Weekend Reading

2025 #7 (Feb 15)

Markets/Econ

The resurgence of inflation in 1979 is usually attributed not to the Fed directly stoking the fire, but to “supply shocks.” Supply shocks do not directly cause inflation, but they lead the Fed to a difficult choice: accommodate inflation or soften the economy. Stagflation of the 1970s was its choice to take a little bit of both pain. We may be in for adverse supply shocks from trade. Or we may be in for hugely beneficial supply shocks from energy, AI, and deregulation.

Buckle up.

Hedge Funds Are Pocketing Much of Their Clients’ Gains With ‘No Limit’ Fees.

Blackstone Inc., with an internal database of almost 100 funds that pass through fees, ran an analysis. It found that on average, passthrough fees amount to about 6.5% of a fund’s assets, with the most expensive managers reaching the high-teens,

Hundreds Of Unicorns Haven’t Raised New Funding Since 2021. Papa.com is my favorite—God bless the Venture Capitalists that gave this company $240mm to build a “platform that connects college students to senior citizens for companionship and assistance.”

…the amount of money that went into long-unfunded unicorns is substantial. Per Crunchbase data, the ones on our list collectively raised more than $260 billion, with $80 billion of that secured by U.S. unicorns.

Lots of folks are bullish silver. The Silver Squeeze & Don't Sleep On Silver & Why Physical Silver Will Emerge as the Ultimate Safe Haven.

With USD 265bn Capex from the big 4, and lets assume that they get USD 50 per sub - would mean 5.3bn users (i.e the whole internet connected world) just to get the capex back in sales - and that is ignoring running costs - which are substantial.

Related: Bankrupt Car Wash Exposes Flaws in Private Credit Valuations. I guess it doesn’t matter where they mark it, it’s not like they could sell it anyway.

The Post-Neoliberal Delusion. Jason Furman burying Bidenomics. Infrastructure spending went down in real terms during the Biden administration!

More than half the funds in the Bipartisan Infrastructure Law dispersed to states through early 2024 went to highway and bridge projects, prompting a spike in highway spending, which rose 36 percent from mid-2019 to mid-2024. But the costs associated with construction, including asphalt, concrete, and labor, increased even more, leaving real infrastructure spending down 17 percent over the same period. In fact, the amount of federal investment in highways during every year of the Biden administration was lower than in any year from 2003 through 2020. Biden’s putative building boom was in reality a building bust.

Contra Krugman on Current Account Controversies

The last point is that the U.S. does not attract net foreign investment for “good” reasons. Krugman wrote that it made sense that Japan would run a current account surplus and that the U.S. would run a deficit because of differences in demographics. Separately, he gave a presentation where he argued that the U.S. ought to run a deficit because of its superior productivity

…

While this makes sense in the abstract, it does not fit with the other things we know about what was happening in the world during this period.

For one thing, the U.S. current account deficit is financed, on net, almost entirely by net foreign purchases of U.S. debt securities—mostly bonds issued or guaranteed by the U.S. Treasury, with the notable exception of toxic mortgage bonds in 2004-7—plus bank deposits and currency.5 In the aggregate, on net, foreigners are not trying to get exposure to high-growth U.S. companies and superior American productivity, but safe claims offering relatively low yields protected by strong legal guarantees.

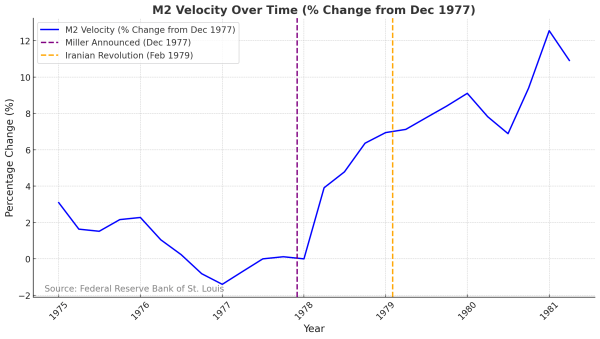

Trump’s Tariffs and the Fed: A 1970s Velocity Nightmare in the Making

A particularly illuminating graph shows the percentage change in M2 velocity from December 1977, marking two crucial events: Miller’s announcement as Fed Chairman (December 1977) and the Iranian Revolution (February 1979).

What the data reveals is striking and crucial for understanding our current risks: The dramatic acceleration in velocity began immediately after Miller’s appointment was announced, well before the Iranian Revolution.

From a slightly negative trend in late 1977, velocity jumped by nearly 4% within months of Miller’s appointment and continued to accelerate steadily. By the time the Iranian Revolution hit in early 1979, velocity was already up by 7% from its pre-Miller level.

Donald Trump’s economic masterplan—He is plotting an anti-Nixon shock.

Central to this new global order would be a cheaper dollar that remains the world’s reserve currency — this would lower US long-term borrowing rates even more. Can Trump have his cake (a hegemonic dollar and low-yielding US Treasuries) and eat it (a depreciated dollar)? He knows that the markets will never deliver this of their own accord. Only foreign central banks can do this for him. But to agree to do this, they need to be shocked into action first. And that’s where his tariffs come in.

The Economic Consequences of the (Ukraine) Peace

Another thing to keep an eye on might be JEMA, or the JPMorgan Emerging Europe, Middle East and Africa Securities trust.

Until 2022 it was known as JPMorgan Russian Securities, but when Russia invaded Ukraine and got slapped around with sanctions the trust marked down the value of its Russian holdings to zero and rebranded itself. It’s still early days, but sanctions on Russia are also rolled back as par of a peace deal then those holdings will become pretty valuable, pretty quickly.

The Shifting Central Bank Sands

Central bankers have acknowledged this unprecedented stimulus has contributed to elevated asset prices (along with 40-year high inflation in developed markets), and noted that indeed, higher asset prices are one of the key objectives of QE. Some market observers appear to operate under the assumption that central banks will be similarly accommodative in future crises. Central bankers themselves have been indicating otherwise in recent days/months, which I think warrants more attention than it’s been receiving.

CDS panel moves closer to adopting independent governance committee

Controversy has long dogged the DCs given that members of the panels – which make decisions vital to the functioning of these complex markets – are among the largest firms trading credit derivatives. That dynamic has ignited concerns over governance and conflicts of interest, prompting ISDA in late 2023 to commission Linklaters to review the structure and operations of the committees.

Foreign

Quick Take: A Military History of the Ukrainian War, 2022-2025

To a large degree, national security hawks in Washington DC (and their counterparts in European and Asian client states) saw the Ukrainian War as a way to replay the Vietnam War more effectively, on the basis of a more solid, reliable client state to support (European Ukraine rather than fickle, Asian South Vietnam) and with fewer escalation concerns, given the supposedly feeble state of Russia’s military and industrial production – a stance that was only reinforced by Russia’s poor military performance during the first year of the war.

One hundred and sixty years later, the Russians did a Gettysburg on the Ukrainians. They knew the enemy had been given endless supplies of money and material and had to attack. The Ukrainians simply had to. So the Russians built up their fortifications and waited. As a matter of fact, there were several Gettysburgs that they Russians kept, and a few that they lost; perhaps the most symbolic was Robotyne, a village north of the Sea of Azov that was taken by the Ukrainians at a huge cost in men and armor.

Hole Blasted By Drone In Chernobyl’s Radiation Shield: What We Know. Reportedly the drones wore MAGA hats and shouted ‘this is Putin country’ as they attacked the Chernobyl facility.

I'm Not Concerned About China and Neither Should You Be

China hawks often talk about how a takeover of Taiwan would allow China to control the South China Sea, which as they like to point out is a major trade route, but much more rarely explain why that would be so terrible for the West. Do they think that China is going to wake up one day and decide to interdict foreign cargo ships from operating in the area? Most of the trade that goes through the South China Sea is probably to or from China, so it would only harm itself in the process.

The truth is that, despite the lofty ideals they profess to justify their hostility toward China and argue that we must “stand up to it”, it’s hard not to conclude that at the end of the day China hawks are really motivated by American or Western chauvinism. They’re just used to the US or the West being on top and they have a hard time accepting that we’re no longer going to be the only game in town.

The Tragic Collapse of Ecuador

Now, cartels openly control prisons, threaten government officials, and seize live television stations. The port of Guayaquil is controlled by the Albanian mafia, which generously pads Ecuadorian banana exports to Europe with cocaine from Colombia. One-quarter of all the cocaine seized in Europe originates from Ecuador.

Opposing them too openly can prove fatal: In 2023, the right-wing politician Fernando Villavicencio was assassinated by Ecuador’s largest domestic organized crime ring, Los Lobos, after calling for a major crackdown on crime as part of his presidential campaign.

Beijing fails to reassure skeptical investors and responds with more regulation

This uncertainty does not sit well with the foreign institutional investors that Beijing has courted for years. Those who pursue strategies built on long-term investments had largely abandoned the Shanghai and Shenzhen markets by late 2023, putting their money in places like Tokyo and Mumbai. Some investors with a higher tolerance for risk—especially hedge funds—stuck it out. However, once last year’s rally ran its course, many of those fund managers took profits—although some bulls continue to place heavy bets on Chinese shares. Net capital outflows from China hit a record $182 billion in 2024, with foreigners joined by Chinese investors who have been shifting money to Hong Kong and elsewhere. A Bank of America survey of 182 institutional fund managers published in late January showed that only 10 percent were optimistic about the outlook for China’s economic growth compared with 61 percent in October. However, the latest tech stock rally appears to have made some fund managers more bullish.

Asia's Great Power Wars. V good podcast with David Kang contextualizing the geopolitics of Asia.

…the core takeaway from our research is that internal dynamics are likely far more consequential than external ones in shaping East Asia’s future.

The second lesson relates to the shared understanding or common conjecture among East Asian countries. From the Opium Wars in the mid-19th century until about 1979, China went through a period of internal chaos. What we’re witnessing now isn’t a rise but a return.

One of the biggest mistakes American policymakers make is trying to force these countries to choose sides, often in a binary, “with us or against us” fashion.

How to torch 220 billion euros

Once started, the Superbonus proved politically impossible to stop. The benefits were concentrated among vocal constituencies: homeowners getting renovations, the environmental movement, and contractors seeing booming business. The costs, while enormous, were spread across all taxpayers and pushed into the future through the tax credit mechanism. No government—leftist, technocratic, or right-wing—was able to resist its logic. Parliament consistently pushed back against efforts to limit its scope, even after fraud estimates hit €16 billion. As prime minister, Mario Draghi, despite publicly criticizing the program for tripling construction costs, could not halt it — in fact, his initial action was to simplify access to it. When his government attempted to curb abuse, the Five Star Movement reacted with anger, and even modest controls on credit transfers were fought. By 2023, Giorgia Meloni's right-wing government faced the same constraints—industry groups protested, coalition partners balked. Economy Minister Giancarlo Giorgetti warned colleagues, “I fear you do not understand the gravity of the situation.”

USA/Politics/Culture

The Trump administration is a crime magnet

U.S. enforcement against foreign businesses has plausibly led those foreign businesses’ home governments to tighten up their own enforcement. When the U.S. enforces FCPA or related legislation against a foreign company, foreign regulators begin to get much more active.

This is more or less the opposite of what Trump claims. U.S enforcement apparently makes foreign countries far more likely to start prosecuting their own businesses for offering bribes.

This leads into the political strategy recommendation. The Trump administration isn’t getting rid of the FCPA. It can’t. All it can do is say that it is ceasing to enforce it. So why don’t Democrats do what Republicans have done in the past, warning businesses that they shouldn’t rely on Trump’s promises to last?

The Tax Trainwreck Everyone Sees Coming

We have here a classic case of politicians searching in vain for political solutions to what is a substantive problem: The U.S. tax code does not raise enough revenue to pay for the spending that U.S. voters want the government to do. No amount of clever legislative drafting will get around that.

This problem could be solved, American Compass showed in our The Return of the Fiscal Conservatives collection, if leaders had the courage to pursue such a combination of tax and spending measures that shared the burden of closing the fiscal gap

Fully 1% of Americans say tax reform should be President Trump’s top priority.

Last Boys at the Beginning of History—Thymos comes to the capital

The mood at the liberalism conference, and the position of those athwart post-liberal “progress,” is well summed by a young man, one of the few in attendance, seated directly in front of me as Fukuyama closes. As we applaud liberalism’s most robust defense, he jokes loudly to his friend, “Yeah!!! Woohoo! What are we going to do?!” The NatCons may not know exactly who they are—economic leftists who hate leftism, right-wing progressives who hate progress or moral traditionalists who praise the male libido—but they know what they’re doing. They have a vocation. Does anyone else?

The Long Twentieth Century has been characterized by these three interlinked post-war projects: the progressive opening of societies through the deconstruction of norms and borders, the consolidation of the managerial state, and the hegemony of the liberal international order. The hope was that together they could form the foundation for a world that would finally achieve peace on earth and goodwill between all mankind. That this would be a weak, passionless, undemocratic, intricately micromanaged world of technocratic rationalism was a sacrifice the post-war consensus was willing to make.

That dream didn’t work out though, because the strong gods refused to die.

Now the strong gods are nonetheless being haphazardly called back into the world as the vitalistic neo-romanticism of our revolutionary moment of reformation tears down the decaying walls and guard towers of the open society. Their return brings real risks, or course – although the return of risk is kind of the point. The thing about strong gods is that they’re strong, meaning they can be fearsome and dangerous; which is precisely why they also have the strength to protect and defend. It remains an open question whether this necessary renewal of strength and vitality can be reintegrated harmoniously into our societies, or whether our world will again be plunged into a time of significantly greater strife, danger, and war.

Court Watch #113: Trolling for A Federal Charge? An Arizona man was charged with threatening to kill “all MAGAs”. Plus: AI caselaw, a Russian oligarch has questions, Ozzy Osbourne, Bluesky Threat, Anti-Woke Billionaires, a Nike train heist, and more

All Extradited Distributors of ANOM Hardened Encrypted Devices Plead Guilty to Racketeering Conspiracy. Probably don’t do lots of illegal stuff on a phone that is marketed as a fool proof way to do crime.

the FBI secretly operated an encrypted messaging network. The ANOM criminal enterprise was responsible for the distribution of more than 12,000 devices in 100 countries. While ANOM’s criminal users unknowingly communicated on the system operated by law enforcement, agents catalogued more than 27 million messages between users around the world whose criminal discussions were covertly obtained and reviewed by the FBI.

defendants promoted the ANOM platform as “Built by criminals for criminals,”

Science/Tech

Forget Psychedelics. Everyone’s Microdosing Ozempic Now. This article will make you want to microdose Ozempic.

Husband's Secret Gay Love Affair with Step Son Ends in Grisly Murder

But Pandora’s AI-generated box is open. Paul and creators like him have shown people there’s a new way to make money on the internet without much work, child safety policies be damned. The fact that YouTube deleted this channel doesn’t mean that it’s taking a broader stand against AI-generated content or AI-generated “true crime.”

The Time to Prepare for AI Financial Agents Is Now—Here’s How

Lastly, these genies are probably going to have crypto wallets. o1 successfully spun up a Bitcoin wallet with a near-perfect success rate. Chatbots can call functions initializing digital asset transfers from non-custodial wallets based on user conversations. Open-source crypto AI agent frameworks are being built to connect LLMs to crypto market data sources, wallets, and smart contracts. As Shaw Walters, the developer of one such framework (ElizaOS) puts it, “If LLMs are kind of the brain, I think that Eliza and frameworks like it are really the body.”

While it’s still early days, and many so-called “crypto AI agent” activity involves LLMs posting weird memes on X, there’s reason to think financially empowered AI agents will be significant economic actors. LLM-based agents that outperform more traditional algorithmic trading agents (“in terms of Cumulative Return and Sharpe Ratio”) already have been built with relatively primitive models, like GPT‑4 Turbo (and some clever memory architecture). As frontier models continue to improve in general reasoning ability, quantitative analysis (a previous shortcoming), and coding ability, we should be prepared for their trading, advising, and financial engineering skills to improve as well.

Meta Plans Major Investment Into AI-Powered Humanoid Robots. First, thank goodness, humanoid robots are where I get off the technology train and this means they won’t be a thing anytime soon. Zuckerberg is like 0 for 10 on this kind of bet, e.g. Oculus, metaverse, and Facebook phone. The fact that Meta is the 6th most valuable company in the world, in spite of regularly vaporizing capital on this kind of nonsense, is a testament to how easily our monkey brains are dopamine hacked by social media.

Dozens of new obesity drugs are coming: these are the ones to watch. These are mostly GLP-1 variations, but bimagrumab, which partially blocks myostatin, is interesting. If it works, wealthy folks will be skinny and jacked without having to Bezos-out on TRT.

Burning in woman’s legs turned out to be slug parasites migrating to her brain

It started with a bizarre burning sensation in her feet. Over the next two days, the searing pain crept up her legs. Any light touch made it worse, and over-the-counter pain medicine offered no relief.

Anduril Takes Over $22 Billion Contract to Build Technomancers for U.S. Army

In Palmer Luckey, the U.S. finds itself in that ultrarare position of having an all-time VR/AR headset guru-cum-weapons dealer at the ready. You can make a strong case that no one on this planet knows more about the particular set of skills required to make a war helmet of the future, and Luckey seems enthused by the challenge.

The Five Stages of Western Fertility

The big change around 2012, as with the Great Awokening, is the rise of the Internet, smartphones and dating apps. Specifically, the opportunity cost for doing anything is much higher than before, because we always have the zero-marginal-cost, frictionless option of having fun online. It’s not the opportunity cost of children that matters here; marital fertility remains high and stable. It’s the opportunity cost of sex and, relatedly, finding a husband or wife. Putting it crudely: rather than have unprotected sex or even dating seriously, teenagers and young adults are going online instead. There are more and more singles, and singles are having fewer and fewer kids.

1DaySooner's Trump II Health Policy Proposals

Regulatory Reciprocity: I will keep this one in here until somebody does something about it. It’s the idea that Americans should be allowed to buy medical products if they’ve been approved by some trusted ally, like the European Union, possibly in exchange for the EU giving FDA-approved products the same deal in Europe. This has been amply championed by Alex Tabarrok and the Mercatus crowd for years, and is starting to make inroads in other countries. If full reciprocity is a step too far, 1DaySooner proposes Makary build off innovative pilot programs like Project Orbis, which enables concurrent submissions and reviews of oncology drugs by multiple regulatory agencies, and the CoGenT pilot, which does the same for cell and gene therapies.