Econ

The Dangers of a Strong Dollar—Why Countries Should Diversify Their Reserve Currencies

In the longer run, the solution is for central banks to diversify their reserves and for countries to diversify their transactions away from the dollar and toward the currencies of the eurozone, China, and smaller economies. Doing so would leave countries less exposed to the decisions of one central bank. It is past due time, after more than half a century, for them to take John Connally’s aphorism to heart.

Geopolitics and the U.S. Dollar’s Future as a Reserve Currency.

Currently, around three-quarters of foreign government holdings of safe U.S. assets are by countries with some military tie to the U.S. Even a reduced reliance on the U.S. dollar for trade invoicing and debt denomination by a large bloc of countries less geopolitically aligned with the U.S. would be unlikely to end U.S. dollar dominance.

Scott Sumner—The policy lag puzzle and Gradualism turned out to be a mistake.

Now we are about to pay the price for the Fed gradualism. Bloomberg just suggested that there is a 100% chance of recession next year. I think that’s too high, but the risk is clearly increasing. By not tightening aggressively at the end of 2021, the Fed let inflation get much more deeply entrenched in the economy. With even core inflation now rising, the pain associated with bringing it down will be much greater. A small recession in 2022 would have been better than a bigger one in 2023.

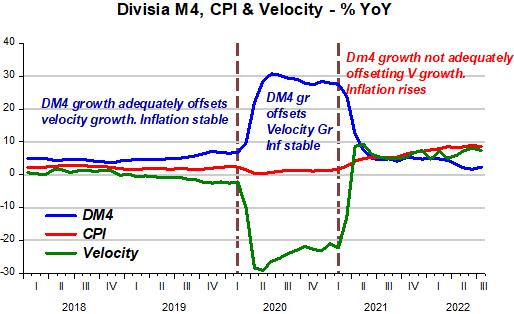

Marcus Nunes on monetary aggregates versus interest rate policy.

Rethinking Arthur Burns, the “Worst” Fed Chair in History

A robust anti-inflationary policy would follow in the spirit of Burns’ approach from 50 years ago and not just rely on the Fed to rein in inflation. Many of the specifics of his recommendations are outdated: price and wage controls, for instance, are unlikely to be successful or effective. But Congress and the White House could work together to restructure markets to bring down the costs of essential goods.

Bill Nelson on How Bank Examiner Preferences are Obstructing Monetary Policy. He highlights how a bank examiner preference for reserves makes it harder for the Fed to manage the balance sheet.

What Capital Discipline? US rig count is actually higher than expected

The evidence is dispositive. Notwithstanding the commentary and what insiders may tell each other, there’s no capital discipline. US rig count after the oil price crash has been just as responsive to the price of crude as it has been since the 1980s.

Russell Napier interview.

So the endgame will be a 1970s style stagflation, but we’re not there yet?

No, not by a long shot. First comes the seemingly benign part, which is driven by a boom in capital investment and high growth in nominal GDP. Many people will like that. Only much later, when we get high inflation and high unemployment, when the scale of misallocated capital manifests itself in a high misery index, will people vote to change the system again

Dovish inflation takes—The Case for Energy Optimism and Steno Signals #20 - NO soft landing unless central banks admit to disinflation.

Inflation has left little untouched– not least some long-standing rules of the investment game.

Our judgement, today, is that now is the time to increase exposure to credit, with for instance US IG yielding close to 6% and US HY yielding close to 10%, currently. …the spread on the much watched Markit iTRAXX Europe Crossover index is currently at 650 bps. At this level, the carry is so high that an investor would still breakeven if spreads blow out to 1000 and stay there for one year before going back to normal levels.

Political Affiliations of Federal Reserve Economists.

Democrat economists at the Federal Reserve outnumber Republicans 10 to 1.

Generative AI is the the new Web 3.0.

Coatue white paper on AI.

Gross only ever really employed four strategies: “There are only four things you need to know. Going long duration, rolling down the [Treasury] curve [i.e., capitalizing on a bond’s price rising as it ticks closer to maturity], going long credit, and going short vol.”

Foreign

On the Public Shaming of Liz Truss.

Whatever happens, all of Europe – not just the UK – will be facing a bitter economic reality over the short to medium term. There are no good options on the table. Just like with Covid, there are only lesser or greater tradeoffs.

In that context, Kwasi Kwarteng and Liz Truss’ growth plan was to the economic challenge we are facing what Boris’ herd immunity plan was to the Covid challenge.

What the mainstream neglects to inform the populace is that the alternatives in both cases were and are no better.

Italy’s Right-Wing Alliance Is Collapsing.

Christopher Caldwell on Andrew Sullivan’s podcast.

Weird how the Washington Post published these after the OPEC production cut—Retired US Generals, Admirals Take Top Jobs With Saudi Crown Prince and UAE Relied On Expertise Of Retired US Troops To Beef Up Its Military.

Türkiye Resisting US Pressure Against Increasing Economic Ties to Russia.

The markets chomped Truss’ Britain — now they’re circling for another leg to gnaw.

Faced as it is with growing financial strains amid soaring inflation, Europe’s shadow finance sector is similarly vulnerable to bond shocks, raising the possibility of bailouts, central bank interventions and yet more borrowing.

China’s Revolution Turns Green

The concerns for China in a warmer future are the same as they’ve always been: avoid famine, put down peasant revolutions, dam the rivers to prevent floods, ease the impact of droughts. In climate change, China’s state has found a match for its predilections and a justification for its preferred mode of social hierarchy. In this situation, Xi says, we’ve got no realistic choice — an emperor and his army of engineers are the only answer.

Fighting a Chip War on the Cheap

America is in a full-scale economic war with China, but Washington has brought a knife to a gunfight. China’s subsidies to its nascent chip industry are four times the Biden administration’s proposed support for American manufacturers. That doesn’t augur well for American victory.

The likeliest outcome of the chip war is the creation of a separate Chinese semiconductor industry, with years of global over-capacity financial distress for non-Chinese firms that depend on high profit margins to sustain capital expenditure and R&D. China will try to amortize its vast semiconductor subsidies by flooding the world market with cheaper products and putting Western companies out of business.

How Silicon Valley Lost the Chips Race.

After he retired, Grove voiced concern that the United States’ advanced manufacturing capabilities were eroding. “Abandoning today’s ‘commodity’ manufacturing can lock you out of tomorrow’s emerging industry,” he noted in 2010, warning that Silicon Valley’s fixation on software at the expense of hardware was misguided.

US/Culture/Misc

What We’ve Lost Playing The Lottery

Considering the regressive nature of state lotteries, their predatory practices, their role in fostering gambling addictions, the way they discourage normal taxation, and their relatively modest financial contributions, he concludes that they “should not exist in the modern United States.” As he acknowledges, this advice is not likely to be taken anytime soon; no state has repealed its lottery in more than a hundred and twenty-five years. Still, he argues, we should work toward common-sense reforms, such as banning the sale of tickets online, capping the cost of scratch-off tickets and the size of lotto jackpots, and, perhaps most important, closing a loophole that leaves lotteries exempt from F.T.C. regulation, and thus free from the constraints of truth-in-advertising laws.

Time to Build: California's Housing Reforms Are About to Pay Off.

Why I'm Telling My Friends That The Senate Is A Toss-Up.

But the bottom line is this: If you’d asked me a month ago — or really even a week ago — which party’s position I’d rather be in, I would have said the Democrats. Now, I honestly don’t know.

How A Tycoon Linked to Chinese Intelligence Became A Darling Of Trump Republicans.

Soon after the dinner with Wynn, Trump was in the Oval Office, receiving a briefing on China. According to two attendees, he called out to his secretary, “Bring me the letter that Steve Wynn brought from Xi.” (One attendee recalls that Wynn’s packet contained a letter from the Chinese government, but not from Xi.) Trump told the group, “We should get this guy out of here. He’s a rapist.”

Much more than you ever wanted to know about NEPA.

Old-school environmentalists consider NEPA to be a foundational environmental law, even the “Magna Carta of environmental law.” Yet the cumulative burden NEPA imposes on our agencies is intolerable. We must protect the environment, but we can’t do it by paralyzing our federal agencies. And if we are going to reform NEPA, we must first understand it.

Book Review: Rhythms Of The Brain.

Big Pharma’s Child-Vax Windfall

The potential profits flowing from this approval are enormous. The Covid injections were all approved under emergency laws that effectively shielded the corporate developers from any liability. This temporary shield would expire in October 2024. When the CDC officially adds the shots to the childhood immunization schedule, all future liability transfers to the National Vaccine Injury Compensation Program, or VICP. The shield extends to adult shots, as well; once the product is covered under VICP, manufacturers become immune against all consumer legal challenges, shifting damages claims to US taxpayers.

Vaccines Never Prevented the Transmission of COVID.

Why Elephants Don’t Get Cancer.

Cold Plunges: Benefits and Where to Start.

Cold exposure goes into the bucket along with things like resistance training, intermittent fasting, sun on your skin, and sauna—all stimuli that stress the body and prompt it to become stronger and more resistant to chronic and acute health issues.