Markets/Econ

Japanification of the entire non-US world

On recent trends, broad monetary aggregates globally have delivered more than enough stimulus in dollar terms to offset the rise in value of the dollar. The difference between dollar rise and money creation can be thought of as financial inflation, which find expression in bidding for US assets. Yes, these trends precede the US election and will need to continue to sustain current elevated valuations. But non-US monetary authorities may not have an option if they wish to avoid a deflationary slump at home. This sets up a dynamic where prolonged funding can be provided by foreign investors into the US. What we may be witnessing is the Japanification of the entire non-US world, creating a global carry trade on US assets. History suggests such trends can last for decades.

Do you think that in our sophisticated financial system, a system in which trillions of dollars of assets are exchanged every day and people on Wall Street care about reducing trading times by microseconds—this is the world in which we routinely swap interest rates, exchange rates, put options, call options, take out options on all kinds of eventualities—in this world, you’re telling me that the power of the Fed, which many people see as tremendous, huge, you’re telling me that the power of the Fed ultimately rests on the fact that people pay for candy bars with cash, or that we trade bonds in three steps instead of one? Put that way, Fischer Black and Fama seemed to be onto something.

Why money is important—Scott Sumner response.

Yes, I really think that.

That “slight difference” is actually all-important. Even if base money is only a tiny percentage of the financial system, changes in the value of base money impact all nominal variables, including nominal GDP. No matter how small the ratio of MB/NGDP, the Fed has almost unlimited control over the value of the dollar and thus NGDP.

But if the productivity growth rate goes up, if you just go work through the models, that affects what you think is neutral. If productivity growth is going to be permanently faster or faster than normal for a long while, that raises the neutral interest rate.

The “Digital Gold” Fallacy, or Why Bitcoin Can’t Save the US Dollar

And—let’s be honest—although some Bitcoin fans may sincerely believe that a Strategic Bitcoin Reserve will strengthen the US dollar, many more favor it despite not caring a fig about the dollar’s future because they expect it to make them richer, and don’t mind if it does so at others’ expense.

MicroStrategy’s secret sauce is volatility, not bitcoin

But for MicroStrategy, volatility is the real currency. Saylor’s bombastic interviews, grandiose predictions, and relentless social media posting aren’t just noise — they’re the fuel for the financial fire. There’s never a dull moment with the guy. The crazier the stock, the better the terms for the next convertible.

The U.S. Income Balance Puzzle

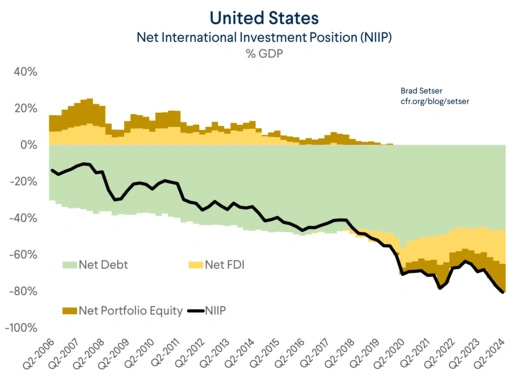

Others argued that the U.S. was simply a successful private equity fund, borrowing from the rest of the world to invest in higher yielding assets abroad, collecting large risk and liquidity premiums along the way.

This argument is a bit too smug.

The U.S. is at best a very profligate private equity fund; it borrows a lot to fund current spending, and it has a lot more debt than equity assets.

Government Spending, Growth & Inflation

Would things have been different for Harris if the Fed had maintained inflation close to target? Likely not, because the counterfactual would have been a massive recession and rise in unemployment, so instead of banging on the Biden-Harris inflationary policies, the Trump gang would bang on the Biden-Harris recession/high unemployment record with the same effect!

Introducing the “More Accurate Consumer Price Index”—Anything is possible

It is very likely that all the most commonly used price indexes overstate the rise in the cost of living by a substantively important amount.

The next chapter in the Tornado Cash saga just dropped. Last week a court ruled last that Tornado Cash, a bot that can be used for obfuscating crypto, is safe from being sanctioned.

Bessent

The Fallacy of Bidenomics: A Return to Central Planning—June 6th Bessent speech

Scott Bessent Weighs In on US Election, Trump and Tariffs —July 17th BBG interview.

What Makes a Great Macro Fund Manager? With Scott Bessent, US Treasury Secretary & Founder of Key Square Capital Management—October 2023 podcast

Thematic Investors: Scott Bessent – A Global Macro Veteran on the Path Ahead—May 2024 podcast

US Fiscal

Will "Efficiency" Fix the Budget?

At the outset, I called this problem intractable, inconsequential, or existential. Some say this topic is simply irrelevant, governments can print forever — just look at Japan! Some cite Ray Dalio’s Changing World Order and claim the nation is in decline. Some simply accept reality and enjoy the stimulative benefits to the private sector today.

For me, I look at math — and the math is only getting tougher.

$700 Billion of Easy Deficit Reduction— “Easy”

To be sure, some of these policies may be unpopular with certain constituencies and interest groups. And even enacting all of them would only get a fraction of the way toward fixing the debt. But these and similar policies are an obvious place to start.

Eight Questions—and Some Answers—on the US Fiscal Situation—Jason Furman.

This paper has documented the role that the abandonment of federalism in fiscal matters has played in the post–World War II rise in federal spending and chronic federal budget deficits since the early 1960s. All the increase in federal spending as a percentage of GDP since the 1950s, and the budget deficits it has created, is due to rapidly growing spending on activities that Congress originally regarded as state and local.

Tariffs/Taxes

A User’s Guide to Restructuring the Global Trading System

As currency accords are typically named after resorts where they are negotiated, like Bretton Woods and Plaza, with some poetic license I’ll describe the potential agreement in the Trump Administration as others have done as the prospective “Mar-a-Lago Accord.”

Trade Intervention for Freer Trade—Pettis

Broadly speaking, deficit countries such as the United States have three options to respond to beggar-thy-neighbor policies: retaliate with similar policies of their own, aggressively subsidizing domestic manufacturing in the hopes of passing the cost on to their trading partners; accept the consequences of surplus countries’ policies, letting rising debt or unemployment set in and succumbing to the erosion of manufacturing in their economies; or opt out of the existing global trade regime, either unilaterally or with other like-minded countries, in the hopes of creating a new system that can truly unleash the potential of trade to raise global fortunes.

The House GOP’s Destination-Based Cash Flow Tax, Explained

Trump Should Finish What He Started—Very good Destination Cash Flow Tax primer.

The main point I’ve tried to convey is that a cash flow tax is good, and a destination-based cash flow tax is great. There’s something in here for everyone to like. If you’re an ardent progressive who believes big corporations wield enormous market power and extract rents through nefarious practices, then a tax on supernormal returns—or more accurately, pure profits—becomes immensely appealing. In fact, you could argue for higher statutory rates while still appealing to so-called "free market conservative" types, since this proposal doesn’t distort investment decisions at the margin.

When Drive-By Punditry Goes Wrong—Defense of free trade.

A worldview obsessed with using blanket tariffs to indiscriminately boost manufacturing jobs misses this reality, along with the significant costs associated with such protection—not merely higher prices for American consumers, but less economic dynamism, innovation, and growth as finite resources are dedicated to low-value activities like making cheap T-shirts.

Foreign

The Forgotten Crucibles: The Korean War and the Balkans Wars as Markers of Geopolitical Flux

As the geopolitical landscape of the 21st century evolves, the Western Balkans re-emerge as a focal point in the intricate web of ‘compound security competition’ among great powers.

Hence…Romania court annuls presidential election result amid Russian interference allegations

Romania’s constitutional court annulled the result of the country’s first-round presidential election on Friday, saying it had received evidence of alleged Russian interference.

The court said the decision was made to ensure “correctness” and “legality,” after the Romanian security services released documents suggesting Russia had engaged in a meddling campaign on social media to favor the winning far-right candidate Călin Georgescu.

How The New Russian Missiles Are Changing The Game

Any U.S. attempt to pressure Russia into a situation where it would either have to concede to the U.S. or to go nuclear has been demolished.

Failure Costs—Why Europe can’t build big tech companies.

…a large enterprise, doing a significant restructuring in the US costs a company roughly two to four months of pay per worker. In France, that cost averages around 24 months of pay. In Germany, 30 months. In total, Coste and Coatanlem estimate restructuring costs are approximately ten times greater in Western Europe than in the United States.

This dynamic pushes European companies toward sticking with what they already know — not because they're more risk-averse, but because it’s the profit-maximising choice given the cost if they fail. Making big bets on new technologies is less worthwhile for big European firms. The widening innovation gap reflects the repeated effect of the structural advantage from cheaper restructuring, increased by (arguably) faster technological change.

Expert Q&A on South Korea: Martial Law and Its Aftermath

*Kaput: The End of the German Miracle*

By Wolfgang Münchau, this book is the best and most detailed account of the German economic decline to date.

The overall lesson I took away from this book (my interpretation, not the author’s) is that if a country does not have enough ambition and seriousness in its businesses and education systems, sooner or later it will not have that in its government either.

I am sad to recommend this one. My primary reservation is that the author does not do enough to diagnose Germany’s obvious cultural malaise as an underlying root cause.

Africa's New King Solomon—Equatorial Guinea's Outrageous Sex Tapes Affair

The scandal is as comical as it is unbelievable; in one video he is on the phone presumably conducting official state anti-corruption business while filming a sex tape. In another his conquest is a woman in a hospital gown. There is also one in a tree and one in the middle of an empty street at night. Not to be outdone, his wife’s own sex tape with a different man was released, perhaps by her in revenge. This was later follow by another video of her with a second man.

Culture, etc.

To review: For years, the US State Department has secretly funded and coordinated the OCCRP, a massive journalism consortium directing the energies of press across the world towards America’s geopolitical rivals and enemies. The dominant figure in the OCCRP is a mysterious man named Drew Sullivan, whose extensive influence on Western media is sufficient to get a leading German public broadcaster to drop a story that he doesn’t like. The man can literally email hundreds of leading journalists around the world with specific instructions about how they should answer questions. And this is only one NGO, amid a vast sea of them – one node in a massive, hopelessly complex system working to coordinate Western media.

Affluent White Students Are Skipping College, and No One Is Sure Why—real whodunnit

In 2015, more than 71 percent of white high-school graduates ages 16 to 24 attended college, according to U.S. Census data. It’s now 60 percent.

White students and their families, however, may be less likely to have a positive perception of colleges and the value of a college degree. In a recent Chronicle survey, 56 percent of people of color said colleges were doing an excellent or very good job of educating students. Just 31 percent of white respondents said so.

The global-capitalist empire is not a cabal of powerful individuals. It is a system. And that system is evolving. Metamorphosing. Transmogrifying. Evolving into a new form of totalitarianism. A global-capitalist form of totalitarianism.

Supersonic flight and nuclear power are two great economic counterfactuals. Like the Chinese emperors of the 1400s who abandoned ocean sailing, our society abandoned two great technologies. Who knows what the world would look like today with abundant power and widely developed supersonic airplanes — and all the technology that would have followed from those two?

Your Cells Are Starving for Creatine

Many people may believe that the high muscle creatine stores that athletes achieve with creatine supplements are “unnatural” and something not achievable until creatine supplements were available.

Here, I argue that nothing could be further from the truth. Every muscle fiber wants to be exactly as rich in creatine as achieved with creatine supplementation.

When Airliners Vanish | Smithsonian (smithsonianmag.com)

Hey, wait – is employee performance really Gaussian distributed??

Hiring in general is difficult because low performers are 3x as common as high performers. The Gaussian-inspired idea that you’ll probably get someone better if you fire the low end is inaccurate – the most likely replacement might not be remarkably better.

New issue of Works in Progress

Horses bled for antivenom, crabs drained for endotoxin tests, and silkworms boiled for silk. Science can now replace these practices with synthetic alternatives — but we need to find ways to scale them.

Why housing shortages cause homelessness

Why do high-cost cities have more homelessness? It’s not just about rents — it’s also about the rooms friends and family can’t afford to share.

How Madrid built its metro cheaply

Madrid tripled the length of its metro system in just 12 years — faster and cheaper than almost any other city in the world. What can its expansion teach other cities?

When the future arrived, it felt… ordinary. What happened to the glamour of tomorrow?

How big data created the modern dairy cow

What do cryogenics, butterfat tests, and genetic data have in common? They’re some of the reasons behind the world’s most productive dairy cows. Here’s how it all started.

Airports and cities may face delays and rising costs, but cruise ships keep breaking records. They show what can still be built.

Buildings are not just art—they are the places people live in, work in, and experience every day. True functionalism combines utility and beauty for the people who use it most.