Markets/Econ

Stanley Fischer – the Central Banker Who Understood Nominal Stability

We do not see many Stanley Fischers in monetary economics. He combined academic rigour with practical wisdom and genuine humility. His legacy endures not just in the institutions he served, but in the lives and careers of those he mentored, and in the intellectual clarity he brought to some of the world’s most difficult economic challenges.

Rest in peace, Stanley Fischer. Central banking, and those of us who care about nominal stability, owe you a debt of gratitude.

Scott Sumner had lots to say this week —

The New Deal's False Promise // What really happened in 2008? // Further thoughts on trade balances // Does Fiscal Stimulus Stimulate? // J'accuse—Further thoughts on the Great Recession

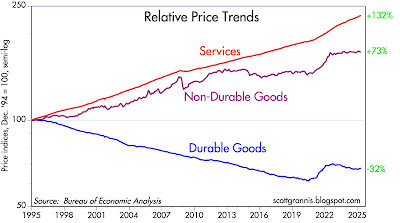

Inflation pressures were tamed a few years ago

Hoover Monetary Policy and Taylor Conference

One point: 250 regulators work inside a typical the bank. And they use the pronoun “we” to describe the bank. Another point: Stocks may be irrationally priced (in Larry’s view!), but “is much safer to loan somebody 96% against Microsoft stock with daily settling up than it is to loan somebody 50% against a shopping center with settling up every six years….that basic idea does not yet heavily influence our systems of financial regulation. And until it does, I think there's going to be very substantial risk.”

The Mechanics of US Debt: Modelling the Unpleasant Arithmetic—Interactive Fiscal Trajectory Analysis 2025-2055

Section 899: A big, beautiful source of uncertainty for foreign investors?

Section 899 would allow the US government to impose taxes on foreign companies operating in the US if their home country is deemed to have an “unfair tax system”.

the European Union (EU), the UK and many other US trading partners would automatically fall into the “unfair tax system” category as a result of their use of the undertaxed profit rule (UTPR), which essentially allows a country to increase taxes on a business if its parent company pays less than the OECD’s proposed global minimum tax of 15% in another jurisdiction.

The second area of concern is that Section 899 would apply not just to corporations but to individuals, government-controlled entities such as sovereign wealth funds and pensions funds, and partnerships. In theory, a UK national or a UK-based pension fund buying US Treasury (UST) bonds could be subject to the same rules as the companies mentioned in the previous paragraph. Currently, the reason these investors do not have to pay tax on their UST coupons is that certain types of income are excluded from a 30% withholding tax that applies to passive income from assets owned by non-US persons. UST and plain vanilla corporate bond coupons are examples of sources of income that are excluded, while coupons on preferred shares are an example of passive income that is not subject to this exclusion; it is no surprise that foreign investors tend to be happy holders of USTs and plain vanilla corporate bonds, while there are very few that would own preferred shares.

Are Businesses Absorbing the Tariffs or Passing Them On to Their Customers?

The Grit from the Sandstorm Is Fierce!

And yet, rather than drawing the obvious conclusion that chaos monkeys produce chaos, which is not the friend of growth or prosperity, El-Erian seems to say that opinions of the future consequences of installing Trump in the White House differ. From whence comes the suggestion that there is a good chance we might be at the dawn of something like the Reagan-Thatcher-style Neoliberal Order rewiring: a period of wrenching dislocation that, with the benefit of hindsight, will appear as the necessary prelude to a new order of higher productivity, greater growth, fiscal rectitude, and a more stable global payments system.

Why does he say this? What does he see that I do not?

The Art of Not Taking the Deal

The classic madman strategy may or may not be effective - political scientists tend to be skeptical - but it is what you do before you strike a deal. You act crazy like you will only accept some outrageous outcome and that you might blow it all up in a fit of pique if you don’t get what you want. But once you have struck the deal, it sticks.

By contrast, Donald Trump is playing the madman strategy after he cuts deals with people. An agreement with Trump is just a temporary prelude to further chaos. To go back to the old Schelling analysis, it’s as if John F Kennedy had waited until after Khrushchev had decided to back down and withdraw missiles from Cuba to go full on madman and threaten to nuke Moscow.

Pro-growth policies alone can’t stabilize federal debt

Pro-growth policies alone won’t get us there. The authors examine seven policy areas–immigration, housing, the safety net, electricity transmission, R&D, taxes on business investment, and permitting–and find no evidence that, even taken together, they can produce a sustained, large enough increase in productivity growth to offset their potential direct budgetary cost and significantly reduce the deficit.

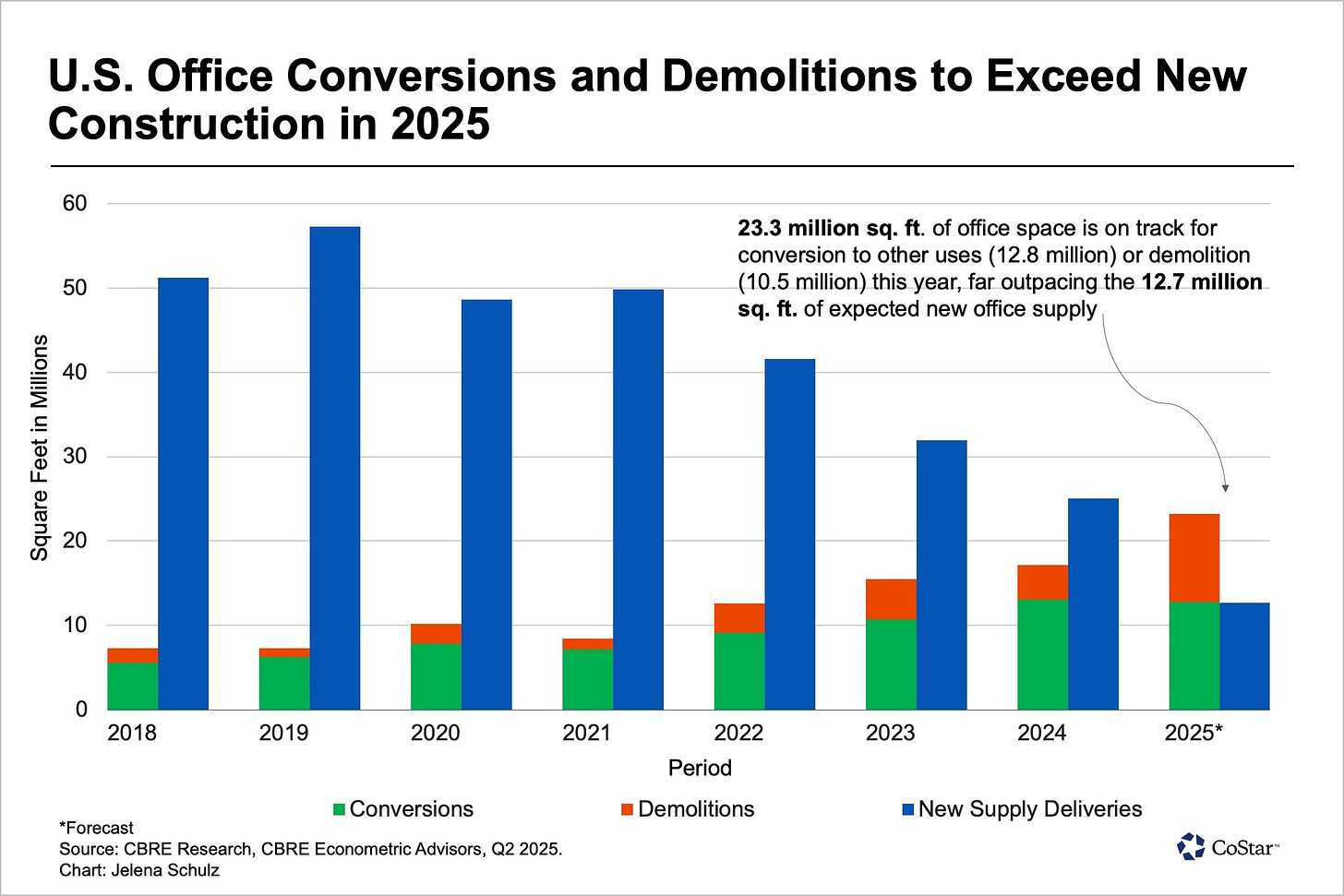

More US office space to be removed this year than added for first time since at least 2000

Jim Chanos Sees Big Short in Saylor’s Strategy, But Others Aren’t So Sure.

To Chanos and other fans of the trade, Strategy’s ample market capitalization — now over $100 billion — and deep float make it relatively easy to maintain the short leg. For hedge funds, new borrows are being priced at a fee of 0.3 percentage point, according to data from S3 Partners. This helps to keep the cost of carry manageable while waiting for the spread to narrow. The inexpensive terms are likely to persist, given the stock’s roughly 250 million free floating shares, and that only 11% is currently sold short, said Sam Pierson, director of research at the firm.

Passive Aggressive: The Risks of Passive Investing Dominance

Passive capitalization-weighted index funds now surpass active management in aggregate investor allocations. Flows into passive strategies cause unrelated stocks to move synchronously, undermining diversification and potentially increasing systemic risk. New flows into passive products mechanically overweight overvalued stocks and underweight undervalued stocks due to market-price weighting, exacerbating momentum-driven price distortions. Rebalancing at the stock level to non-price-based anchor weights may mitigate these distortions and enhance long-term returns.

For years, the U.S. has been building, in fits and starts, a ventilation system for digital assets. Like any ventilation system, it is supposed to have two separate pipes. One flushes bad actors down the drain through criminal prosecution and regulatory enforcement. The other provides fresh air for legitimate innovation. This includes clear rules which encourage entrepreneurship and reassure investors that their cryptokitty investments are safe.

But, *sniff*, do you smell that? It’s a peculiar stench. It’s the smell of Trump granting pardons to every convicted criminal referenced in the previous paragraph (or, in the case of Binance, dropping the SEC’s lawsuit).8 It’s also the smell of Trump disbanding the DOJ’s National Cryptocurrency Enforcement Team.9 And it’s the smell of Trump releasing a personal meme coin, running a contest to see who can

bribeinvest the most, and hosting a dinner for the winners.10 This reeks. And nobody should be more upset about the smell than the cryptocurrency industry itself.

Stablecoins may be nasty, but for Americans they’re also cheap

Find a way to “provide a worse service for less money” is the single best-proven fintech strategy of them all. It’s no surprise, then, that the biggest US banking groups are said to be exploring the idea of launching their own stablecoin solution. But even if they hang on to the market share, the dawn of price competition in US payments business is unlikely to be a pleasant experience for the incumbents.

Private Credit

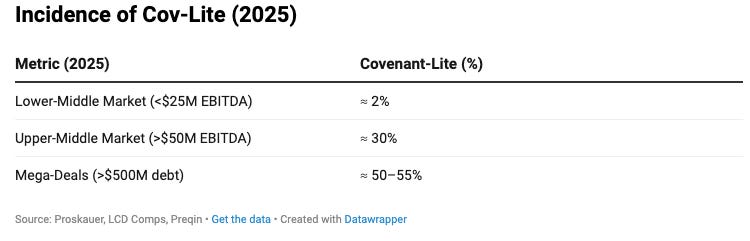

Covenant Lite #22: Guardrails Gone: The Erosion of Covenants in Private Credit

Fast-forward to today, and the private credit landscape looks radically different. Covenants have significantly eroded, transforming from a fundamental lending standard to an optional add-on—especially in larger transactions.

Private Credit Ratings: Egan-Jones Deals Raise Wall Street Scrutiny.

A report issued — and then abruptly rescinded — last year by the National Association of Insurance Commissioners showed that small outfits like Egan-Jones rated private investments three notches higher on average than the association’s in-house valuation office. Almost a year after its retraction, the report’s conclusions are still reverberating across the industry.

Could the Growth of Private Credit Pose a Risk to Financial System Stability?

Our analysis of Federal Reserve and proprietary loan-level data indicates that the growth of private credit has been funded largely by bank loans and that banks have become a key source of liquidity, in the form of credit lines, for PC lenders. Banks’ extensive links to the PC market could be a concern because those links indirectly expose banks to the traditionally higher risks associated with PC loans. Such concerns would be mitigated if PC lending is growing by capturing a share of the business credit market from banks rather than by expanding the market through riskier loans that banks are not willing to make

A Deep Dive into Private Fund Performance

Daniel Rasmussen: ‘Be Very Wary of Illiquid Asset Classes’

And so what you’re seeing is these very inflated valuations in private markets funded by massive amounts of borrowing from private credit. And with allocators putting huge percentages of their endowments or pension funds into this asset class. And by the way, they’re doing so at very high fees and with illiquidity. And so my view is that that’s the tremendous amount of correlated risk. Everybody’s doing it. Everybody’s doing it in way bigger proportion than the actual economic substance of what they’re investing in would justify all with the same correlated belief that private equity will outperform. And I think it’s not going to end well. Debt-fueled, illiquid asset over allocation rarely does. And this is, I think, one of the biggest risks that large, sophisticated investors face today.

And so I think what the problem with private credit, is that I think it’s a classic case of fool’s yield. These are risky borrowers. You just haven’t realized the risk yet. And when you do, you’re going to do it all at the same time, which is what happens in default cycles. And you’re going to realize why all of these companies had to borrow at 12%. The sort of a Venn diagram of high-quality companies that are never going to go bankrupt and companies that have to borrow at 12% is virtually nonexistent.

ECB Steps Up Scrutiny of Banks’ Exposure to Private Markets

The Future Ain’t What It Used to Be for These Funds. They collect the incentive fee on their fake marks, they don’t have to realize a gain first.

Like other such funds that invest in secondaries, Hamilton Lane Private Assets can buy private-equity stakes from other holders, often at a deep discount to the official net asset value. It can promptly mark up its holdings to that official NAV. By doing so, it disregards the discounted price it just paid—even if that price was set in a competitive auction.

Foreign/Military

In the EU nothing succeeds like gross failure: The astonishing case of Ursula von der Leyen

It is one of life’s guilty pleasures when one’s cynical prejudices are confirmed. One such moment, when I allowed myself a long, hard laugh, came as the news arrived that Ursula von der Leyen had been awarded the International Charlemagne Prize of Aachen for “her services to the unity of the Member States, in the containment of the pandemic, for the unity of the Union’s determination to defend itself against Russia — and for the impetus towards the Green Deal.” It was now official: In Brussels, nothing succeeds like gross failure and, even worse, nothing is rewarded more generously than corruption.

Is Germany ready to build a new military ethos?

The Bundeswehr is wary of discipline and blind obedience, which are seen as characteristics of previous German militaries, especially the Nazi Wehrmacht. So instead, its self-declared ‘company ethos’ is that of a ‘citizen in uniform’ acting on his or her own ‘inner guidance’. In other words, soldiers are explicitly encouraged to question each and every order. ‘The Bundeswehr knows no absolute obedience,’ recruits are told. ‘The ultimate decision-making body is the conscience of the individual.’

Ukrainian Commander's Exclusive Insights On Brutal Drone Warfare On The Frontline

Q: What percentage of Russian targets in your sector are destroyed by drones as opposed to artillery, indirect fire, aerial munitions or other means?

A: I would like to say that, according to my conservative estimation, well, once again, we use drones more than the Russians because there is a deficit of other kinds of fires. And drones are actually the cheapest way to strike the enemy, the cheapest kind of fires that we have. And that’s also quite efficient, because, for example, if we fire one artillery shell that costs $3,000, that’s quite a lot. But we have switched to drones, and I can say about my unit that we ensured approximately 80% of all targets engaged, from our brigade, are by unmanned systems. I think that this percentage is a bit lower, but still, most of the targets struck by our fires are struck by drones.

Coming to a Military Base Near You: Ukraine’s Drone Attack Changes Everything

Bases need new legal tools to act beyond their fences. Think Border Patrol-style jurisdiction for inspecting commercial vehicles near sensitive installations. That means working with lawmakers, not just DoD policy.

The most controversial—but possibly most essential—upgrade may be the ability to kill local mobile networks on command. Drones often rely on LTE or 5G signals for control and coordination. If base command can’t shut that infrastructure down immediately during an incident, they’re already behind. It won’t be easy: it will require relocating or modifying cell towers outside the wire. But the capability must exist. It can prevent adversaries from coordinating attacks and using our own infrastructure to communicate with the UAVs.

If McDonald’s Can Fix Its Own Machines, Why Can’t the U.S. Military?

Anyone who has ever tried to get a sundae at McDonald’s knows the disappointment of hearing, “Sorry, the ice cream machine is broken.” But behind those words lies a deeper truth: Until recently, the company that made McDonald’s machines had exclusive rights to repair them. So, when a machine broke, there was nothing a local store could do but wait for the manufacturer.

The dysfunction with McDonald’s ice cream machines became so notorious that the Federal Trade Commission even took notice. Last November, the government introduced a new rule that allows outside vendors to fix commercial food equipment.

But shockingly, no such solution exists for the U.S. military, which faces the same problem.

Just like the McDonald’s stores that were forced to wait on the manufacturer to fix an ice cream machine, the Pentagon often does not have the right to repair the equipment it’s bought. Instead, companies are able to include provisions in their contracts that enable them to hold onto intellectual property rights, allowing only the manufacturer to perform repair and maintenance. These contractors may refuse to share essential tools or data, or they may invalidate the equipment’s warranty if service members undertake repairs.

Politics/Culture

Curtis Yarvin’s Plot Against America.

When Yarvin and Camus went on ahead, the filmmakers paused to assess the day’s shoot. Brun said that Yarvin reminded him of the long-winded character in “Airplane!” who talks so incessantly that it drives his seatmates to kill themselves. We wondered what Camus was making of the afternoon. It wasn’t long before we found out. “If intellectual exchanges were commercial exchanges—which they are, to a certain extent—the amount of my exports would not reach one per cent of that of my imports,” Camus wrote in his diary, which he posted online the following day. “The visitor spoke without interruption from his arrival to his departure, for five hours, very quickly and very loudly, interrupting himself only for curious fits of tears, when he spoke of his deceased wife, but also, more strangely, certain political situations.”

SBSQ #21: Why young men don't like Democrats

The Money 'Game' and the All-Powerful Executive

Of course, the exploitation of public service for private profit poses legal perils for politicians. A range of statutes can trip them up: bribery, illegal gratuities, mail and wire fraud. But the Supreme Court has systematically trimmed back the application of the statutes, leading one highly skeptical scholar to argue that “the Court has consistently—and [often] unanimously—ruled that federal law must be interpreted so as not to cover behavior that looks, to any reasonable observer, sketchy as hell.”

These advisers might also conclude that Trump is protected by how he plays “the game.” At the core of the public corruption statutes is the prohibition on bribery: receiving “anything of value … in return for … being influenced in the performance of any official act.” Perhaps evidence of direct, criminal quid pro quo exchange will still surface over the next four years. “The game” as Trump plays it, so openly and with abandon, would seem to elevate that risk. But it is in the nature of his style of play, so connected to the show of power, that this player delights in demonstrating that he can pull in the riches without having to commit to promising or giving anything in return.

Why Trump and the New Right Declared War on Bureaucrats

Orwell was particularly struck by Burnham’s observation that the major political systems of the day — fascism, Communism and New Deal-era social democracy — were fundamentally similar in their turn toward the bureaucratic management of society. He observed that everywhere “laissez-faire capitalism gives way to planning and state interference” and “the mere owner loses power as against the technician and the bureaucrat.” Believing that accelerating managerial control risked dragging every society inexorably into totalitarianism, Orwell made Burnham’s ideas the basis of his novel “1984.”

Science/Health

Doctors Were Preparing to Remove Their Organs. Then They Woke Up. Don’t check the box.

The investigation centered on an increasingly common practice called “donation after circulatory death.” Unlike most organ donors, who are brain-dead, patients in these cases have some brain function but are on life support and not expected to recover. Often, they are in a coma.

Toxic Origins, Toxic Decisions: Biases in CEO Selection. “Science!”

Highlighting The Substantial Body Of Evidence Confirming The Importance Of Vitamin K2

In an ideal world, Vitamin K2 would have the same association with cardiovascular health that folic acid has with pregnancy. Optimal Vitamin K2 intake is crucial to avoid the calcium plaque buildup of atherosclerosis, thus keeping the risk and rate of calcification as low as possible.1-3

Rubedo doses first patient in trial targeting senescent skin cells

Skin, of course, is more than a cosmetic canvas – it is the body’s largest organ and a sentinel of systemic change. It accumulates senescent cells with age, and these cells do not remain idle: they secrete pro-inflammatory signals, attract immune cells, and disturb the local and systemic environment. While dermatological disease might not be the end goal, it offers an accessible context in which to test whether modulating GPX4 – a key ferroptosis regulator – can alter the behavior of senescent skin cells without harming normal ones.

Taurine is 'not a reliable biomarker of anything yet'

To gain clarity, the new study included both cross-sectional and longitudinal data, the latter of which included blood samples taken at different time points from the same groups of people and lab animals as they aged. Ultimately, what the scientists found is that taurine didn't decline with age; instead, it increased or stayed stable across all of the groups studied.

Occasional paper: The impossible predicament of the death newts

Okay then — if evolving toxin resistance carries a cost, and if even with resistance eating the newts is unpleasant, then why then do garter snakes insist on eating newts? They cheerfully eat frogs, fish, and other non-toxic prey items. Why don’t they just eat those, and leave the poor newts alone?

Turns out there is an answer: the garter snakes sequester the tetrodotoxin, storing it in their livers. This makes them toxic to their own predators. (Of which there are plenty. They’re not large snakes, so they’re hunted by everything from raccoons to ravens.) But they don’t harbor the bacteria, so they don’t produce tetrodotoxin of their own. So eventually, the toxin that they’ve ingested breaks down. And then they need to eat another newt to refresh their defense.

The Radical Development of an Entirely New Painkiller

Now we know that there is a condition known as congenital insensitivity to pain. Woods met other people in the region who had experiences similar to those of the child who died. “The boys, about half of them end up killing themselves by their early twenties, just doing the craziest things that normally pain would have taught you not to do,” he said. “The girls are sensible. They are hypervigilant. They know they’re at great risk of terrible problems and are very careful.” Woods eventually discovered that all these people had mutations in the SCN9A gene, which is involved in the production of tiny passageways, found in cell membranes, which regulate the flow of sodium ions into and out of cells, and are thus crucial in sending electrical signals. Nerves use such signals to communicate pain to your brain.