Crypto-Schadenfreude

This is a total meltdown. You should assume that Binance and Tether will fail unless some Cyber Warren Buffet arrives on the scene. Crypto isn’t going away, but what the market valued at $3 trillion at peak, will likely settle in at a couple hundred billion or whatever the floor ends up being in bitcoin and ether.

My two cents on SBF, he’s either a psychopath or a sociopath.

SBF is Keyser Soze/a psychopath. The chubby vegan/nerd look, Effective Altruism, and vague autism were all a put-on to steal money and disappear into the night. Maybe he shaved his head and right now is undergoing plastic surgery at some Nazi doctor grandson’s Argentinian practice. BTW, the conspiracy theories that this will spawn are going to be epic. SBF was the second biggest Dem donor this cycle and was buddying up with Bill Clinton—tales of adenomchrome fueled child sacrifice rites are incoming. Already starting—Did Epstein’s Island Truly Shut Down?

The much more likely alternative is that SBF was a garden variety sociopath that happened to exist at the confluence of several dumb recent trends.

The exultation of nerds and the decline of physical bullying.

Monetary policy that ignores asset bubbles.

The fake wealth creation from artificially low discount rates needs someplace to be invested. Since real cash flowing investments are supply constrained, ipso facto, there will be a proliferation of fraud and ponzi schemes.

The Cult of the Founder/the idiocy of Venture Capital.

Crypto as an asset class. Bitcoin is a fine thing to own, especially if you live someplace subject to periodic hyper-inflation. Ether is great and may spawn decentralized tech that completely supplants incumbent companies. But OFC an offshore unregulated financial system based on them will blow up. You don’t need to be a financial historian to see that coming.

SBF may be on the run to Argentina.

At least $1 billion of client funds missing at FTX.

The documents showed that between $1 billion and $2 billion of these funds were not accounted for among Alameda's assets, the sources said. The spreadsheets did not indicate where this money was moved, and the sources said they don't know what became of it.

In a subsequent examination, FTX legal and finance teams also learned that Bankman-Fried implemented what the two people described as a "backdoor" in FTX's book-keeping system, which was built using bespoke software.

They said the "backdoor" allowed Bankman-Fried to execute commands that could alter the company's financial records without alerting other people, including external auditors. This set-up meant that the movement of the $10 billion in funds to Alameda did not trigger internal compliance or accounting red flags at FTX, they said.

Now hackers seem to have drained $600mm from the bankrupt FTX entities. FTX Faces Potential Hack, Sees Mysterious Outflows Totaling More than $600M

Sam Bankman-Fried Has a Savior Complex—And Maybe You Should Too. Sequoia published panegyric to their crypto Jesus. You can’t say they weren’t warned.

The math couldn’t be clearer. Very high risk multiplied by dynastic wealth trumps low risk multiplied by mere rich-guy wealth. To do the most good for the world, SBF needed to find a path on which he’d be a coin toss away from going totally bust.

A dialogue with the future CEO of Almeda Research that could easily be the beginning of the world’s worst pornographic movie.

“So,” Ellison asked after joining SBF at a table, “what have you been up to in the last few months?” Ellison, it should be noted, was dressed as a sultry wood nymph—she was on her way to a LARP (Live Action Role Play) party.

“Oh,” SBF responded cryptically, “I can’t tell you. It’s a secret.”

“Okay, that’s fine,” Ellison said, sipping her tea.

Uncomfortable silence.

“Well, I guess I could tell you if you really want…” SBF offered after a moment.

“Nope. It’s okay.” Sip.

An awkward beat later, SBF broke, slayed by the silent force of Ellison’s four-eyed gaze.

“I’ll just tell you,” he said.

Anyone that aspires to running a fraudulent or ponzi investment scheme would be well served to create the same impression SBF did.

The problem, as Bailhe saw it, was that FTX didn’t appear to need any money.

His zoom meeting with Sequoia is perfection. If a recording exists, it should go to the Smithsonian.

Bailhe remembers it the same way: “We had a great meeting with Sam, but the last question, which I remember Alfred asking, was, ‘So, everything you’re building is great, but what is your long-term vision for FTX?’”

That’s when SBF told Sequoia about the so-called super-app: “I want FTX to be a place where you can do anything you want with your next dollar. You can buy bitcoin. You can send money in whatever currency to any friend anywhere in the world. You can buy a banana. You can do anything you want with your money from inside FTX.”

Suddenly, the chat window on Sequoia’s side of the Zoom lights up with partners freaking out.

“I LOVE THIS FOUNDER,” typed one partner.

“I am a 10 out of 10,” pinged another.

“YES!!!” exclaimed a third.

What Sequoia was reacting to was the scale of SBF’s vision. It wasn’t a story about how we might use fintech in the future, or crypto, or a new kind of bank. It was a vision about the future of money itself—with a total addressable market of every person on the entire planet.

“I sit ten feet from him, and I walked over, thinking, Oh, shit, that was really good,” remembers Arora. “And it turns out that that fucker was playing League of Legends through the entire meeting.”

“We were incredibly impressed,” Bailhe says. “It was one of those your-hair-is-blown-back type of meetings.”

Not only that, Arora says, but League of Legends is the kind of multiplayer online battle arena video game where every four minutes or so of tactical maneuvering is punctuated by ten seconds of action known as a gank—gamer slang for “gang killing”—where you and your team gang up on an enemy. “There’s a fight that happens, basically,” says Arora, who was watching over SBF’s shoulder as he answered that final question from Sequoia, “and I’m like, This guy is fucking in a gank!”

The B round raised a billion dollars. Soon afterward came the “meme round”: $420.69 million from 69 investors.

C’mon.

“Oh, yeah?” says SBF. “I would never read a book.”

“I’m very skeptical of books. I don’t want to say no book is ever worth reading, but I actually do believe something pretty close to that,” explains SBF. “I think, if you wrote a book, you fucked up, and it should have been a six-paragraph blog post.”

So there you have it: Books are for losers.

Enron’s Liquidator to Oversee FTX’s Massive Crypto Bankruptcy. John J. Ray III, who I hope goes informally as JJ Ray, Trey, is FTX’s new CEO.

Econ/Markets

Is Inflation Stable Or Unstable Under Under An Interest Rate Target?

Newer theory, which primarily uses rational (better, forward-looking or model-consistent) rather than adaptive expectations, says that inflation is stable under an interest rate target. It follows that inflation can go away all on its own, even with interest rates substantially below inflation.

With fiscal theory + rational expectations, we are having a burst of inflation to devalue government debt, as a response to the 2020-2021 fiscal blowout. But once the price level has risen enough to bring the real value of debt back, it's over. Until the next shock hits.

This is a puzzle if you think about inflation as basically arbitrary, a symptom of mismanagement by central banks of purely nominal units. But that’s entirely the wrong way to think about stubborn inflations. Demand mismanagement can lead to some inflation, but it’s rarely durable. When there are not fundamental reasons for the inflation, moderate monetary and fiscal tightening quickly ends it. That happens a fair amount. Team transitory wins.

Stubborn inflations occur when there are in fact deep reasons why the inflation, or else some alternative form of unpleasantness, is necessary. Generally, inflation is the answer to a question: What do we do if we are not as rich as we thought we would be? More precisely, what do we do when the expectations of the labor force, in real terms, cannot be satisfied by the output we are capable of producing? Then we have to cut real wages relative to prior expectations somehow. If the shortfall is large, given the reality of downward nominal wage rigidity, we must resort to some mix of inflation and unemployment.

A "monetarist" forecast for G7 inflation.

Some thoughts on European monetary policy.

So I remain agnostic on the wage question. I’m quite willing to accept the view of Eurozone doves that the inflation problem has been almost entirely supply-side up through mid-2022. I’m less sure of the situation now and going forward, and indeed am puzzled as to why the Economist predicts tight Eurozone labor markets in late 2023. I thought all the experts were telling us that a Eurozone recession was inevitable in 2023? The situation remains confusing, at least to me.

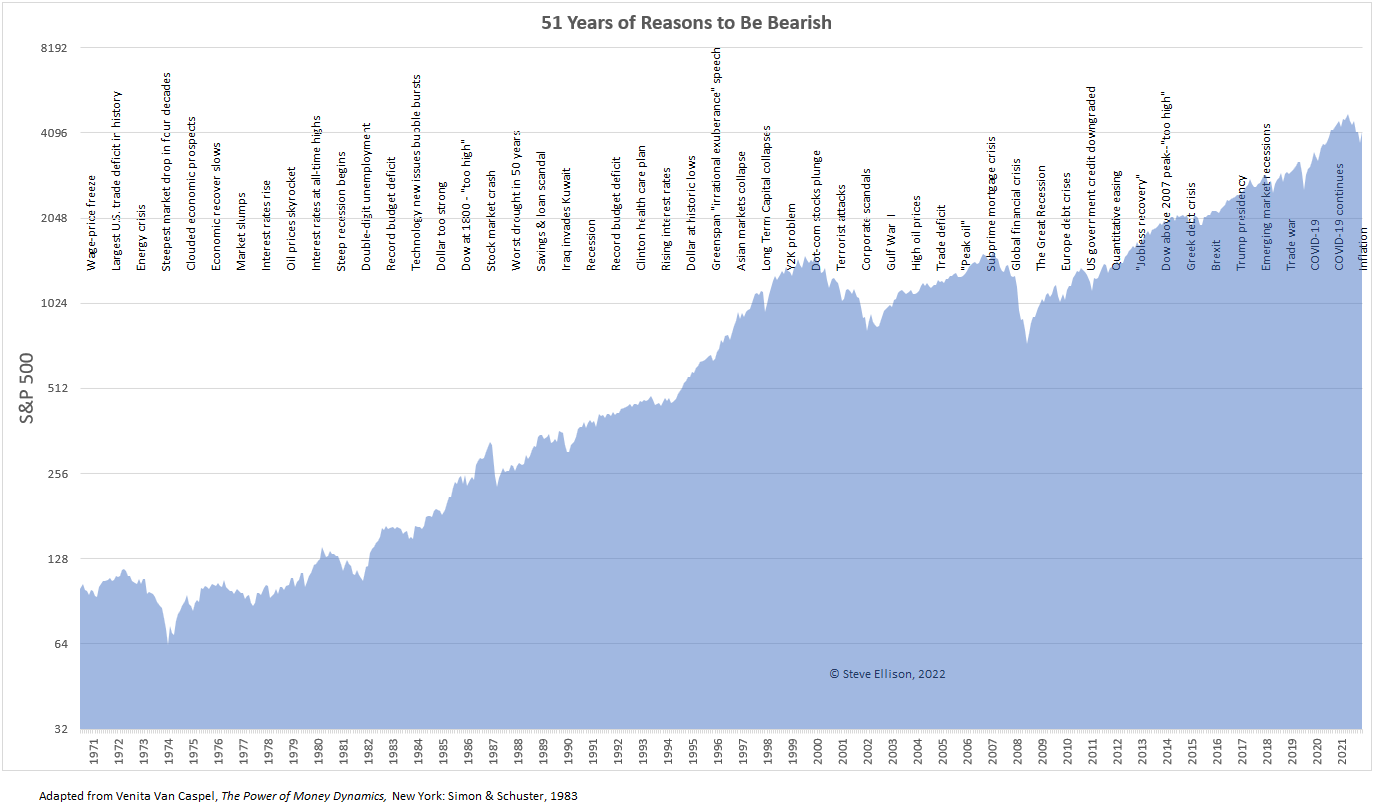

Reminder—There is always a reason to be bearish.

Demystifying financial leverage.

Am I a DeFi fan as a result of this experience? Not so much, no, but at least in reinventing things from first principles the folks seem to have created a very concrete demonstration of what leverage management (and mismanagement) looks like.

Hopefully that helps demystify leverage and leverage management to you. You will, in both the near future and long after that, read a lot about leverage, and how it blew someone up. And hopefully you will remember that it is not some dark art only accessible to the high priests of finance.

And now you know enough to understand what I'm saying with an otherwise opaque statement like "Tether is 35:1 levered on risky assets during market contagion."

But it is now evident that FTX was a Rube Goldberg monstrosity and all CZ did was remove–call into question, really–one piece of the contraption which led to its failure.

Bank capital can be seen increasingly as a modern-day Maginot line, an impressive fortress that financial risk will simply bypass. And it turns out that the southern terminus of the Maginot line was in a little town called Basel. The question is whether construction will continue, or whether regulatory attention will focus on the costs to the economy of constructing this fortress and forcing the risk to move elsewhere

Death of a soft-landing salesman.

Nonetheless, here are the killer questions. What justifies the Fed’s lingering optimism? Does the Fed believe unemployment will reach only 4.4 per cent? Or is the Fed keeping an unrealistically dovish scenario open so that, if rate hikes can slow, it doesn’t appear to have changed its new hawkish approach?

Do Exchange Rates Fully Reflect Currency Pressures?

Macro factors of the risk-parity trade.

a strong theoretical case can be made for managing risk-parity strategies based on economic trends and risk-adjusted carry. We propose simple strategies based on macro-quantamental indicators of economic overheating.

Foreign

The Present and Future of Europe's Energy Supply. The autocratic countries of the Persian Gulf play a key role in the new world order – and for the future of Germany's economy. Complete dependence will be difficult to avoid.

These ideological shifts, the accompanying political rhetoric, and the resulting new policy directions make it clear that China is now breaking from decades of political, economic, and foreign policy pragmatism and accommodationism. Xi’s China is assertive. He is less subtle than his predecessors, and his ideological blueprint for the future is now hiding in plain sight. The question for all is whether his plans will prevail or generate their own political antibodies, both at home and abroad, that begin to actively resist Xi’s vision for China and the world. But then again, as a practicing Marxist dialectician, Xi Jinping is probably already anticipating that response—and preparing whatever countermeasures may then be warranted

The Case for Keeping US Troops in Syria. I wonder what percent of Americans know we have troops in Syria?

Strategic Scarcity: Allocating Arms and Attention in Washington.

Despite these assertions of Indo-Pacific import, the administration’s actions fall demonstrably short of this prioritization. The extent of material support for Ukraine is producing serious opportunity costs, infringing on Washington’s ability to safeguard its cardinal interests, namely: maintaining the capability and capacity to deter or deny Chinese territorial aggression in Asia, the most likely target of which is Taiwan.

Congress Has Removed a Ban on Funding Neo-Nazis From Its Year-End Spending Bill. Hopefully our Neo-Nazi seeding program isn’t as successful as our Al-Queda program was.

US/Miscellany

Go With the Regs or Go to Jail.

Last summer, armed federal agents sent by the USDA demanded that Miller cease operations and prepared to hit him with more than $300,000 in fines. That would shut Amos Miller down.

They demanded that he stop selling meat until he comes under federal agencies that regulate it. Miller responds that such regulation “hurts the nutrition of the food…you wash it in these things, you’re given these vaccines, and the cows get all types of medicine, I don’t do any of that…your regulatory process will actually hurt the quality of my food and that’s what I’m being paid top dollar for…”

What Moneyball-for-Everything Has Done to American Culture.

Cultural Moneyballism, in this light, sacrifices exuberance for the sake of formulaic symmetry. It sacrifices diversity for the sake of familiarity. It solves finite games at the expense of infinite games. Its genius dulls the rough edges of entertainment. I think that’s worth caring about. It is definitely worth asking the question: In a world that will only become more influenced by mathematical intelligence, can we ruin culture through our attempts to perfect it?

Everything went from bad to worse at Twitter on Thursday. Today let’s talk about a truly chaotic 24 hours at the company, and the mounting fears over what it means for the service that still serves as the heartbeat of the global news cycle.

Oxidized Seed Oils Cause Diabetes.

This study should end debate about whether or not increasing linoleic acid consumption increases body levels of oxylipins in humans. It does. We also know that the role of D6D activity is likely CAUSAL in the development of diabetes. That strongly suggests that oxylipins cause diabetes because D6D only has one job.

Furthermore, there is a significant interaction between genetics and diet, which probably goes a long ways towards explaining why some people (20%) seem to do fine on a high PUFA diet whereas some have real problems (33%) and some are in the middle (50%).

Nicotine in Inflammatory Diseases: Anti-Inflammatory and Pro-Inflammatory Effects.

Of all the diseases summarized here concerning systemic inflammation, especially in sepsis and endotoxemia, nicotine exerted the most pharmaceutical effect and significantly improved the survival. Next, nicotine is also a potential candidate for treating ulcerative colitis, rheumatoid arthritis, osteoarthritis, multiple sclerosis, and myocarditis; the in vivo data provided a much better foundation.