Weekend Reading

3/10/23

Markets/Econ

General Sherman’s memoirs about the Page & Bacon 1855 bank run in San Francisco. His experience bears out the dictum that solvency is philosophy, but liquidity is fact. His bank, Lucas, Turner & Co, was fine.

This run on the bank (the only one I ever experienced) presented all the features, serious and comical, usual to such occasions. At our counter happened that identical case, narrated of others, of the Frenchman, who was nearly squeezed to death in getting to the counter, and, when he received his money, did not know what to do with it. "If you got the money, I no want him; but if you no got him, I want it like the devil!"

Startup Bank Had a Startup Bank Run

But there is another, subtler, more dangerous exposure to interest rates: You are the Bank of Startups, and startups are a low-interest-rate phenomenon. When interest rates are low everywhere, a dollar in 20 years is about as good as a dollar today, so a startup whose business model is “we will lose money for a decade building artificial intelligence, and then rake in lots of money in the far future” sounds pretty good. When interest rates are higher, a dollar today is better than a dollar tomorrow, so investors want cash flows. When interest rates were low for a long time, and suddenly become high, all the money that was rushing to your customers is suddenly cut off. Your clients who were “obtaining liquidity through liquidity events, such as IPOs, secondary offerings, SPAC fundraising, venture capital investments, acquisitions and other fundraising activities” stop doing that. Your customers keep taking money out of the bank to pay rent and salaries, but they stop depositing new money.

The Demise of Silicon Valley Bank

But then interest rate expectations started to shift and bond prices began to slide. Having been sitting on mark-to-market gains on their securities portfolios, banks started to see losses emerge. Unrealised gains of $39 billion across banks’ AFS portfolios at the end of 2020 swung to unrealised losses of $31 billion by the end of 2021.

To staunch the bleed, many banks reclassified AFS securities as HTM. This meant recognising losses upfront, but the switch would protect balance sheets from further losses as bond prices continued to fall. The largest bank, JPMorgan transferred $342 billion of securities from AFS to HTM, taking its weighting of AFS down to 30%. Others followed suit: Across the industry, the weighting of banks’ securities held as AFS shrank from three-quarters to just over half by the end of 2022.

The trouble is that when rates started to go up, mortgage assets got hit hard. The duration of Silicon Valley’s HTM portfolio extended to 6.2 years, as at the end of 2022, and unrealised losses snowballed, from nothing in June 2021, to $16 billion by September 2022. That’s a 17% mark-to-market hit. The smaller AFS book was also impacted, but not as badly. Mark-to-market losses there amounted to 9% by the end of September.

So big was this drawdown that on a marked-to-market basis, Silicon Valley Bank was technically insolvent at the end of September. Its $15.9 billion of HTM mark-to-market losses completely subsumed the $11.8 billion of tangible common equity that supported the bank’s balance sheet.

“The good news is that the securities portfolio is constantly paying down. And so we’re roughly seeing about $3 billion a quarter,” said the group’s CFO on his third quarter earnings call. It would take a long time, but the losses were expected to unwind as the bonds redeemed.

What neither the CEO nor the CFO anticipated, however, was that deposits might run off faster. Which is odd, because they’d seen deposits run off before. In the aftermath of the dotcom crash 20 years ago, deposits at the bank fell from $4.5 billion to $3.4 billion by the end of 2001 as customers drew down on their cash reserves.

Silicon Valley Bank was never subjected to the Federal Reserve’s LCR requirement – even as the 16th largest bank in America, it was deemed too small. It’s a shame. Regulation is not a panacea since banks are paid to take risk. But a regulatory framework to suit the risks of the day seems appropriate and it’s one US policymakers may now be scrambling for.

Silicon Valley Bank is a very American mess

So the Fed adopted a rule under which only the very largest international banks were subject to the full Basel NSFR requirements. It adopted a second tier, under which the ratio only had to be 85%, and a third tier where it was calibrated to 70%. And even then, the majority of US banks are not required to follow the NSFR or LCR standards at all.

Despite being the 16th largest bank in the US by balance-sheet size, SVB was apparently not subject to the “no more Dexias, no more HBOSes” regulation. The reason, as implied in the 10-K disclosure above, seems to be that a bank is only required to follow the NSFR and LCR rules if they have a certain amount of “short term wholesale funding”, and SVB’s liability side was dominated by deposits from corporate customers.

What Could Go Wrong When a DIP Maintains a Large, Uninsured Deposit Account at Silicon Valley Bank?

You gotta feel for BlockFi customers. First, they find themselves creditors in BlockFi's bankruptcy. And now they've found out that BlockFi had a large, uninsured deposit...at Silicon Valley Bank.

Corporate Pension Funds Lobbied for a Rule Change. Now It’s Coming Back to Haunt Them.

Passed in the wake of the global financial crisis, amid a low interest rate environment, MAP-21 allowed pension plan sponsors to use an artificially high discount rate to calculate plan liabilities. In effect, this rule allowed struggling corporations to avoid making pension fund contributions, instead using excess capital to shore up their businesses.

But here’s the rub: Actual interest rates are higher than the artificially high rates used in their liability calculations. “Rather than those historic averages keeping interest rates up, the ceiling hits, and they’re keeping interest rates down, meaning the pension contributions are inflated,” Kreps said.

In other words, plan sponsors may actually have to contribute capital to their pensions, even though the plans are fully funded.

The Bank of England's shifting target horizon

Such slippery leadership from the Bank rather undermines the purpose of the constrained discretion written into the remit.

And rather than educate the public, Bailey and company have engaged in classic obfuscation-through-language characteristic of the analytically challenged but unaccountable macroeconomics profession of which the Bank is a prime example.

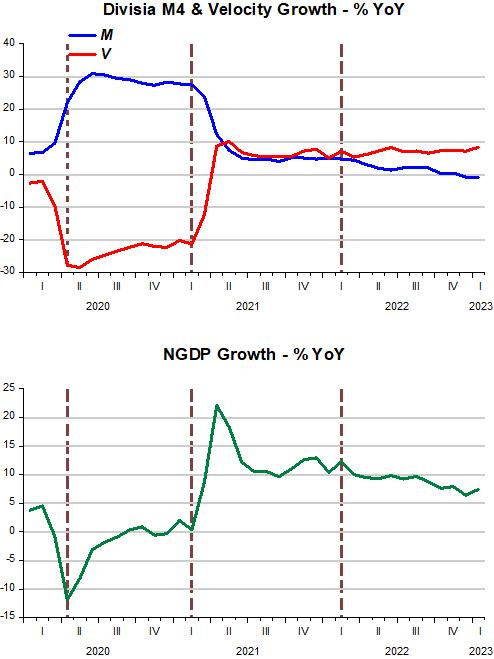

The charts below show the “thermostat” at work. A well-functioning thermostat will adequately offset changes in the “outside temperature” so as to keep the “inside temperature” stable. In our case, the “outside temperature” is represented by the velocity of money (V) (the inverse of money demand). As Friedman wrote in 1971, V can be “whatever people want”. The “inside temperature” is represented by nominal aggregate spending (NGDP). The “thermostat” is the money supply which has to vary to offset changes in V in order to keep changes in spending stable.

From 2019—Are Asian Insurers the New European Banks?

Secret Cyborgs: The Present Disruption in Three Papers

We now have two separate controlled studies of the impact of ChatGPT and related technologies on knowledge work, and the results are impressive. A study of programmers found a increase of 55.8% in productivity when using AI (and this is using the Copilot AI tool, which isn’t even state-of-the-art!). I wish that Substack had cool font options because I would make those letters flash, and underline them, and maybe make them spin: 55.8%.

And the amazing thing is that we don’t need new technologies (though many are coming!) to achieve AI-driven performance improvements of 30% or more, the current tools are enough. The implications may reshape the way we work in ways that rival the impact of the Industrial Revolution. During that era, organizations that were able to harness steam power and automation gained a significant competitive advantage, requiring individuals to work within complex organizations in order to benefit from these technological advancements. Today, there are far fewer advantages to organizations in this coming AI boom. With these potential productivity gains, every company should be spending a significant amount of their best employees time - right now! - figuring out how to use AI to improve performance.

We are in the early days of AI but disruption is already happening. There’s no instruction manual. No one has answers yet. The key is to learn fast.

Silver linings from inflation?

That’s not to say inflation and interest rates won’t decline at some point–I believe they will. But this sort of monetary infidelity will impose a price on future borrowings. If inflation really were painless, the government would do it again and again. More likely, it won’t be painless. Investors will understand that the Fed is less committed to 2% inflation than they had previously imagined, and demand a higher inflation premium when lending to the Treasury. (Recall the 1980s.)

It’s best to view public finance from a “timeless perspective”. Over a period of decades and centuries, policymakers will occasionally enact inflationary policies. Over the long run, investors will rationally adjust their behavior in such a way as to be compensated for the risk of occasional high inflation. During actual bouts of unexpected inflation (such as the 1970s), lenders will not be fully compensated. During other periods (the 1980s), they’ll be over compensated.

Dark sky: On the ill-fated search for R-star

The conclusions of this report are not unique. Policymakers keep at arms-length these models, and their implications for the neutral rate of interest.1 Fed Chair Powell and ECB President Lagarde have expressed uncertainty about r*. Professional forecasters have been equally skeptical of any definitive claim about the neutral rate. And yet, the models explored in this report are still used to provide a benchmark for r*. The “long-run” estimate of the nominal policy rate in the Fed’s Summary of Economic Projections has tumbled over the past 15 years and now stands at 2.5% (or 0.5% in real terms). It is unlikely a mere coincidence that the same conclusion is made by the model-based estimates of r*. The academic models of r* inform central bank economists’ thinking, and this in turn informs the thinking of policymakers.

Labor Market Recap February 2023: A Strong Labor Market Keeps Participation High

Given the strength in this jobs report and slowing average hourly earnings, the Fed’s decision in March of whether to go to a 50 bps hike will likely hinge on the CPI and PPI data next week. However, this month’s jobs data reinforces the case that we can still pursue disinflation without resorting to rising unemployment.

Foreign

The striking feature of course is that China and Global South powers do not need anymore to rely on some action from the West. In that sense, China is following the script that Russia itself was the first to write by organizing through the Astana Process a cooperation with Turkey and Iran on managing the Syrian crisis.

The myth of China’s military might

But that is hardly a stable remedy for a demographic and cultural reality with deep roots in Chinese history; it’s a key reason for the long sequence of foreign conquest dynasties that ruled China until 1912. They could do so because their Turkic, Manchurian and Mongol populations preferred to serve as soldiers rather than farmers, while with the Han Chinese it was the other way round.

Blinken Builds a Palestinian Hezbollah in the West Bank

The U.S. plan, which is being pushed by Blinken, does several things, none of which seems likely to have a positive impact on the physical security of Israelis, whether living inside or outside the West Bank—which is known to Israelis as Judea and Samaria. First, by standing up a 5,000-strong militia, training it specifically in counterterrorism and commando tactics, and (one must assume) arming and equipping it, the U.S. will be giving the Palestinians military capacities far in excess of anything they can organically create or currently possess. The U.S. plan will create a working military command structure for a faction (the recruitment pool is likely to be controlled by Fatah) likely to be armed with advanced weapons.

The chemist vs. the Dutch farmers

Across Europe, the pressure is set to grow. The EU has proposed a cluster of new laws that, if they are adopted, would push farmers to do far more to protect nature, potentially offering campaigners new legal weapons. And so — as the collateral damage, measured in wrecked lives and political upheaval in the Netherlands, accrues — what is happening there raises uncomfortable questions about the change needed for societies to live within their earthly means. Does saving nature necessarily mean ripping society apart? And if so, will this green transformation happen at all?

Since roughly 1960, the United States has averaged about 36 percent of allied GDP but more than 61 percent of allied defense spending. Why have American policymakers failed to distribute defense burdens more equitably?

The United States has been the primary security provider in all of its alliances for decades. The level of security the United States enjoys means that U.S. policymakers should play harder to get with their allies. Every ally has more to lose from a U.S. withdrawal than the United States does. U.S. taxpayers, and potentially U.S. servicemembers, deserve a level of effort commensurate with their own interests. Unless policymakers force this issue on U.S. allies, they are unlikely to do more, meaning that Uncle Sucker will continue to deserve the nickname.

US/Culture

Where are the limbic anti-capitalists?

They haven’t noticed that what the historian David Courtwright calls ‘limbic capitalism’ has been hard at work for decades now, doing an end-run both around government and around the human capacity to self-regulate.

As long as the Right remains either accidentally or wilfully blind to the toxic, predatory nature of this business model, they’ll go on mumbling about ‘personal responsibility’, ‘freedom’ and ‘free enterprise’, while hand-waving the innumerable immiserating impacts of junk food, pornography, social media and other addictive-yet-noxious business models that weaponise our own drives against us for profit. And as long as anyone goes on pretending there’s a “conservative” case for this dereliction of duty, the Right will go on failing to do the one thing conservatives should do: wield power responsibly in defence of human flourishing.

Why the Mental Health of Liberal Girls Sank First and Fastest

We are now 11 years into the largest epidemic of adolescent mental illness ever recorded. I know so many families that have been thrown into fear and turmoil by a child’s suicide attempt. You probably do too, given that the recent CDC report tells us that one in ten adolescents now say they have made an attempt to kill themselves. It is hitting all political and demographic groups. The evidence is abundant that social media is a major cause of the epidemic, and perhaps the major cause. It's time we started treating social media and other apps designed for “engagement” (i.e., addiction) like alcohol, tobacco, and gambling, or, because they can harm society as well as their users, perhaps like automobiles and firearms. Adults should have wide latitude to make their own choices, but legislators and governors who care about mental health, women’s health, or children’s health need to step up.

Dropping the SATs Hurts Poor Kids

Columbia University has just become the first Ivy League school to permanently abandon the SAT/ACT requirement for college admission.

Elite colleges are eliminating standardized tests before they eliminate legacy admissions. Tells you all you need to know.

The chattering class is using poor kids as pawns to eliminate standardized testing, which helps their own kids—rich kids who “don’t test well.” But they know how to strategically boost their GPAs, get recommendation letters from important people, stack their résumés with extracurriculars, and use the right slogans in their admissions essays. They have “polish.”

Applicants from the most affluent families excel at these games. A study at Stanford found that family income is more highly correlated with admissions essay content than with SAT scores. Applicants from well-to-do backgrounds are especially adept at crafting their essays in ways that please admissions committees.

“Power is going to change hands,” he warned. “The Democrats are not going to be in power forever. When power changes hands, that precedent is going to travel with it. If somebody else from the other side gets in and starts to target the people who are in power now, their families, their businesses, their lives, their freedom, then it’s over. America goes from being a free democracy to a tribalist partisan state. Maybe there’s not ethnic-cleansing in the streets, but people are cleansing each other from the workplace, from social media, from the banking system and they’re putting people in jail. That’s where we’re headed. I don’t know why people can't see what’s on the horizon.”

The cheerleading, or at best indifference, by Democratic Party supporters and much of the left to these show trials will come back to haunt them. We are exacerbating the growing tribalism and political antagonisms that will increasingly express themselves through violence. We are complicit, once again, of using the courts to carry out vendettas. We are corroding democratic institutions. We are hardening the ideology and rage of the far-right. We are turning those being hounded to prison into political prisoners and martyrs. We are moving ever closer towards tyranny.

Feeding the World Without Sunlight

There’s three main possibilities, which would be a volcanic eruption, an asteroid impact, or a nuclear winter. In each of these cases, material is ejected high enough into the atmosphere such that it will persist for an extended period of time because it rises above the level where moisture naturally occurs, so it won’t get rained out. As they diffuse, these materials would persist for years and result in a loss of agricultural output — around 5 to 10 percent for the solutions we’re talking about to be necessary.

The eruption of Mt. Tambora in 1815, for instance, led to the year without summer in 1816, when global temperatures decreased between 0.4 and 0.7 degrees Celsius. There are interesting anecdotes in relation to it. Frankenstein was written because of the terrible summer that year — Mary Shelley spent much of her holiday in Geneva indoors because of it. And lots of J. M. W. Turner’s paintings have a unique style because of what happened to the sky.

From preliminary calculations, we could maintain dairy stocks if we used material that’s inedible to humans — residues, grasses, things like that. There’d be less after the disaster, but there would be some, and dairy is the most efficient conversion of that material into human-edible food.

A VEI-7, something like Tambora, has about a 15 to 20 percent probability of happening per century, and that would cause crop losses in the range of 5 to 20 percent. VEI-8 events are less frequent, but have occurred once in somewhere between every 17,000 to 50,000 years.

The first indication that the Chinese Communist Party is aware of TikTok’s malign influence on kids is that it’s forbidden access of the app to Chinese kids. The American tech ethicist Tristan Harris pointed out that the Chinese version of TikTok, Douyin, is a “spinach” version where kids don’t see twerkers and toilet-lickers but science experiments and educational videos. Furthermore, Douyin is only accessible to kids for 40 minutes per day, and it cannot be accessed between 10pm and 6am.

Has the CCP enforced such rules to protect its people from what it intends to inflict on the West? When one examines the philosophical doctrines behind the rules, it becomes clear that the CCP doesn’t just believe that apps like TikTok make people stupid, but that they destroy civilizations.

Land and Wang were not just polar opposites in personality; they also operated at opposite ends of the political spectrum. While Wang would go on to be the top ideological theorist of the Chinese Communist Party, Land would become the top theorist (with Curtis Yarvin) of the influential network of far-right bloggers, NRx.

And yet, despite their opposite natures, Land and Wang would develop almost identical visions of liberal capitalism as an all-commodifying, all devouring force, driven by the insatiable hunger of blind market forces, and destined to finally eat Western civilization itself.

The Invisible Graveyard of Crime

Critics of the FDA talk about the “invisible graveyard,” or the untold numbers who die due to the overregulation of medicine. The federal government tries to protect people from taking dangerous or unproven treatments, but if the system errs too much on the side of caution, people will die because they can’t get treatments that might otherwise save their lives. Ideally, you want a system that considers the tradeoffs between preventing harms through regulation and the need to let innovation go forward.

I’ve recently realized that a similar metaphor can apply to crime. President Nayib Bukele of El Salvador has undertaken a gang crackdown that has been roundly denounced by the American press, even as articles grudgingly acknowledge its successes.