents make this argument. I remain unsure if it’s true, yet I’ve heard myself repeat it. For the usual reasons of work-life intractability, writing this piece has taken me away from my own little boys. When I asked my eight-year-old why someone should have children, he stopped punching his little brother long enough to say, “We’re excellent company.”

What's Behind the SynBio Bust?

Not too long ago, synthetic biology was fashionable.

Then, in quick succession, we saw massive stock price collapses of three unicorn synbio startups in 2021-2023: Ginkgo Bioworks, Zymergen, and Amyris.

What went wrong? And can synthetic-biology startups be successful at all?

Pathfinder 1: The airship that could usher in a new age

This was the first flight of the first airship built by the Google cofounder's company, the first time a classic rigid airship of this size had flown since the 1930s, and the first of a new generation of airships. The last giant rigid airship Graf Zeppelin II flew for the final time on 20 August 1939, 12 days before World War Two started, and was scrapped the following year. Rigid airships have a complex metal framework that supports a huge envelope filled with enough hydrogen or helium to lift a sizeable number of passengers, or cargo such as disaster relief, for days at a time.

This blog post is the culmination of a few months of research by myself and my cofounder into the lightbulbs and computers of genetics: how to do large scale, heritable editing of the human genome to improve everything from diabetes risk to intelligence. I will summarize the current state of our knowledge and lay out a technical roadmap examining how the remaining barriers might be overcome.

Adapting to an Environment of their Making

Farming created a storable food surplus that fell under the control of powerful families, thereby increasing their power further (Harris, 1959; Testart et al., 1982). Society thus became stratified, and this stratification would determine the pace of cognitive evolution through a continual replacement of lower social classes by higher ones:

—Alleles associated with high cognitive ability became concentrated in the dominant class through the rise of more capable individuals and the fall of less capable ones.

—Because this class enjoyed higher fertility and lower mortality, it produced more offspring than could be supported by niches at the same social level.

—Surplus offspring moved down into niches left vacant by the lower classes, which had lower fertility and higher mortality.

—The lower classes were thus continually replaced by the higher ones, with the result that mean cognitive ability steadily rose from one generation to the next.

The same “rinse and repeat” cycle has been described by Gregory Clark in his work on English demography from the Middle Ages onward (Clark, 2007; 2009; 2023).

Misc

The stock-price drop came as little surprise to Yeung, the Maspeth wholesaler, who speculated it was the result of declining demand for electric bikes and mopeds. “Electric bikes is dead,” he said, drawing a finger across his neck. It’s true that Deliveristas have been shifting to gas mopeds for a while, and the reasons make sense: Low-end gas mopeds are generally cheaper than e-bikes, filling a tank is faster than charging a battery, and the vehicles aren’t likely to blow up in your home and kill your loved ones. The development appears problematic for Fly. The business is built on the bet that two-wheeled battery-powered vehicles are a big part of the future of urban transportation. What happens if customers see it differently?

And though personal tracking devices may not be safe or sensible for car owners, criminal gangs find them effective. “Criminals are chucking AirTags into your car. Say it’s a shady guy at the place where you get an oil change. Then they see where you live and steal your car. We see a lot of that,” Schmidt says. He suggests that car owners download tracker-detection apps to see if they’re being monitored by a device stashed in their vehicle. After recovering stolen cars, Schmidt has found AirTags hidden by thieves in the back seat, under a floor mat and attached to the spare tire. “They just toss it in, and it’s only the size of a quarter. I see this more and more,” he says. “In the last couple of weeks, we probably found seven AirTags in cars.”

James Bond and the killer bag lady—This is an old article, but I think I am going to put in every week because it is so good.

If Nicholas Deak had never existed, Graham Greene would have tried -- and failed -- to invent him. Born and raised in Transylvania during the last decade of the Austro-Hungarian Empire, Deak received a Ph.D. in economics from the University of Neuchâtel in 1929 and held posts with the Hungarian Trade Institute and London's Overseas Bank before taking a post in the economics department of the League of Nations shortly before World War II. He fled Europe for the United States in 1939, enlisted as a paratrooper in 1942, and was quickly recruited into the Office of Strategic Services (OSS), the wartime precursor to the CIA. Among his first assignments was developing a plan to parachute oil executives disguised as Romanian firefighters into the Balkans to sabotage Axis energy supply lines. (Sadly, it was never implemented.) He spent the final year of the war in Burma, where he recruited locals into guerrilla units to fight the Japanese occupation. Japan's Burmese commander would surrender his samurai sword to Deak at the end of the war, a memento Deak later kept in his Scarsdale, N.Y., attic.