Pre-Fed Instrument Check

Here’s a quick run through of what came up at the last press conference. All quotes are from Powell on June 15th.

Terminal Rate

So the question really is, how high does the rate really need to go? And this is—the estimates on the Committee are in that range of 3½ to 4 percent

then later

We see it as appropriate to get the policy rate up to restrictive levels, which would be, in the thinking of the Committee, somewhere in the range of 3 to 3½ percent by year-end

Fed funds have gone from pricing 4% as the peak in rates to 3.37% and have moved it closer by 5 months, from June to January.

Si vis pacem, para bellum. It’s so far, so good from the Fed’s perspective. The extra 25 bps in June reduced pricing for terminal funds without jacking inflation expectations.

The forwards are pricing cuts because the survey data is weak and many of us think the $ economy is over-levered. But, given the Fed thinks:

the longer-run neutral rate…we think that’s in the mid-2s.

They may see rates coming back to 2.5% as the perfectly executed soft landing. In that case, I think Powell will be vigilant about not implying a pivot of any sort.

Market inflation pricing

5Y5Y bounced around, but is basically unchanged from the last meeting.

This is just a simple representation of the impulse in inflation pricing—1Y1Y inflation is 38 bps higher than 5Y5Y. The level is basically unchanged from the last meeting—higher than normal, but off the highs.

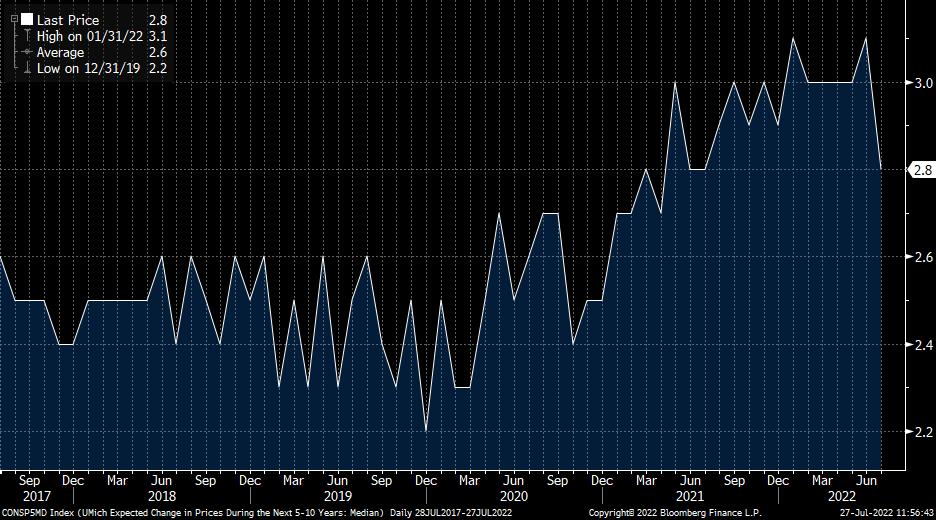

Umich Inflation expecations

So the preliminary Michigan [survey] reading—it’s a preliminary reading; it might be revised—nonetheless, it was quite eye-catching, and we noticed that. We also noticed that the index of common inflation expectations at the Board has moved up after being pretty flat for a long time, so we’re watching that, and we’re thinking, “this is something we need to take seriously.” And that is one of the factors, as I mentioned—one of the factors in our deciding to move ahead with 75 basis points today was what we saw in inflation expectations.

The Fed has to be happy with the last UMICH reading, and until gas heads higher, I don’t think it will be much of a focus.

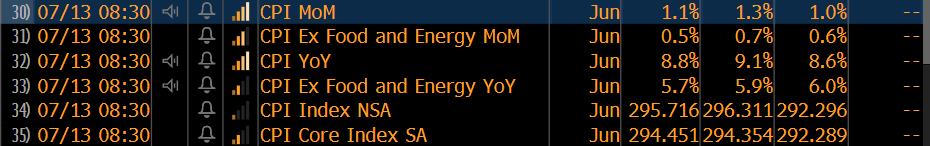

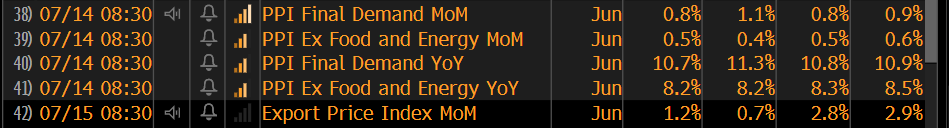

Inflation Data

what we want to see is a series of declining monthly readings for inflation, and we’d like to see inflation headed down

Core CPI was a real Whammy, otherwise kinda ok.

But given Powell said—

we’re not going to declare victory until we see a series of these, really see convincing evidence, compelling evidence, that inflation is coming down.

It’s not a close call, the Fed’s internal logic demands a continued show of resolve.

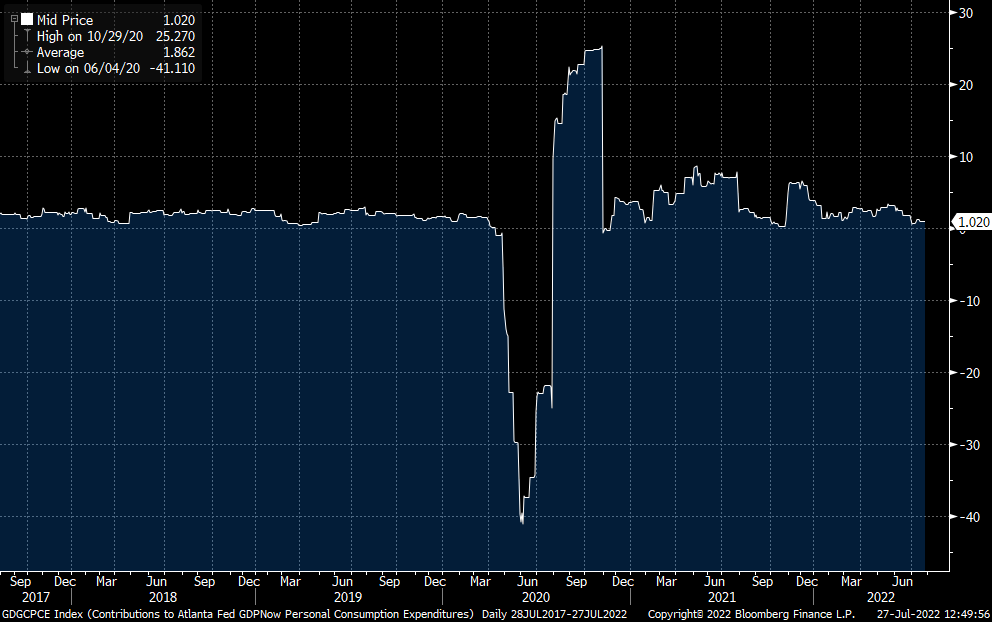

Fixed business investment

We watch business fixed investment, which actually has softened a bit. And we watch—we’re responsible for watching everything.

This is weaker than the last meeting, but not enough to matter, imho.

Consumer

The consumer’s in really good shape financially. They’re spending. There’s no sign of a broader slowdown that I can see in the economy.

There is a lot out there about bloated inventories and negative consumer sentiment. But I don’t think the Fed cares yet.

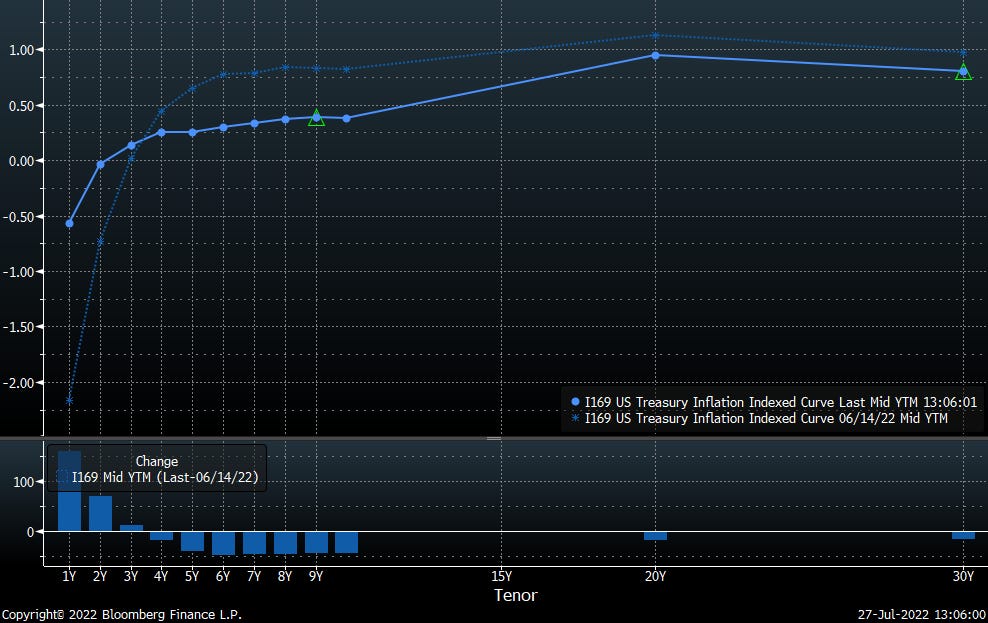

Real rates

I think we’ll know when we get there really. I mean, honestly, though, that would be—you would have positive real rates, I think, and inflation coming down by then. I think you’d have positive real rates across the [yield] curve. I think that the neutral rate is pretty low these days. So I would think it would, but you know what? We’re going to find that out empirically. We’re not going to be completely model driven about this. We’re going to be looking at this, keeping our eyes open, and reacting to incoming data both on financial conditions and on what’s happening in the economy.

Mission accomplished on this one. Real rates—to be clear, TIPs real yields, not CPI deflated nominals, which are still crazy negative—are much closer to going positive across the curve and financial conditions have eased.

Conclusion

I think that Powell will say that monetary policy is in a ‘better place’ than it was at the last meeting. I think he will say that the Fed is seeing progress in meeting its dual mandates.

I think the Fed’s plan here is to add to what it perceives to be the winning trade of continuing to exhibit inflexible commitment to price stability.

Powell will try not to signal a dovish pivot.

If that’s right than whites will get smoked, rates will flatten and stocks will go down. There is a material risk though that Powell will unconsciously, or the market will mistakenly, detect a pivot. In which case reds will sell off and stocks will ramp.