Markets/Econ

2035: An Allocator Looks Back Over the Last 10 Years—Cliff Asness

So at the end of the day, a lot of managers got paid a **** ton of money for less-than-equity returns, with at-least-as-high-as-equity risk, just so allocators could feel safe in their jobs and to make sure others thought they were on the cutting edge of investing. That was a pretty large payment, like many hundreds of billion dollars over 10 years industry-wide, from our collective investors to our collective managers, just to make our allocator lives easier! A lot of the people who made this allocation decision are not around anymore, so I guess the laundering did kinda work out for some of them.

Trump 2.0: Can Populist Keynesianism Survive a Hawkish Fed?

The parallels to historical episodes of fiscal-monetary misalignment are clear. The Bundesbank’s reaction to German reunification in the early 1990s provides a particularly relevant example. Faced with massive fiscal expansion, the Bundesbank tightened monetary policy aggressively to maintain price stability, even at the cost of a sharp economic slowdown. See more on this here.

Today, Powell’s Fed faces a similarly challenging environment, though its tools differ. Instead of raising rates aggressively, Powell may demonstrate monetary restraint through a slower-than-expected pace of rate cuts.

The Dollar and the Trade Deficit. The most surprising thing here is that Krugman worked in the Reagan administration.

We may not be looking at a fiscal shock as big as Reagan’s, but it’s still probably enough to induce the Fed to keep interest rates much higher for longer than most people were expecting a few months ago, which will translate into a stronger dollar and a bigger trade deficit. Also strengthening the dollar: what looks like a spreading economic funk in Europe. And look back at the charts above: we start from both a level of the dollar and a trade deficit comparable to their peaks under Reagan.

If we go back to the two types of mistakes outlined at the top of this post, the late 2021 error was clearly an example of “having the wrong target.”

More broadly, almost all important Fed policy mistakes are of this type. Commenters occasionally point out that the inflation surge of 2021-23 ended up being much larger than the TIPS market expected in early 2021. That’s true, but this fact doesn’t have the implication that many assume. It does not mean that the Fed was doing the best job it could, and just got unlucky. Under a level targeting regime the inflation surge would have been far milder, some transitory supply-side inflation but no permanent NGDP overshoot. The primary cause of high inflation over the past 5 years has been NGDP overshooting its 4%/year trend line by 11%. That’s a lot!

The coming American labor market shock

What would the country have done if 2022-24 immigration had averaged half a million instead of 2.2mn, and demand for workers stayed strong? It’s an interesting question. After all, the US enjoyed very healthy job growth in 2017-18 even when immigrant labor supply was just half a million a year.

But an important difference is that labor force participation had dropped in the second Obama term, and had room to rise considerably — as it did — in the first Trump term. This time, with LFPR already high and the US continuing to age, wages would probably have had to rise very sharply, far more than actually happened. After all, the retiree sitting on the sidelines will only enter the job market is they are enticed into doing so. And even with higher wages, actual job creation would likely have been far less.

Meanwhile, high wages would have passed into inflation, pushing it even higher than it peaked this cycle. The Fed would have hiked rapidly, and kept going until companies’ demand for workers cooled off. And the business cycle would almost certainly not been as long and seemingly indestructible as it has been in the past couple of years.

Are Tax Cuts Contractionary at the Zero Lower Bound? Evidence from a Century of Data

Today, by contrast, Americans consume far too large a share of what they produce, and so they must import the difference from abroad. In this case, tariffs (properly implemented) would have the opposite effect of Smoot-Hawley. By taxing consumption to subsidize production, modern-day tariffs would redirect a portion of U.S. demand toward increasing the total amount of goods and services produced at home. That would lead U.S. GDP to rise, resulting in higher employment, higher wages, and less debt. American households would be able to consume more, even as consumption as a share of GDP declined.

Foreign

The Real Risks of Escalation in Ukraine

But there is another way to measure success that is rarely discussed: namely, whether Biden’s team effectively defeated Putin’s attempts to redefine thresholds for escalation that would have set a dangerous precedent for the future. This conflict is not only about Ukraine or the rules-based international order. It is also about how the United States and the West more broadly should think about escalation thresholds in a new era of great-power rivalry that often bears little resemblance to the Cold War. From the beginning, Putin tried to enforce redlines that aimed to deter status-quo parties—the United States and NATO allies—from assisting Ukraine. Slowly, carefully, and with circumspection, Biden succeeded in eroding and undermining those redlines. Salami tactics did not offer the ringing victories that many hoped for, but they did provide important pushback.

In India’s shadow war with Pakistan, a campaign of targeted killings.

The incident appeared to be the most recent example of what Pakistani officials call a striking development in the long-running shadow war between the two South Asian rivals. Although India and Pakistan have long used militant groups to sow chaos in each other’s countries, India’s intelligence agency, the Research and Analysis Wing (RAW), has since 2021 deployed a methodical assassination program to kill at least a half dozen people deep within Pakistan, according to Pakistani and Western officials.

USA

How the H-1B System Undercuts American Workers

But if they are interested in real reform, I propose the following.

For both H-1B and green cards, replace the current prevailing wage requirement by a policy in which applications are approved in order of offered salary. This addresses the cheap, mediocre-quality labor issue in a clean (if broad-stroked) manner. It also to a large extent attains our goal of targeting “the best and the brightest.” For example, Stanford computer-science graduates enjoyed starting salaries that were 37 percent higher than average in 2009-2010, according to the school. A more refined version of this policy could rank on the ratio of offered salary to the occupational/regional median, so as to attain quality among less expensive occupations and regions.

Make green card issuance immediate after approval, instead of waiting in a queue for years. This addresses the de facto indentured servitude issue, and also solves the problem of queues based on country caps.

Establish an open, national online registry for jobs that employers propose to fill with H-1Bs or green card applicants. Use would be advisory for H-1B, mandatory for green cards and H-1B-dependent employers. Placing newspaper ads as a way of giving public notice is downright silly in today’s Internet Age. An online registry is the efficient, effective way to handle the recruitment requirement.

Liberalize the National Interest Waiver, under which outstanding talents can apply for a green card without employer sponsorship. Do the same for the O-1 work visa, which again involves exceptionally talented workers. The industry lobbyists greatly exaggerate the number of foreign workers who are “the best and the brightest,” but some are indeed top-flight. Our nation benefits enormously from them, so targeted measures are vital.

Require that an employer justify a job requirement of an advanced degree. Very few tech jobs truly require a master’s or doctoral degree. Just look at all the major notables in the field who lack such a degree, such as Larry Ellison and Jensen Huang, or who have no degree at all, such as Bill Gates and Mark Zuckerberg. Since international students who work in tech largely have a master’s, setting a requirement of that degree is a common method of rejecting US workers.

Rapid-Onset Political Enlightenment

The collapse of the 20th-century media pyramid on which Lippmann’s assumptions rested, and its rapid replacement by monopoly social media platforms, made it possible for the Obama White House to sell policy—and reconfigure social attitudes and prejudices—in new ways. In fact, as Obama’s chief speechwriter and national security aide Ben Rhodes, a fiction writer by vocation, argued to me more than once in our conversations, the collapse of the world of print left Obama with little choice but to forge a new reality online.

The Obama Democratic Party (ODP) was a kind of balancing mechanism between the power and money of the Silicon Valley oligarchs and their New York bankers; the interests of bureaucratic and professional elites who shuttled between the banks and tech companies and the work of bureaucratic oversight; the ODP’s own sectarian constituencies, which were divided into racial and ethnic categories like “POC,” “MENA,” and “Latinx,” whose bizarre bureaucratic nomenclature signaled their inherent existence as top-down containers for the party’s new-age spoils system; and the world of billionaire-funded NGOs that provided foot-soldiers and enforcers for the party’s efforts at social transformation.

Science/Tech

The No-Hunger Games: How GLP-1 Medication Adoption is Changing Consumer Food Purchases. More savory snacks for me.

Households with at least one GLP-1 user reduce grocery spending by approximately 6% within six months of adoption, with higher-income households reducing spending by nearly 9%. These reductions are driven by significantly larger decreases in purchases of calorie-dense, processed items, including a 11% decline in savory snacks.

H5N1: Much More Than You Wanted To Know

The forecasters I talked to raised one other point of uncertainty: does the flu work more like a dice roll, or like a bus? Dice rolls are uncorrelated with their predecessors; even if it’s been a hundred rolls since you last rolled a 6, your chance this time is still 1/6. But buses come at fixed intervals; if the buses are hourly, and you haven’t seen a bus in the past 59 minutes, then your chance of seeing a bus in the next minute is very high. It’s been 16 years since the last flu pandemic; these pandemics come (on average) every 20 years. I don’t think anyone has a good sense of how to think about this.

Some people have suggestions for how to prepare for a possible pandemic, but none of them are very surprising: stockpile medications, stockpile vaccines, stockpile protective equipment. The only one that got so much as a “huh” out of me was Institute for Progress’ suggestion to buy out mink farms. Minks are even worse than pigs in their tendency to get infected with lots of different animal and human viruses; they are exceptionally likely to be a source of new zoonotic pandemics. Mink are farmed for their fur, but there aren’t as many New York City heiresses wearing mink coats as there used to be, and the entire US mink industry only makes $80 million/year. We probably lose more than $80 million/year in expectation from mink-related pandemics, so maybe we should just shut them down, the same way we tell the Chinese to shut down wet markets in bat-infested areas.

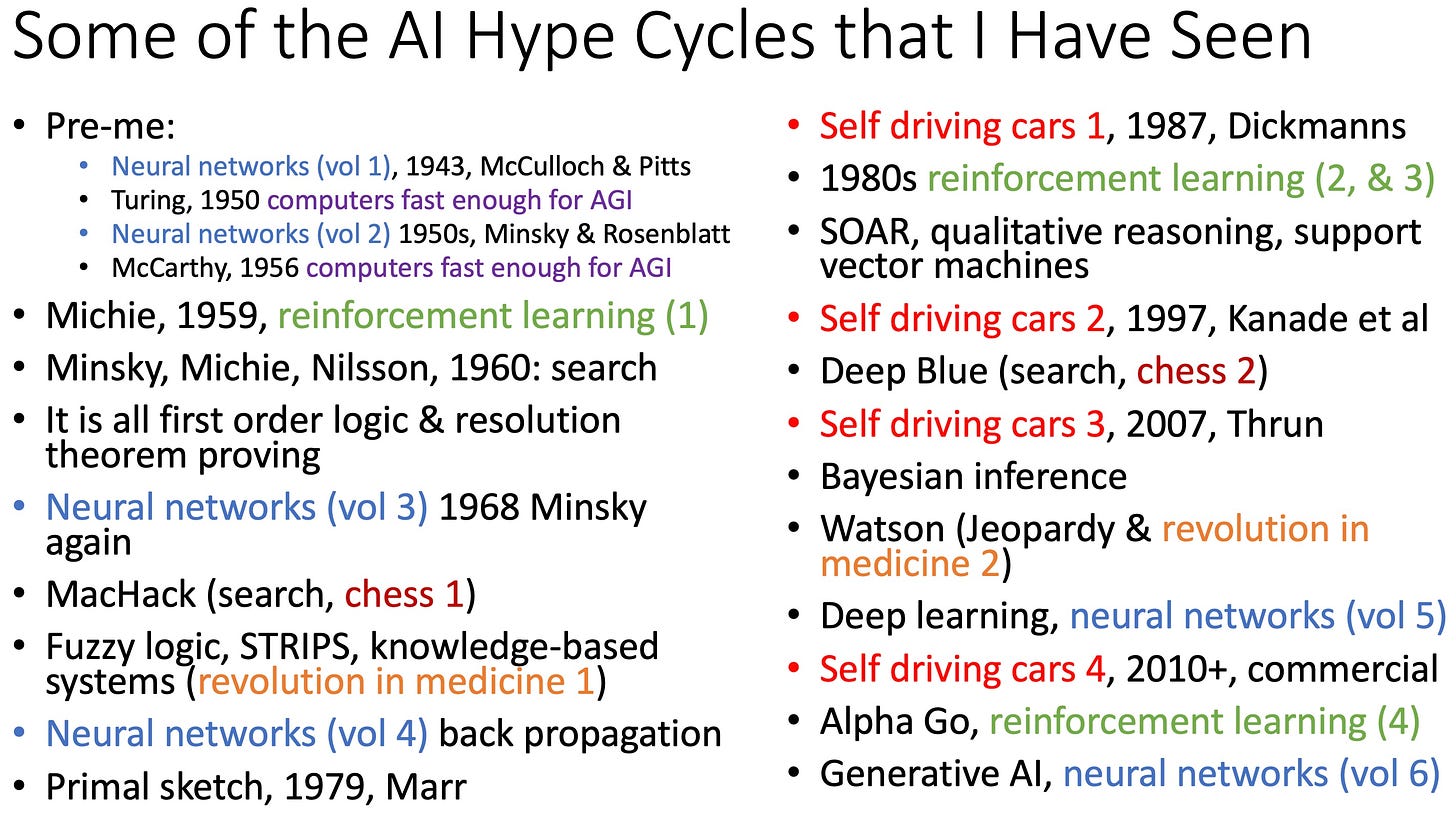

Predictions Scorecard, 2025 January 01 – Rodney Brooks. Good AI hype antidote.

We all know about FOMO, Fear Of Missing Out. In late 2023, for a talk on generative AI that I gave at MIT, I coined another acronym, FOBAWTPALSL, Fear Of Being A Wimpy Techno-Pessimist And Looking Stupid Later. Perhaps that one is a little bit too much of a mouthful to catch on. These two human insecurities lead people to herd-like behavior in establishing and propagating the zeitgeist on almost any topic.

But this time it is different you say. This time it is really going to happen. You just don’t understand how powerful AI is now, you say. All the early predictions were clearly wrong and premature as the AI programs were clearly not as good as now and we had much less computation back then. This time it is all different and it is for sure now.

China to Build Thorium Molten-Salt Reactor in 2025

The attraction of thorium is that it can help achieve energy self-sufficiency by reducing dependence on uranium, particularly for countries such as India with enormous thorium reserves. But China may source it in a different way: The element is a waste product of China’s huge rare earth mining industry. Harnessing it would provide a practically inexhaustible supply of fuel. Already, China’s Gansu province has maritime and aerospace applications in mind for this future energy supply, according to the state-run Xinhua News Agency.

Shaken Baby Syndrome: A Hypothesis That Keeps Sending Innocent People to Prison

The hypothesis stems from a 1971 article by British pediatric neurosurgeon Norman Guthkelch, who sought to explain why some babies would present with brain swelling, intracranial bleeding, and hemorrhages behind the retinas without any external signs of trauma (physicians now call this the diagnostic “triad”). He hypothesized that aggressively shaking the baby might be responsible.

By the 1980s, the shaken baby syndrome explanation had gained acceptance among child abuse pediatricians, and medical educators now teach it as orthodoxy to students and residents, even though since the late 1980s, biomechanical researchers have been unable to elucidate a biomechanical basis for the hypothesis. One such study concluded: “Severe head injuries commonly diagnosed as shaking injuries require impact to occur and that shaking alone in an otherwise normal baby is unlikely to cause the shaken baby syndrome.”

REVIEW: Reentry, by Eric Berger. SpaceX…Good Elon.

What Should Tesla’s Stock Be Worth? Automaker, Stagnating Vehicle Sales like GM & Ford, Getting Overtaken by Competitors, Losing Share in the Booming EV Market? Tesla…Not So Good Elon.

Public Domain Day 2025—”On January 1, 2025, thousands of copyrighted works from 1929 will enter the US public domain, along with sound recordings from 1924. They will be free for all to copy, share, and build upon.[2] 2025 marks a milestone: all of the books, films, songs, and art published in the 1920s will now be public domain.”