Weekend Reading

2025 #6 (Feb 7)

Markets/Econ

Today’s jobs report provides more evidence for the view that inflation remains a very significant problem. Average hourly earnings rose by 0.5%, well above the 0.3% rate consistent with the Fed’s inflation target.

Over the past 12 months, wage inflation has averaged 4.1%, which is only modestly above the roughly 3.0% to 3.5% figure consistent with 2% price inflation. Unfortunately, progress against inflation seems to have stalled, and may be going into reverse. Over the past 6 months, wage inflation has average 4.6%. We seem to be moving in the wrong direction. High nominal wage inflation increases the risk of recession.

The Fed is running out of excuses and losing credibility. It is time to take the inflation target seriously, or else set a new target that honestly reflects what the Fed is trying to achieve.

Trump or No Trump, 2% Inflation Was Not Coming Any Time Soon

It is understandable why consumers surveyed by the University of Michigan have become more anxious about the inflation outlook over the past month. But even if there were no threats to price stability (among other things) emananting from the current administration, inflation would not be settling into the Federal Reserve’s 2% yearly target any time soon.

Macro myths—18 misconceptions about the Great Recession

7—The Fed adopted an easy money policy in 2008. This is a textbook example of reasoning from a price change. Nominal interest rates did decline in 2008, but the natural interest rate declined even more rapidly. Other than short-term nominal interest rates, every other financial market indicator suggested that money got tighter over the course of 2008. Interest rates are not a good policy indicator.

Back to the Future: NIRP edition

OK, yes, sure, this is just the SNB, and Switzerland is a weird place. It has possibly earned itself a place in the old joke of how here are just four kinds of economies; developed, emerging, Japan and Argentina. Just because it reintroduces NIRP it doesn’t mean that other countries will do the same.

This confirms the base low-volatility effect we see everywhere. The true anomalies are when returns and volatilities are positively correlated.

—the equity premium (equity has higher volatility and returns than bonds),

—the short end of the yield curve (durations under 3 years)

—the top end of the credit curve (Treasury to BBB-rated bond returns)

As to why low-volatility assets have higher returns, the best concise explanations are given by Blitz, Falkenstein, and van Vliet (2017). There are a handful of reasons at play. My out-of-print book Finding Alpha is downloadable by chapter (not to be confused with the Finding Alpha book about gay werewolves, which I did not write). I self-published a cheaper version of that book on Amazon (The Missing Risk Premium).

The practical takeaway is that you should be very wary of crypto portfolios, as outside of a handful of coins, everything in crypto is crap (high vol & low returns). A crypto ETF with many coins would be a horrible investment.

Treasury Market Resiliency and Large Banks’ Balance Sheet Constraints.

U.S. regulatory agencies should reassess these leverage ratio calibrations. Several options exist to enhance large banks’ capacity to hold additional U.S. Treasury securities during periods of increased issuance. Implementation requires coordinated action through joint rulemaking by all three regulatory agencies, as changes must apply both at the bank holding company level and at the lead insured depository institution level.

To provide broad relief, the agencies must be willing to allow the definition and calibration of the SLR to deviate from certain Basel requirements, provided U.S. capital requirements remain holistically as stringent as the Basel requirements.

Governor Bowman agrees:

Where we can take proactive regulatory measures to ensure that primary dealers have adequate balance sheet capacity to intermediate Treasury markets, we should do so. This could include amending the leverage ratio and G-SIB surcharge regulations for the largest U.S. banks. Adopting regulatory changes to mitigate these concerns may not be sufficient to ensure market liquidity, but it would be an important step toward building resiliency in advance of future stress events. In my view, it would be better to fix the roof now, while the sun is shining, by addressing over-calibrated leverage ratio requirements, and considering the unintended consequences of any future capital reforms.

Companies Issue Debt in Fast-Growing Hybrid Bond Market, Citing Ratings Benefits

Corporate advisers say the U.S. hybrid market is gaining popularity with issuers and investors, and expect strong issuance in the year ahead, largely because Moody’s changed its methodology a year ago to more closely align with its competitors. The change kick-started a wave of hybrid issuance in an otherwise strong year for corporate debt sales. U.S. companies issued about $27.93 billion in hybrid bonds in 2024, up from $3.35 billion a year earlier, according to investment firm Cohen & Steers.

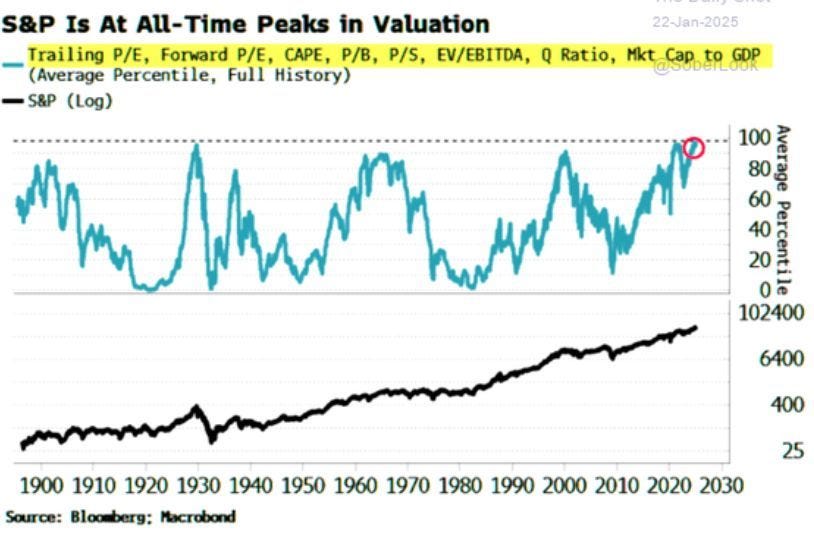

Have We Been Partying Like It’s 1999?

What’s different this time is that AI fever is concentrated on a handful of companies — the Magnificent 7 — most of which are already entrenched quasi-monopolies. I don’t know whether people realize how anomalous this is. Historically, major new technologies have tended to disrupt the existing market hierarchy; this time, investors are in effect expecting radical new technology to reinforce that hierarchy.

And I guess I don’t understand why anyone expects AI to make highly profitable quasi-monopolies even more profitable. How much bigger can the market for Office or Google search get? I understand that these companies feel the need to invest in AI for defensive purposes, to fend off potential competitors. But this need should if anything make them less rather than more profitable. This will be especially true if, as the shock over DeepSeek suggests, big, established companies are investing in expensive, bloated models rather than thinking carefully about what they actually need.

Michael Pettis responds in the FT

So why hasn’t the demand shortfall “gone away”, as Cowen’s model would predict? The answer lies in China’s trade and industrial policies, which enhance global manufacturing competitiveness at the expense of domestic consumption. These policies include an undervalued currency, repressed interest rates, highly directed credit, and, yes, tariffs. These policies, together with strict controls on trade and even stricter controls on the capital account, have prevented any natural adjustment from taking place. This matters, because a country’s internal imbalances created by domestic policies lead automatically to its external imbalances which, in turn, must be reflected in the external imbalances of the trade and investment partners of that country. That is how internal policies in one country will lead automatically to changes in the internal conditions in other countries. Cowen’s models may well be internally consistent, but they are based on simplified assumptions that clearly fail to describe the real-world factors that shape trade imbalances.

Related: Mistaken Identities Make for Bad Trade Policy

While it is true that a surge in foreign demand for dollar assets would strengthen the dollar and thereby induce to some degree a wider US trade deficit, the notion that America has “no choice” but to run bigger deficits in this situation is incorrect. The United States could take any number of actions to mitigate this outcome, including trimming its federal budget deficit while loosening monetary policy if needed to support domestic full employment.

Maaku Renaado マーク レナードChronicles—Guiding Thoughts on Japanese Software Companies

Much in the way that 5 or even 10x revenue was cheap in hindsight for US SaaS in the early 2010’s, Japanese SaaS at low revenue multiples is similarly cheap given the clear opportunities ahead. While not all are “cheap” in the backwards looking sense, it is cheap relative to the economics they can generate as growth continues (e.g. 20% operating margins on doubling revenue takes a co from 3x revenue to 1.5x revenue and 7.5x EBIT with continued high margin growth opportunities).

The Trump Superspike: If Trust in U.S. Governance Breaks, Interest Rates Will Explode

In risk departments across Europe’s banks and pension funds, intense discussions are unfolding. The topic? Trump’s increasingly erratic behavior and what it means for financial stability.

A European bank cannot avoid U.S. exposure, but it can prepare for a scenario where the dollar collapses and interest rates spike. That means modeling:

What happens if U.S. interest rates hit 10%?

What happens if the dollar loses 50% of its value?

What happens if U.S. banks experience a sudden funding crisis?

These are not baseline forecasts. But they are entirely possible scenarios that every CRO in Europe should be running now.

Why Pension Funds Are Betting on Alternative Assets

my concern is that public pensions may have arrived at the party too late and are now paying fees in these asset classes that are not justified by their performance.

What does Taiwan have to do with US mortgage rates?

As the supply of callable bonds was choked off, so too was the supply of volatility. No longer did dealers “rinse and repeat” by issuing Formosa bonds and selling them for scrap. That led prices on long-dated interest rate options to rise steadily, essentially reversing the impact on mortgage rates of artificially low prices.

Depending on how you measure it, the increase in implied volatility likely raised American mortgage rates by between one-quarter to three-eighths of a point.

But the combination of likely tariffs, geopolitical costs, demographics and a unusable business model will bring forward the Japanification of Europe, opening the door to further QE. I’d give it a year.

…If there was a spike in rates the Fed can expand the list of counterparts for the Standing Repurchase Facility, or come to some pass-through agreement. This would effectively disguise a return to QE as simply providing a short-term repo backstop. But QE it would be unless it really was temporary. The system that evolved post-GFC requires ample reserves to work, and we still don’t really know what ‘ample means'.

There is a very good chance some proto-QE appears in the United States within twelve months, possibly sooner. And for different reasons a similar fate awaits the EuroArea. Who will get to the QE gate first?

The US Needs a Sovereign Wealth Fund Like a Fish Needs a Bicycle.

It’s hard to see why anyone who understands how a sovereign currency works would be pushing a sovereign wealth fund. Even if it became “one of the biggest funds” in the world, as Trump envisions, it wouldn’t give the federal government any spending power it doesn’t already have.

Just as the NFL understands that the Superdome doesn’t need a storage facility to accumulate a hoard of points ahead of Sunday’s Super Bowl, and Delta Airlines knows it doesn’t need a strategic reserve of #SkyMiles in order to dole them out at will, President Trump knows—or knew—that the federal government can conjure money into existence on an as-needed basis.

Foreign

The Electricity Front of Russia’s War Against Ukraine

Russia is close to achieving a decisive edge on the energy front of the Russo–Ukrainian war.

Two New Reports on Iran's Nuclear Weapons Program

Both reports could be right in that Iran may be trying to produce both uranium and plutonium-fueled weapons. This would track just how the US developed atomic weapons leading to Hiroshima and Nagasaki and eventually to an entire arsenal of nukes with various delivery means.

The US Intelligence argument that the Supreme Leader has not made a decision on fielding nuclear weapons seems disingenuous. The IRGC, which really runs the show in Iran, is certainly investing billions in the effort, and if anything the effort has been intensified and sped up.

Questioning China’s ability to actually fight. Hopium?

Last month, the RAND Corporation think tank released a report questioning the combat readiness of China’s People’s Liberation Army (PLA) despite its breakneck modernization.

RAND argues that while the PLA boasts advanced weaponry and the world’s largest navy, it prioritizes upholding Chinese Communist Party (CCP) rule over actually preparing for war.

The Amazing Pace of Chinese Mil-tech Innovations

Now pushing beyond arming its missile with hypersonic technology, China is incorporating the technology to its unmanned aircraft programs.

China is the only nation known to operate hypersonic aircrafts (above Mach 5 speed). These include the WZ-8, WZ-9, MD-19 and MD-22 family of unmanned aerial vehicles (UAVs) that can operate at near-space altitude and conduct deep-penetration ISR, strike and kamikaze missions without fear of interception.

China building world’s biggest military base in prep for US war.

China Moves on the Cook Islands

The PRC wants to be the primary power in the Pacific. She is patient. She sees all hills worth fighting for. She isn’t playing the game by our modern rules, but she is playing.

Euro Doom—Political Unification Has Turned Europe into a Substandard Version of China

I spent some time covering the EU institutions in Brussels, which is one of the world’s most dispiriting places and boasts a unique concentration of unappealing, useless and arrogant people, whose main skill is a certain ability to combine powerlessness with bigotry (real bigotry). If Washington DC is Hollywood for the ugly, Brussels is Washington for the bureaucratic underclass, the poor ugliest Ozempic-swallowing losers who couldn’t make it in Washington.

and Target price, not quantity

The basic problem is institutional. Dutch voters have indicated that they prefer to have houses and farmers over biodiversity. But the view of the state is that they cannot be changed.

Nor does ‘Cheems mindset’ seem to be a uniquely Dutch trait. Across Europe, high energy prices are currently taken as a fact of life due to Europe’s geographic endowment, not an outcome of policies we can change. GDPR is treated as fixed and unchanging rather than an obstacle that can be adjusted. On immigration, policy changes 'cannot be made' due to ECHR. The nuclear shutdown cannot be remedied because it cannot be done.

All parties, save for the AfD, are presently doing everything in their power to exclude all possible post-election paths to a government. The only hard rule seems to be that if this or that coalition partner might provide a way to govern, if this or that scenario might promise a path through the impossible thicket, somebody will appear on television in the next five minutes and promise not to do precisely that thing.

Realistically, I think this resolves only one of three ways: with a realignment to the left, a catastrophic and farcical collapse to the left, or a realignment to the right.

Who Else Wants Access To Apple Users' Encrypted Data?

The British demand is of course outrageous and will not be followed. But I wonder why the Brits would even try to go this way.

We know thanks to Edward Snowden's revelations that the British signal intelligence agency GCHQ is a mere offshoot of the U.S. National Security Agency. It may thus be that the real people trying to get access to Apple users' encrypted archives are sitting on the west coast of the Atlantic.

Why Britain Should Scupper the Chagos Islands Deal. or as Senator Kennedy says

We need to stop this deal. President Trump and and Secretary Rubio need to pick up the phone and and call Prime Minister Starmer in the United Kingdom and say to to the Prime Minister: ‘Mr Prime Minister with all due respect stop dipping into your ketamine stash! Put down the bong… Our struggle with China is serious. It’s serious as four heart attacks and a stroke, and it is bone deep down to the marrow stupid for us because of guilt over colonialism to bow to the wishes of the United Nations.

Yes, there is a Mexican state-cartel alliance

To catalog the particulars of the present Mexican regime’s full partnership with the cartels — and the Sinaloa Cartel in particular — would require a lengthy exposition. (See, for example, the updated 2025 report from the Texas Public Policy Foundation on the extensive history of Mexican state-cartel collusion.) Nevertheless, the toplines are sufficient to make the case. It is necessary to understand that the Mexican state is now essentially a single-party, left-populist regime, aligned ideologically and operationally with comparable regimes in Cuba and Venezuela. Like those regimes, it regards its nation’s trafficking cartels as vehicles for profit and control and also agents of national policy abroad — especially but not only in the United States.

The Mexican presidency changed hands on October 1, 2024, from AMLO to his longtime protégé Claudia Sheinbaum, a technocrat handpicked for her near-total absence of political independence. The entire apparatus, cartel connections and all, remains in place — and in charge. If you doubt it, look now to the Mexican-officialdom reaction to the White House simply speaking the truth. There is an element of reflexive nationalism in it to be sure, the timeless response of Mexican civics confronted with even the most-reasonable American critiques. But there is something more: interests threatened, and fear of the only real instrument of justice for narcos and their allies in this hemisphere: the United States of America.

Casinos, high-rises and fraud: The BBC visits a bizarre city built on scams

Eight years ago there was nothing over there in Karen State. Just trees, a few roughly built cement buildings, and a long-running civil war which has left this area of Myanmar one of the poorest places on earth. But today, on this spot along the border with Thailand, a small city has emerged like a mirage. It is called Shwe Kokko, or Golden Raintree.

It is accused of being a city built on scams, home to a lucrative yet deadly nexus of fraud, money-laundering and human trafficking. The man behind it, She Zhijiang, is languishing in a Bangkok jail, awaiting extradition to China.

USA

Dick Cheney's Wet Dream—related? Dick Cheney's Other Big Secret

Donald Trump has always viewed his office as an elected monarch, and he has a mass movement that has explicitly declared and supported him as such. Musk sees himself as the monarch’s aide, and has no understanding of the Constitution at all, as far as I can tell. The role of the legislature, in this worldview, is to do whatever the president wants; and the role of the Court is to buttress presidential power. This has, alas, been the trend now for decades, with Democratic and Republican presidents, facilitated by the Congress’s sad abdication of so many of its inherent powers. But Trump and his Claremonsters want to take this to a whole new level of an elected dictatorship. There is nothing that would make Trump and Vance happier.

Until, of course, a Democrat is elected president.

On Undermining the Administrative State

… the second Trump administration is embarking on some dramatic actions that will destabilize existing conventions in and the known workings of the machinery of government and the state’s witnessing of truth.

It’s predictable their actions in the disrupting of the machinery of record and state’s witnessing of truth will reduce social trust and so increase social conflict and coordination costs (and reduce long term growth rate). I suspect that the more politically savvy among them expect to be make a profit of that, too, (as they have done already in the last few decades). Yet, we’re soon entering territory where the cascade effects will be quite unforeseen and uncontrollable and, if copied elsewhere, where the state’s role in shaping our life-worlds and social practices will inevitably be quite different than the pattern of (say) the last hundred years.

Why elections have surprised us in recent years'

Coalitional instability might paradoxically be good news. The fact that no coalition is likely stable in voting games can seem disappointing at first sight, but it is in fact likely a blessing for the democratic process. It means that any group has the potential to become part of a winning coalition. No segment of society is forever under the tyranny of a permanent majority, which in turn promotes widespread acceptance of democratic conflict resolution. If you lose today, you know that you might win tomorrow.

US Navy hits drone with HELIOS laser in successful test

Hard Lessons from the New NAEP Results. Not great.

Assessing the Race: Polling the 2025 NYC Mayoral Election. Congratulations Mayor Cuomo.

Meanwhile, on a completely different note, I re-read the part of Kushner, Inc. in which poor Rex Tillerson, then the new Secretary of State under Trump’s first presidency stumbled across his Mexican counterpart Luis de Videgaray at dinner at Cafe Milano in DC. Tillerson was shocked. How come he had not known - per protocol - Videgaray was in town? Well, it emerged, because he was there to see the man really running State Department: Jared Kushner.

How history is repeating itself!

I give you the example of Marco Rubio.

Science/Tech/Health

Making the U.S. the home for open-source AI

In the time being, if we (as Western countries) decide to stop training and releasing open models another power will happily do this. This is not just China — there are countless countries with the wealth to create the current generations of frontier language models. While it is understandably a stressful proposition, it has been said for at least a year that “Whether or not we want it, open language models are likely here to stay.”

Attempts to restrict a adversaries ability to impact the world on AI should focus nearly entirely on compute rather than model weights. There is of course a chance that models continue to progress and eventually are so simple that only the weights are needed to deploy a destabilizing application. For now, and in the near future, powerful AI systems require substantial inference compute and even more custom software infrastructure.

Anthropic's Dario Amodei on AI Competition

Dario Amodei:My sense is that it is unlikely that the Huawei chips become anywhere near comparable to US chips anytime soon. As I wrote in “Machines of Loving Grace” and in the post on export controls, the critical period here where there’s really going to be contention, or where it’s important to achieve a balance of power, is going to happen in 2026, 2027, or at the latest, 2030. Policy should target that time range. Things are moving very fast in the AI world — 10 to 15 years is like an eternity. It’s forever. It’s almost irrelevant.

Jordan Schneider: The dominant framing, how you’ve written and other folks in AI policy circles is that AI is going to be something that entrenches autocrats. People are talking about the CCP like it could turn into a thousand-year Reich. Can you see a world in which AI, and perhaps particularly open source AI, is actually sort of like a democratizing force?

Dario Amodei: I actually can and I wrote about it a bit in “Machines of Loving Grace.” I don’t really think it’s about open source or closed source. I could imagine a world where China makes powerful AI that’s open source, but they have the biggest clusters, they have the biggest ability to fine-tune the model. If I’m a citizen of an autocracy, does a flash drive with some model weights on it help me resist the autocracy? There’s this almost impressionistic connection between “oh, there’s this thing that’s available to everyone” and it’s like a freeing resource. I don’t really see that connection.

It’s similar to saying like, suppose I had the code for TikTok or the code for Twitter or something. Would that change the effects that social media had on all the people around? I don’t think that it would — this all comes from things operating at scale. What does matter is how we use the technology, whatever form it’s been produced in.

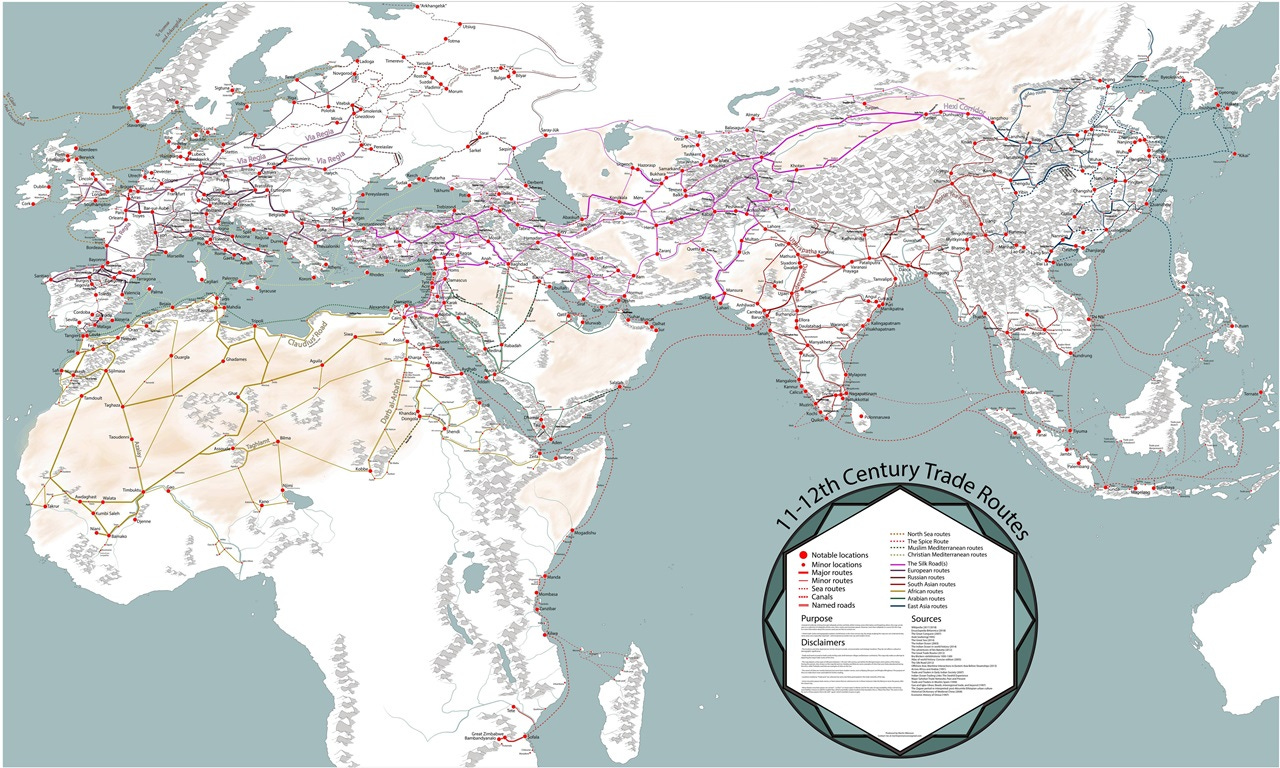

A Brilliantly Detailed Map Of Medieval Trade Routes & Networks

Life Lessons from the Blue Zones? Maybe Not. Taubes.

The most notorious example would come in 2010, when the Japanese government did an audit of the nation’s centenarian population and realized that some 230,000, 82% of them, were missing, likely long dead, whose centenarian status would be the result of clerical errors or fraud.

We’re back to the familiar story: something about western, industrialized diets is bad for our health. No surprise there. And we’re back to asking what that is. Refined grains and sugars remain a simple explanation because those are the foods that began appearing in populations in large quantities beginning in the 1800s with the industrial revolution, when diabetes rates in particular started to climb. Sugar and white flour were considered obvious suspects from the 1920s to the 1960s and 1970s when British researchers first introduced and then institutionalized this discussion of western diets and their harms. Maybe seed oils play a role. Maybe we just eat too much of these foods (which I doubt).

One thing is for sure, the blue zone research will not be able to tell us.

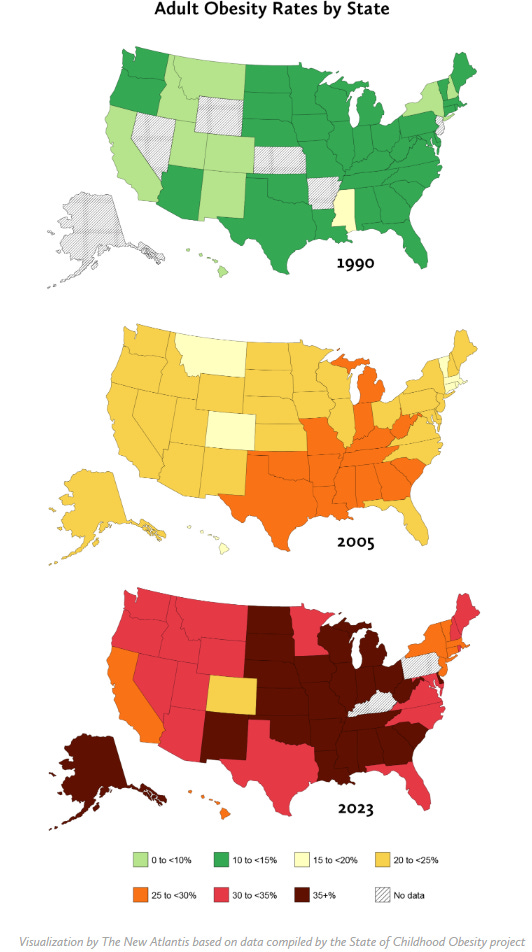

Can You Solve a Lifestyle Epidemic Without Lifestyle Gurus?

In The True Believer, the philosopher and critic Eric Hoffer writes, “The quality of ideas seems to play a minor role in mass movement leadership. What counts is the arrogant gesture, the complete disregard of the opinion of others, the singlehanded defiance of the world.” The trouble is that the world we find ourselves in demands a bit of leadership, a bit of disregard for the opinions of others, and at least a bit of defiance. Still, a lesser prophet is one thing, and a would-be Messiah something else. Exercise care.

Polls Askew, Justice Denied, Lives in Peril, and the Subtle Truths of Double-Yolk Eggs

After I wrote the above, my wife cracked another egg, and it was a double-yoke again. From eggs in general, that would be a one-in-one-trillion occurrence. From Nellie’s Jumbos, it’s no less frequent than one-in-sixteen. Using another little trick called Bayesian Revision, I’m going to guess that it’s considerably more common with Nellie’s Jumbos than one-in-sixteen. This article argues that there is a one-in-a-trillion chance of your having a doppelgänger; just last week, I published an essay with photos of dozens of doppelgängers. Maybe the researcher’s definition is more rigid than mine; or maybe they don’t buy eggs from Nellie’s.

As with double-yolk jumbos, FDR’s victory, or Sally Clark’s infant sons, the problem was fundamentally one of mistakenly assuming that a high-probability event was a low-probability event.